Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Reviews

Diego Geroni

- on February 22, 2021

Asset Tokenization on the Blockchain – A Complete Guide

The following discussion aims to reflect on the basics of asset tokenization with blockchain and how the system will work with blockchain.

Blockchain is undoubtedly one of the hot topics presented in the world of finance. It has introduced various new advancements alongside presenting distinct benefits with its traits such as decentralization, transparency, distributed structure, and immutability. Therefore, blockchain has found various applications in the global financial ecosystem, and asset tokenization is one of the notable mentions that draw attention towards blockchain.

Asset management is a very crucial concern for all organizations. However, the existing asset management landscape is plagued with various setbacks due to duplicity of documents, limited transparency, and forgery. The tokenization of assets can help in leveraging the capabilities of blockchain for transforming the physical asset management process.

Readers could find out the meaning of tokenizing assets and types along with the reasons for choosing tokenization of assets. In addition, the discussion would also reflect on the different areas where the new trend of tokenizing assets can be applicable.

Want to learn the fundamentals of tokenization? Enroll Now: Tokenization Fundamentals Course

What is Asset Tokenization, and Is It Really Necessary?

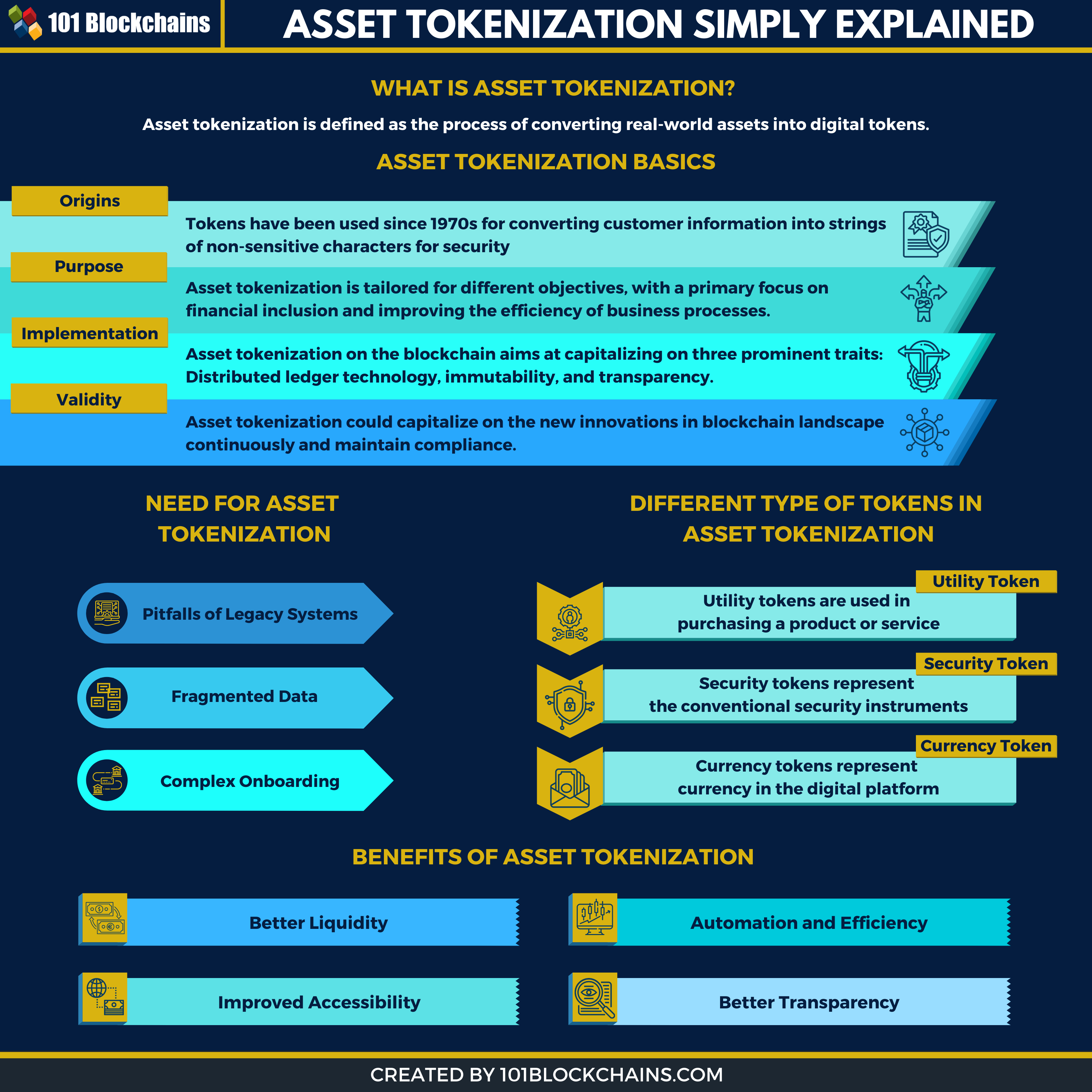

Tokenization is basically the process involving conversion of physical as well as non-physical assets into blockchain. The concept of blockchain tokenization has gained considerable popularity in recent times. Gradually, tokenization is finding blockchain applications in traditional industries such as real estate, stocks, and artwork. So, why did we need tokenization in the first place?

