Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Reviews

Hasib Anwar

- on April 08, 2021

Digital Dollar Wallet: Simply Explained

This article talks about — the basics concepts, usage method, maintenance procedures, and benefits of digital dollar wallet.

Digital dollar and digital dollar wallet are the two things that are taking the internet by storm. The technology is really coming our way, and soon we will see a massive shift in our economy. In reality, the need for this type of technology is more than ever when the world starts dealing with pandemics. But not only pandemics is the main reason for using them. In reality, we already faced many issues relating to paper-based currencies and inferior banking methods.

If you are reading our guide, then it’s safe to say you too are curious about what is digital dollar wallet and how to use the digital dollar wallet properly. So, to help you out, I’ll cover every digital dollar wallet info I know so far about this technology in this guide.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

What Is Digital Dollar Wallet?

Before we move into what is digital dollar wallet, I’ll explain what is a digital dollar in the first place.

A digital dollar is a digital currency that uses a distributed ledger technology to function. More so, this electronic unit of dollar value is redeemable from an eligible financial institution. In simple terms, think of it as a digital version of the typical U.S. dollar that you use at the moment. However, at present, it will not directly replace the dollar just yet, but in the future, it might.

So, this currency will have a similar value, and you can use it to make purchases just like any other dollar. Anyhow, now comes the answer to your question – what is a digital dollar wallet?

Here, the digital dollar wallet means a digital account or wallet that the federal reserve bank will maintain for you. In reality, the digital dollar wallet application will hold all your digital dollar credits in it. So, it’s just a digital form of your typical account that you use in banks at the moment. But it will use blockchain to back it up.

Earlier this year, the digital dollar foundation and Accenture were already implementing a digital dollar project. And they will use blockchain to back it up. Actually, there’s a lot of blockchain platforms to use – Ethereum, R3 Corda, Hyperledger, etc.

However, we aren’t talking about that at the moment. Due to the recent coronavirus issue, a new project came up with the proposal of the digital dollar and digital dollar wallet application.

So, we got a peek into how it can actually look in real-world scenarios. But this electronic cash project may happen or may not occur in the future. But the first project is going to happen soon that I can say for sure.

Want to learn the basic and advanced concepts of Blockchain and Hyperledger Fabric? Enroll Now: Getting Started with Hyperledger Fabric Course

How to Use Digital Dollar Wallet?

Many of you are wondering how to use a digital dollar wallet. At the moment, we only have limited digital dollar wallet info, but that will give you a best-case scenario of how it might work.

Generally, the Secretary of the Treasury will make the payments to your digital dollar wallet app. The Secretary of the Treasury will use the Commissioner of the Internal Revenue Service to make all the payments.

More so, they can do it using two means –

- Using the direct deposited method, you will get all your credits into the digital dollar wallet app. But this only happens if the Commissioner has enough information about you and your digital dollar wallet app to make the payment.

- In other cases, they can do it using a check.

When the digital dollar wallet app is ready for launch, they will notify every individual about the process of the whole situation. Basically, they will establish a system where you will have to inform them with your direct deposited information, for example, wallet address to make the payment.

Once you get the payments in your digital dollar wallet application, you can use it right from that moment. So, you won’t have to wait any additional days to start using the credits. Also, you can withdraw the credits from any federal bank members.

Here, member banks are a member of the Board of Governors of the Federal Reserve System. So, you can use these banks only to deposit your electronic digital dollar cash.

By far, this is all we know about the digital dollar wallet application. Hopefully, we will update this guide when we get more digital dollar wallet info.

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2020/04/digital_dollar-wallet.png' alt='digital dollar wallet='0' /> </a>

Ensuring Enough Withdrawable Digital Dollar

As you know, the digital dollar is strictly digital. But would it have enough paper-based money to cash out? As this version is purely electronic cash only, so every single credit will be backed up by the federal bank reserve.

Before, making every monthly payment, the Secretary of the Treasury will notify how much payment they have to make. And if they don’t have enough notes, then they will issue notes and transfer those to the federal reserve to initiate the payment process.

So, you shouldn’t face any issue withdrawing the amount from the bank.

Pass-Through Digital Dollar Wallet

Usually, this means that member banks will maintain these digital wallets for you. So, these wallets ensure that you will get your credit without any hassles. More so, these wallets are here to safeguard your payments from any type of fraud or laundering problems.

Additionally, you won’t have to pay any digital dollar wallet fee to maintain these accounts for you.

According to the digital dollar wallet info, all the member banks have to maintain all the passthrough digital wallet to ensure that you have eligibility to receive payments directly. More so, member banks can use a separate entity to maintain all the assets and liabilities in these wallets. In this case, assets are only the digital dollar explained in the stimulus bill, including the master account within the federal reserve.

