Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Decentralized Finance

James Howell

- on June 05, 2023

DeFi Llama: A Professional Analytics Dashboard

Decentralized Finance, or DeFi, is the most prominent technology trend with dominant influence across different sectors. As of 2022, the total number of DeFi users worldwide is 4.8 million. In November 2022, the total value locked or TVL of DeFi protocols amounted to $55.9 billion. The continuous growth of DeFi ecosystem has created challenges for new and existing users in monitoring different protocols.

Interestingly, DeFi Llama has emerged as a promising solution for helping DeFi users in tracking every project individually. It works by offering cross-chain data regarding the state of DeFi alongside details on the popularity and liquidity of DeFi protocols. The answers to “What is DeFi Llama?” define the platform as a TVL aggregator which collects the TVL data of different DeFi protocols. The following post offers a detailed introduction to the largest TVL aggregator in the world and how it works.

Want to explore in-depth about DeFi protocol and its use cases? Enroll today in Decentralized Finance (Defi) Course- Intermediate Level Now!

Significance of DeFi

Before you start searching for more information on DeFi Llama, it is important to learn the reasons why you should use the platform. The only reason to learn about a TVL aggregator refers to the popularity of DeFi. Decentralized finance introduces financial products and services with a priority for decentralization.

In addition, DeFi also encourages lucrative incentive systems which can boost user participation. Another significant highlight of DeFi refers to the flexibility for anonymous transactions without relying on intermediaries or regulatory agencies. The adoption of DeFi increased by huge margins in 2020 and 2021 as businesses shifted towards DeFi protocols for financial services.

The importance of DeFi is also evident in the different use cases of DeFi, such as decentralized exchanges, forecasting markets, lending platforms and better transparency. Decentralized exchanges are one of the most popular applications of DeFi, which enable direct interactions among users in trustless environments.

Another prominent reason to seek answers to “What is DeFi Llama used for?” is the application of DeFi in creating decentralized lending platforms. The decentralized lending platforms have democratized the conventional loan ecosystem by replacing traditional intermediaries with smart contracts. Most important of all, DeFi can guarantee secure and transparent access to financial services for millions of unbanked individuals worldwide.

Want to understand the best ways to use DeFi development tools like Solidity, React, and Hardhat? Enroll now in DeFi Development Course!

Definition of DeFi Llama

The first thing you need to understand DeFi Llama is its definition. First of all, you may think about the possible reasons behind such a unique name for the TVL aggregator. Could it be due to the fact that it spits out facts just like a Llama without any filters? Without diving further into the quirky reasons behind the name, you need to find answers to “What is DeFi Llama?” to understand the platform. It is a decentralized analytics dashboard that helps in tracking DeFi protocols and the chains on which they are deployed. The analytics dashboard also helps in monitoring the dApps in the DeFi protocols.

The platform utilizes DeFi TVL as a marker for documenting the journey of development of DeFi protocols. It collects cross-chain data regarding DeFi protocols and creates cumulative data for all the chains. Common questions about the TVL aggregator, such as “Is DeFi Llama free?” can also help you learn about its fundamentals.

You should note that the TVL aggregator platform offers its services to all DeFi users without any cost. The platform has claimed that it would pursue efforts to ensure data accuracy and transparency in the DeFi ecosystem. Most important of all, the platform claims that it provides DeFi analytics services without introducing sponsored content or ads.

Want to know more about DeFi? Enroll Now in our Introduction To DeFi – Decentralized Finance Course!

How Does DeFi Llama Work?

The basic definition of DeFi Llama creates curiosity regarding the way it works. First of all, the TVL aggregator lists all DeFi projects from different blockchain networks. It obtains reliable data from different open DeFi protocols, which offer blockchain data available to the public. The platform collects blockchain data from more than 130 layers, 1 blockchain and around 1750 dApps. A team from the respective communities works on maintaining the blockchain data. In addition, the team can leverage the DefiLlama/DefiLlama-Adapters Github repository for coordination in maintenance of the data.

How does the aggregator obtain data from DeFi protocols? You can find clarity in responses to “How does DeFi Llama make money?” by reflecting on the intricacies of its working. The DeFi analytics platform makes blockchain calls or calls some endpoints of DeFi protocols for collecting data. As of now, DeFi Llama SDK provides support for EVM-based chains.

If you have a DeFi protocol on EVM-based chains, you must have an SDK-based adapter for listing the protocol on the analytics dashboard. On the other hand, protocols on other chains would require a fetch adapter, which returns the balance for tokens in the smart contract of the DeFi protocol. At the same time, the fetch adapter also takes a timestamp of the DeFi protocol at that instant on Ethereum.

Curious about the Ethereum Technology ? Enroll now: The Complete Ethereum Technology Course

How Does DeFi Llama Generate Revenue?