Many would assume that asset tokenization started with cryptocurrency. On the contrary, tokenization has been used since the 1970s as a data security apparatus for financial services. Many conventional enterprises in the world of finance leverage tokenization for safeguarding sensitive and confidential information such as credit card numbers, personally identifiable information, and financial statements.

Generally, the traditional approach to tokenization involves replacing the sensitive information of users with a token that is actually a string of non-sensitive letters and numbers. Let us take an example to understand the conventional asset tokenization approach. Mobile payments utilize one of the significant examples of tokenization.

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2021/02/tokenization-of-assets.png' alt='tokenization of assets='0' /> </a>

How It’s Used

Some hospitals utilize tokenization for patient records, while software programs leverage tokenization for security of login credentials. Furthermore, tokenization has also found applications in the case of governance, such as voter registration. Asset tokenization in blockchain for government solutions can help in safeguarding a lor of sensitive information. On the other hand, it is also important to notice the reasons for coming up with blockchain tokenization.

Then, the bank enters the details of the customer into a cryptographic function for creating tokens. Then, the customer receives the token representing their credit card on their phone. Any criminal trying to hack into the phone of the user would be able to find the token only, without any credit card information. Another important aspect of asset tokenization is that it is not restricted to financial information only.

It all started with cryptocurrencies and it’s now projected to introduce a new type of token or digital asset called CBDC or central bank digital currencies. In reality, CBDC and cryptocurrencies are quite different from one another even though both of them are digital assets or tokenized assets.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Current Asset Management Scenario

In order to find the background behind the introduction of asset tokenization, it is essential to understand the existing state of asset management. Asset management basically refers to the process of producing, procuring, storing, and managing asset-related documents prior to, during, and after the process of transferring ownership. For example, smart contracts can help in the automation of tasks.

On the other hand, distributed ledger technology could serve as a single source of truth for reducing information mismatches. It is a reliable instrument for trading stocks, equities, real estate, bonds, and similar types of assets. The existing asset management ecosystem includes various stakeholders, including multiple intermediaries such as investors, brokers, auditors, and custodians. Therefore, it is inevitable to expect a substantial rise in the overall cost of the process.

Issues in Asset Management

At the same time, the conventional asset management approach also presents a higher vulnerability to the chances of fraud and errors. In addition, the following issues in asset management industry also point out the need for benefits of asset tokenization.

- The current asset management industry depends on approaches that create exceptional difficulties in pinpointing the source of error in event one occurs. Furthermore, the complexity of asset management with traditional tokenization also creates barriers to ensuring proven accountability.

- The fragmented storage of data with existing tokenization mechanisms also creates the need for blockchain tokenization. All the parties involved in asset management transactions with conventional tokenization have their own versions of data. As a result, it creates considerable difficulties in pointing out the source of error, especially considering the complexity of the processes.

- Another prominent issue that plagues the existing state of asset management refers to the complicated onboarding process. Malicious agents could leverage the extended duration and slow speed of conventional tokenization processes. Hackers could exploit the vulnerabilities arising from complications in the process and use forged documents or IDs for getting onboard without any difficulties.

Separating Asset Tokenization from Securitization and Fractional Ownership

The benefits of blockchain technology with asset tokenization would also improve information security through timestamps and cryptographic encryption. Blockchain tokenization is slightly, although not completely, different from the traditional tokenization mechanisms. The conventional tokenization mechanisms focused on data only, while the asset tokenization with blockchain brought the focus on assets.

You can issue a blockchain token as a digital representation of any actual tradable asset. It allows you to trade with even a single fraction of the asset. Now, many beginners can confuse the process with fractional ownership or securitization. However, tokenization of assets with blockchain bears considerable differences with both of them.

Tokenization and securitization are completely different terms. Tokenization involves the transformation of all real-world assets into a digital token with higher liquidity. On the other hand, securitization deals with conversion of assets with low liquidity into security instruments having higher liquidity.

The security tokens would provide options for trading in markets as well as over-the-counter. Blockchain tokenization is different from fractional ownership as the latter offers the opportunity for bringing unrelated parties to one place for enjoying trading in the digital world.