Want to explore the basics of crypto wallets? Read here to Know Everything About Crypto Wallet now!

Pass-Through Digital Dollar Wallet Terms

There are certain terms that the member bank has to maintain in this case. These are –

- No one will have to pay any digital dollar wallet fee or have any minimum or maximum balance limit.

- Additionally, they have to pay the required interest if applicable, but not more than the required amount.

- All the wallets will have typical banking features such as – debit cards, online account access, mobile banking, automated teller machine, automatic bill pay, money send options, and many more.

- No bank can limit the functionalities of digital wallets in any case.

- Thus, only the passthrough digital wallet will not have overdraft coverage.

- The member banks will use the term “FedAccount” as the primary name of the digital dollar wallet system.

- Anyone can get their account statement or other marketing material from these accounts.

- Additionally, member banks will use the KYC/AML protocol to assign the wallets in the first place.

- No bank can restrict functionalities to any individual without any probable cause.

- Every bank has to offer protection against security breaches and fraudulent activities.

- Federal reserve banks can offer other state banks or credit unions permission to open or maintain pass-through digital wallets if necessary.

Let’s check out the next section in our digital dollar wallet review guide.

Maintaining the Digital Dollar Wallets

Only the federal reserve bank can issue any kind of authorization restrictions or regulations such as digital dollar wallet fees, interest rates, and so on. So, any changes in your wallet functionality will come from the federal reserve only.

More so, the availability of this electronic cash was supposed to happen within 2021. However, at present, we still don’t know whether they will make this official or not within that date. So, the possibility of having a digital dollar wallet 2021 still hangs by a thread.

Anyway, in those areas where the reach of federal reserve banks is limited, they will partner up with other United States Postal Service branches to offer all the citizens this awesome new technology.

Digital Dollar Wallet Terms

There are certain terms that the member bank has to maintain in this case. All of the terms are similar to the pass through digital wallet.

Penalty in Case of Fraudulent Activities

Don’t worry; your money is safe with the federal bank. They are taking drastic measures to protect your digital credits from any influence at all. In any case, if any employee within the Federal bank leaks any information, then they will have to face penalties.

Similarly, any outsider entity trying to hack into the enterprise system will also get penalties. So, the security for your credits is of high value here. No one can take your digital dollar like other cryptocurrency scandals in the market.

Want to become a Cryptocurrency expert? Enroll Now in Cryptocurrency Fundamentals Course