The next important highlight for understanding the applications of DeFi Llama would point at the ways in which it makes money. As a popular TVL aggregator and analytics platform, it offers information regarding DeFi TVL and trading volumes, as well as other crucial metrics. Most important of all, the platform does not charge any fees for accessing the data. If the answers to “Is DeFi Llama free?” suggest that it does not charge its users, then how does it make money? The primary source of revenue for the platform includes advertisements and sponsorships. What about the claims of preventing ads and not disturbing users?

The interesting fact about the ads on the platform is that it features ads by popular companies in the DeFi industry. In addition, the facility of sponsored listings for DeFi protocols helps the platform earn money in return for promoting the protocols and exposing them to a broader audience.

The sponsored listings create a steady stream of revenue for the TVL data aggregator. The responses to “How does DeFi Llama make money?” also point toward the prospects for collaboration with other players in the DeFi space. For example, the platform can help users of DeFi protocols access the protocol services directly in return for a fee.

Why Does the TVL Matter for DeFi Protocols?

Another crucial aspect in the basics of DeFi Llama would point at TVL or the total value locked in DeFi protocols. It is one of the most significant data pointers available on the DeFi analytics platform. What makes TVL an important indicator of the data aggregator and analytics platform? The TVL of a DeFi protocol serves as a quantifiable metric for user activity and confidence in the protocol. How do you calculate the TVL for a DeFi protocol? Aggregators can calculate the DeFi TVL by using the value of the tokens in different smart contracts. Here are some of the notable smart contracts which fall in the scope of TVL evaluation.

-

Staking Pools

TVL aggregators include the total value of assets in staking pools, including the staked liquidity provider tokens.

-

Lending Protocols

TVL estimates also apply to DeFi lending protocols which use smart contracts for processing loans. The value of tokens in different lending platforms is also an important aspect of TVL estimates.

-

Liquidity Pools

The TVL calculations of DeFi protocols also include the value of tokens in liquidity pools. Higher TVL in liquidity pools offers a formidable indication of the trust of people in DeFi projects.

It is also important to note that the TVL estimate for a DeFi protocol does not offer evidence for profitability. The Total Value Locked of a DeFi protocol only offers a view of the total value of tokens in the protocol. TVL could change with fluctuations in the price of tokens supported on DeFi protocols. In addition, the crypto asset withdrawals and deposits by users in DeFi projects can also influence the TVL calculations.

Curious to know about top crypto wallets which serve as the ideal solution for simplifying access to your crypto assets? Check the detailed guide on An Exclusive List Of Crypto Wallets

How Can You Use DeFi Llama?

A clear understanding of questions like “What is DeFi Llama?” and how it works create curiosity about using the platform. The most important tool in using the DeFi Llama TVL aggregator and analytics platform is the dashboard. As a matter of fact, the analytics dashboard is the first thing you find on the website of the aggregator.

The dashboard showcases a chart featuring TVL of different DeFi protocols. You can find a ranking of dApps according to TVL, represented in terms of USD, alongside the TVL estimate of different blockchains. Furthermore, the dashboard also displays the TVL of insurance and yield-generating protocols alongside decentralized exchanges.

Users have the option to browse through the DeFi protocol rankings according to different blockchains. On the other hand, you can also use the DeFi TVL aggregator to obtain a general overview of the market. Users can select a specific chain for viewing the TVL for applications tailored to the concerned chain. In addition, the “Chains” tab in the analytics dashboard helps you check the compatibility of a DeFi app with other chains. As a result, you can find the most popular DeFi exchanges for larger chains without the need for individual research on every platform.

New to Blockchain Technology? Get started with the Free Blockchain Course now.