Example for Understanding Asset Tokenization

You must have gained a clear impression of asset tokenization on blockchain by now. However, it is important to understand how tokenization works by taking the example of investment in real estate. You want to invest in a specific property, and you have $5000 only for making an early investment. In such cases, you might look for small beginnings with a focus on sources that can help you bring in the desired investment at moderate rates.

For example, you can think of investing few thousand at a gap of two or three months. However, such an approach might seem out of place, especially in the real estate industry. Think of it like this- you cannot buy a few square meters in an apartment two months at a time before you are able to purchase the whole apartment. Similarly, think of the situation in reverse to know how asset tokenization becomes important.

In real world, central bank digital currencies or CBDC is a similar take on asset tokenization. The two types of CBDC you will encounter are –

- Retail CBDC

- Wholesale CBDC

Retail CBDC mainly is for the general people and not suitable for companies. On the other hand, wholesale CBDCs are introduced for the sake of financial or payment organizations. More so, wholesale CBDC is responsible for security settlements and increasing the efficiency of payments.

Real Estate Scenario

For example, you have an apartment, and you are in urgent need of some money. However, you need only $40,000 while your apartment has a value of $200,000. Is it possible for you to use the concerned property for obtaining the money you want in a given situation? This is where you can look at the prospects for bringing blockchain tokenization into the picture. Let us take a deeper look into how tokenization works here, other than the fact that it helps in the conversion of ownership rights in an asset to a digital token.

Asset tokenization can help you convert your $200,000 worth of apartment into 200,000 tokens. Each token would carry a 0.0005% share of the apartment. In addition, asset tokenization on blockchain platforms enables support for smart contracts such as Ethereum. If a user purchases on the token, they get 0.0005% of ownership in the asset. On the other hand, purchasing 80,000 tokens entitles an individual to ownership of almost 40% of the concerned asset.

Since blockchain is an immutable ledger, users could not delete ownership after purchasing tokens. Therefore, it is clearly understandable how blockchain can help in bringing the benefits of asset tokenization closer to users. Tokenization can enable better liquidity, faster settlements, and reduced costs easily without any concerns. As a result, it continues to gain popularity with prominent enterprise blockchain use cases.

Watch On-Demand webinar on Digital Asset Convergence – Blockchain and the Rise of Embedded Finance now!

Types of Tokens Used in Blockchain Tokenization

Now that you know the fundamentals of asset tokenization let us find out more about the types of tokens. If you are investing efforts in developing a tokenized asset, then you should look at the different types of tokens used commonly in the blockchain landscape. The first category of tokens refers to the ones that are classified on the basis of their nature. Here are the types of tokens in the blockchain world for different assets.

- Tangible tokens are the collection of assets with specific monetary value alongside general availability in the physical form.

- Fungible tokens refer to digital assets that are created in a way that all the tokens have equal value. This means that one Bitcoin is equal to one Bitcoin, and users can exchange it with one Bitcoin only.

- Non-fungible tokens are also another prominent concern in asset tokenization. The non-fungible assets generally feature unique traits and are not interchangeable.

Aspiring to Become a Certified NFT Expert? Enroll in Certified NFT Professional (CNFTP) Course Now!

Speculated Tokens

Tokenized assets are also subject to the influence of speculation. Therefore, you can find the following tokens that have speculation as to the underlying element. For example, stablecoins are a form of tokenized assets where it used several types of tokens to create a stable value.

- Utility tokens are a prominent example of tokens in blockchain for assets on the basis of speculation. Utility tokens are basically digital tokens that can support the funding for developing cryptocurrency. In addition, it can also help in purchasing a specific product or service presented by the agent issuing the cryptocurrency.

- Asset tokenization is better with security tokens as they act as one of the top cryptocurrency trends in the existing market. The advantages of security tokens are evident in their functionality of serving as digital representatives of traditional security instruments.

- Another notable type of token used widely in circulation presently is currency token. Currency tokens are basically representing currency in the digital form, thereby providing another direct benefit of asset tokenization.

Curious about the difference between security tokens and utility tokens? Here’s a guide to security token vs utility token.

Why Should Businesses Choose Tokenization?

With clarity about different types of tokens available to tokenize your assets, it is reasonable to move towards reasons to opt for the same. Many companies using blockchain technology are presently considering asset tokenization on the grounds of following reasons,

1. Better Liquidity

The foremost entry among benefits of asset tokenization refers to higher liquidity. Privately held firms experience many issues, especially with the additional time required for buyers and sellers to know each other as well as the service offerings. In addition, businesses have to spend lots of time in determining the factors for conducting business together and hiring lawyers as well as other service providers to create contracts for execution of transactions.