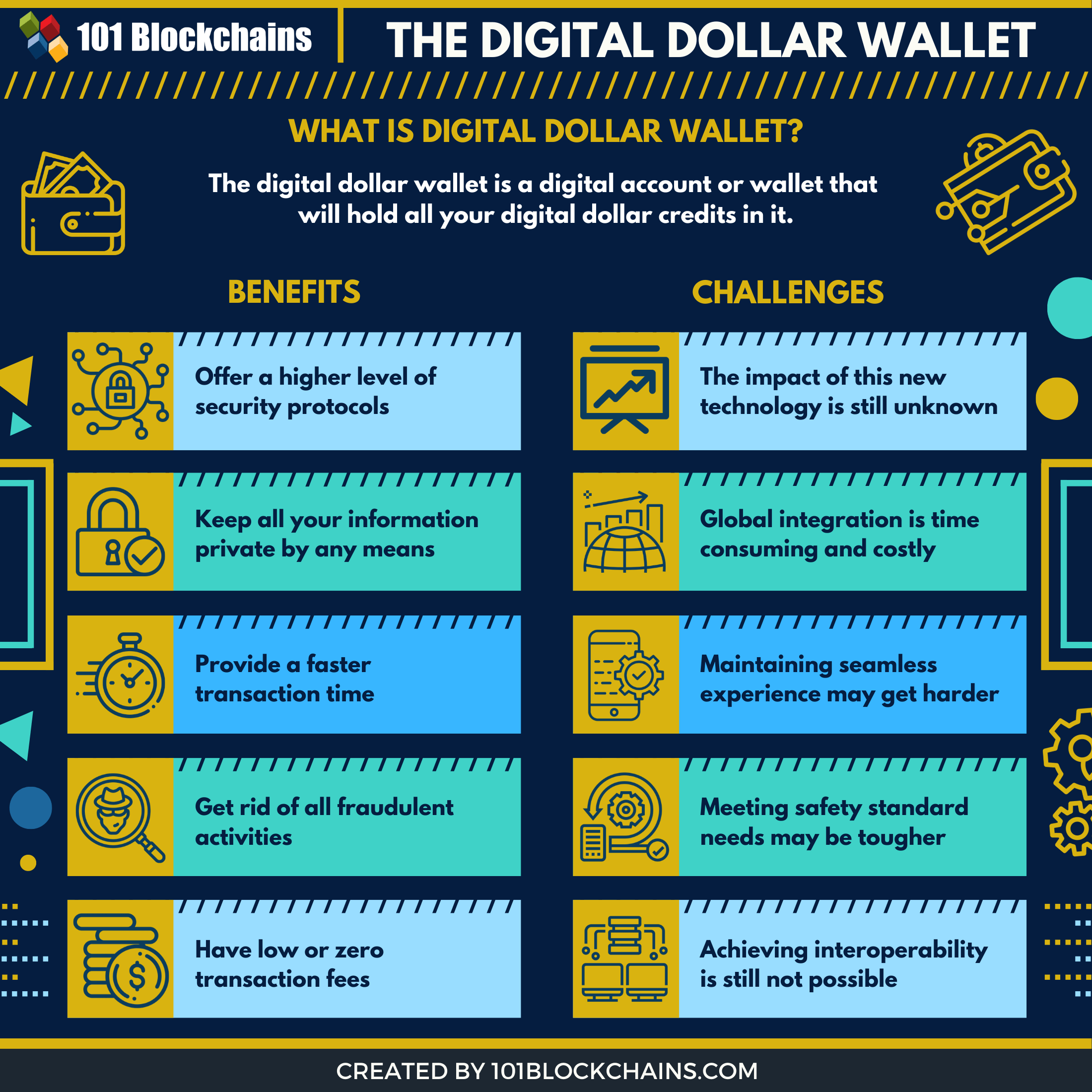

Digital Dollar Wallet Benefits

-

Higher Security

Using blockchain technology, digital wallets will have a higher level of security. In reality, blockchain uses cryptography to increase its security protocols so that no one can alter any ledger value. So, you won’t have any issues in securing your digital dollar value no matter what.

-

Full Privacy

Every single wallet will come with its privacy option. So, no one can see where you are using your digital dollar. However, if the federal reserve is maintaining the main account, some of your information may be available to them. But abusing these credentials from federal banks is highly unlikely.

-

Short Transaction Time

The typical bank takes a lot of time to send money internationally. But when you start using the digitized wallets, you can send money within seconds! It will definitely save you a lot of time, mainly in supply chain and enterprise processes.

-

No Fraudulent Activities

Due to blockchain’s nature, hackers can’t get access to the ledger system. Also, the authentication process of distributed ledger is extremely secured. Thus, using digital dollar wallets will stop fraudulent activities for good.

-

Low/Zero Fees

Unlike typical banks, you can send your money using a very low fee or no fee at all. Also, the maintenance of your wallet won’t require you to spend any extra money.

Make sure to check out China’s Digital currency — the DCEP Project.

Challenges in The Future for Digital Dollar

-

Fairly New Technology

Even though blockchain has been around for some time now, it’s still a new technology. Thus, using a digital wallet, all of a sudden may seem like a broader change. Furthermore, the impact of this technology on our economy is still not that much clear.

-

Global Integration

Integrating these wallets globally would be a tough call. In many cases, banks in other regions are still skeptical about it. Also, it takes time to alter legacy networks as well. So, it might take a lot more time for the world to fully accept the digital dollar altogether.

-

Seamless Experience

Maintaining a seamless experience can be tough. As a matter of fact, blockchain has scalability problems, like many other disadvantages of blockchain. So, the impact of making this dollar publicly available can hinder the performance.

-

Meeting Safety Standards

There have been some bad scandals around the use of blockchain. So, maintaining all the security needs might be tougher than we think.

-

Interoperability

When you start to use the digital dollar, you will have to make the payments online. Thus, you need to have interoperability among all the networks. However, at the moment, there aren’t many interoperability features available.

Start your blockchain journey Now with the Enterprise Blockchains Fundamentals

In the End,

A digital dollar wallet is an extraordinary facility that you can use along with your digital dollar credits. Obviously, due to the nature of the currency, you can’t use typical accounts to hold your credits. That’s why the use of the digital wallet is absolutely necessary.

At present, the wallet can help you streamline all your payments and even help you use smart contract features as well. However, we still don’t know how many functionalities you may have or how much will the foundation include.

Needless to say, we are going towards a completely different kind of future than we anticipated. But it seems it’s all for the best causes of the people and business. If you’re curious about learning such new technological advancements, make sure to enroll in our blockchain courses to get started.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!