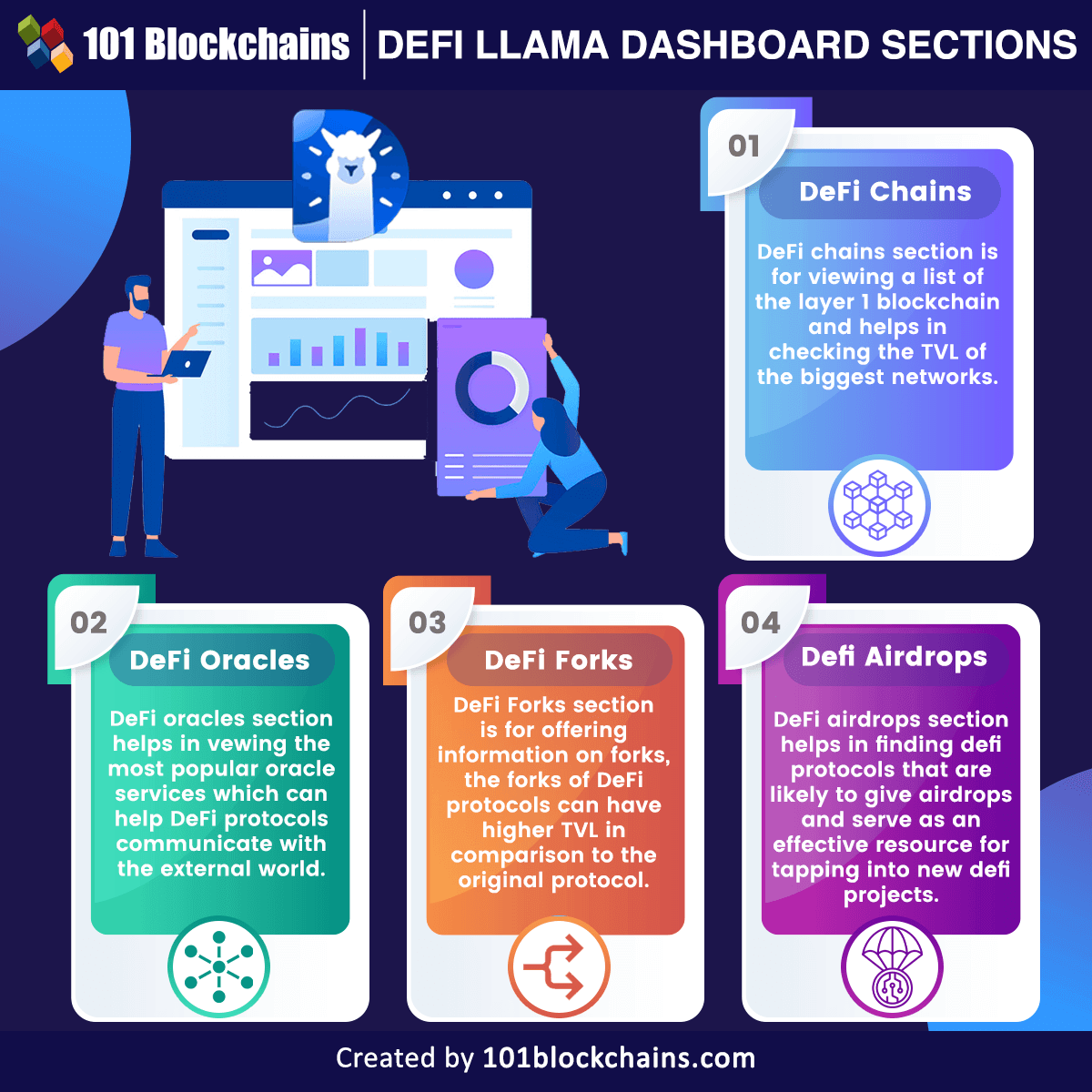

Sections of the DeFi Llama Dashboard

The most common response to “What is DeFi Llama used for?” draws attention toward its role as a TVL aggregator. It helps in monitoring the performance of DeFi protocols and analyzing your options before making crucial investment decisions. The distinct sections of the DeFi Llama dashboard can provide exclusive tools for using the aggregator platform to its full potential. Here is an overview of each section of the analytics dashboard and its functions.

-

DeFi Chains

You can find the “Chains” section in the DeFi Llama dashboard for viewing a list of the layer 1 blockchain. The section helps in checking the TVL of the biggest blockchain networks. It includes the TVL details of blockchain networks that support smart contract programmability.

-

DeFi Oracles

The “Oracles” tab in the dashboard helps in viewing the most popular oracle services, which can help DeFi protocols communicate with the external world.

-

DeFi Forks

You can find answers to “What is DeFi Llama used for?” in the functionalities of the dashboard for offering information on forks. In some cases, the forks of DeFi protocols can have higher TVL in comparison to the original protocol.

-

DeFi Airdrops

The “Airdrops” tab on the aggregator and analytics platform helps you find DeFi protocols that are likely to give airdrops. It can serve as an effective resource for tapping into new DeFi projects in the early stages of development.

Conclusion

The detailed overview of the fundamentals of DeFi Llama provides a clear impression of its functionalities. It is important to note that the platform serves more functionalities than a simple TVL aggregator. The platform not only collects data about total value locked in DeFi protocols but also provides information about forks and airdrops. In addition, it can also guide new DeFi protocols in the selection of oracle services. Most important of all, the DeFi analytics dashboard is completely free of cost. Dive into the world of DeFi and figure out how an analytics platform could help you.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

![30+ Best Decentralized Finance Applications [Updated] best decentralized finance (DeFi) applications](https://101blockchains.com/wp-content/uploads/2020/10/decentralized-finance-applications.png)