On the other hand, asset tokenization helps in making the process streamlined and smoother. Tokenization of assets brings the enterprise blockchain platform that shows a representation of tokens as private company securities. Tokens are then sold to participants with prior vetting in similar areas in the role of authorized investors with sufficient capital for risk-taking.

Investors could also leave the platform at any time by selling off their tokens on a secondary market efficiently and easily. As a result, investors don’t have to worry about early redemption and the massive costs associated with it. Subsequently, individuals and agencies with high net worth could invest in private company securities. In the long run, asset tokenization could lead to development of a global market for private securities.

2. No More Intermediaries

Traditionally, asset trading took days, or even months, to achieve the desired settlement for involved parties. Asset trading brings in external entities for validating documentation of transactions along with eligibility of investors. The external entities could, in turn, add up to the costs of the process. On the other hand, asset tokenization with blockchain can bring better transparency and immutability through smart contracts. As a result, tokenization can take away the intermediaries from transactions for better efficiency.

3. Automation and Efficiency

The use of smart contracts with blockchain-based asset tokenization is also helpful for automation of a major share of the process. The reduction of intermediaries takes away the burden of cost of intermediaries and the efforts needed in administration of the complete process. So, all users could achieve transactions with more speed and cost-effectiveness.

4. Better Transparency

Another notable highlight that marks the efficiency in tokenization of assets refers to transparency. With the help of tokenization, the token holder can embed their rights and responsibilities in contracts for definition of token attributes, as well as a comprehensive ownership record. As a result, users could have a clear idea of the person they are dealing with, their power, and the source of purchasing the token. All of these factors can improve the transparency of asset management processes.

5. Improved Accessibility

The final advantage associated with asset tokenization points out to better accessibility. It is helpful in fragmentation of a specific asset into minimum possible amounts as tokens. Subsequently, tokenization also drives investors to obtain ownership of a minimal fraction of shares. As a result, enterprises can find open doors for asset management with considerable relaxation in minimum investment amount and period.

Curious to learn about blockchain implementation and strategy for managing your blockchain projects? Enroll Now in Blockchain Technology – Implementation And Strategy Course!

Industries Where Tokenization is Applicable

All of these reasons are clearly indicating the potential of tokenization with blockchain in the domain of asset management. With blockchain digital transformation gaining momentum across different sectors and the growing prominence of blockchain technology, it is reasonable to expect asset tokenization in many industries in the future. Let us take a brief overview of the applications of tokenization in different industries.

1. Finance

The finance technology industry has been capitalizing on blockchain for reforming the industry landscape in different ways. Blockchain in payment tokenization has helped in transforming margin lending, investment, or product structuring. Tokenization enables finance organizations to access opportunities for transforming the assets and allows seamless exchange functionalities. As a result, merchants could avoid storage of actual credit card numbers of customers in POS machines and other systems. Therefore, tokenization contributes to improvements in liquidity while reducing data security breaches.

Want to learn about the practical implementation of blockchain in the financial sector? Enroll Now: Blockchain in Finance Masterclass

2. Real Estate

Real estate is also another notable sector that leverages asset tokenization to its advantages. Blockchain for real estate tokenization focuses on streamlining the investment process, starting with elimination of intermediaries. As a result, it can create cost-effective and easy ways for interactions between buyers and sellers. Furthermore, tokenization allows comprehensive inclusivity in the real estate market as it can enable investment of any amount in real estate. At the same time, tokenization is also a trusted safeguard against real estate fraud.

Want to learn about the blockchain in the Real Estate sector? Enroll Now in Blockchain For Real Estate Masterclass

3. Healthcare

Healthcare sector is considering asset tokenization for addressing some of the critical challenges encountered commonly in present times. Tokenization of blockchain for healthcare solutions could help in replacement of sensitive and confidential patient data such as ePHI, PANs, and NPPI with non-sensitive values. Most important of all, patients and healthcare organizations gain control over creation, access, and sharing of sensitive data from intermediaries such as insurance companies.

Start learning Blockchain with World’s first Blockchain Skill Paths with quality resources tailored by industry experts Now!

Conclusion

On a final note, it is clearly known that tokenization can spell new benchmarks for the asset management industry. The rapid scalability of digitalization also calls enterprises across different sectors to consider asset tokenization. In addition, tokenization can also provide benefits on an individual level, thereby strengthening their relevance in the existing market.

With so many issues related to security and transparency plaguing the existing asset management industry, it is reasonable to opt for tokenized assets with blockchain technology. Over the course of time, tokenized assets would become one of the dominant instruments in a digital economy. If you want to learn more about tokenization on blockchain, then you should start exploring our wide collection of blockchain courses right now!

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!