Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Decentralized Finance

101 Blockchains

- on January 21, 2020

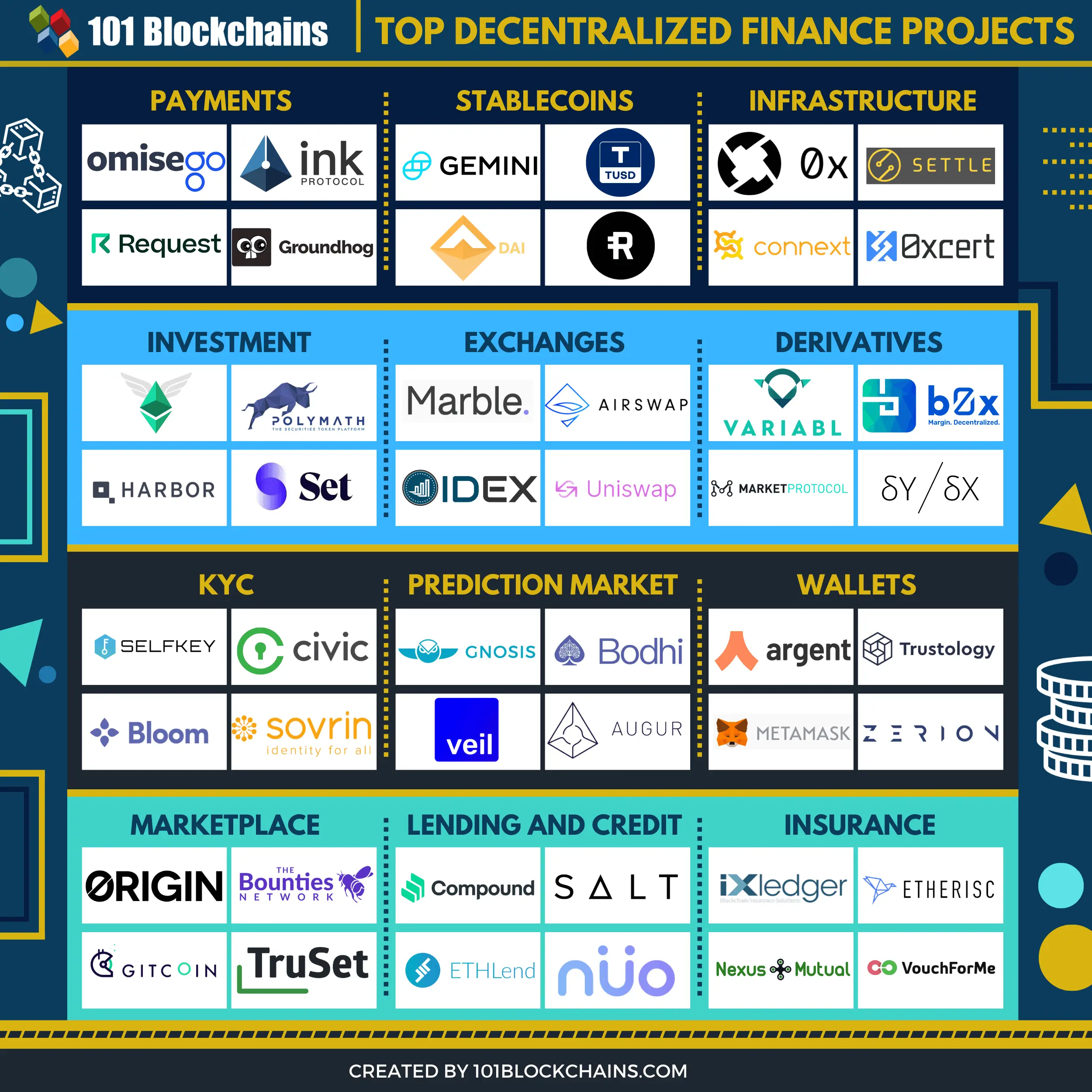

50+ Top DeFi Projects in 2020 And Beyond

Are you looking for Defi projects? If you do, then you have come to the right place.

Decentralized Finance (DeFi) has been the talk of the town for the last year or so. It has rapidly grown where you can, many companies and businesses are investing in creating a finance ecosystem with blockchain. DeFi has its presence in decentralized exchanges, payment networks, key infrastructural development, investment engines, stable coins, and more! In short, the decentralized finance ecosystem is proliferating.

These projects also fall in the category of “top decentralized finance projects” and “top decentralized finance applications.”

The article aims to list the best DeFi projects out there. Among the DeFi projects, we are going to list the Ethereum DeFi projects as well. So, without any delay, let’s list the top DeFi application projects below.

Want to know more about DeFi? Enroll Now: Introduction to DeFi Course

50+ Top DeFi Projects

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2020/01/Top-Defi-Projects.png' alt='Top Defi Projects='0' /> </a>

Payments

OmiseGO: OmiseGo offers instant peer-to-peer transactions that enable financial institutions to do real-time transactions. It can work worldwide across asset classes, geographies, and applications.

Ink Protocol: Ink Protocol is another trusted peer-to-peer transactions on any platform. It works with XNK token and offers escrow options as well. In short, it is a decentralized marketplace.

Groundhog: Groundhog lets you create a crypto-based subscription. In simple words, it enables customers to make recurring payments on Ethereum. Payments can be made in DAI, ETH, or ERC-20 Token.

Request Network: Request Network offers an open network for transaction requests. Furthermore, it can be used by individuals and apps using IPFS and Ethereum.

Want to explore in-depth about DeFi protocol and its use cases? Enroll in Decentralized Finance (Defi) Course- Intermediate Level Now!

StableCoins

Gemini Dollar: Gemini Dollar is backed to the US dollar at a 1:1 ratio. It is issued by Gemini Trust Company LLC. It helps in all crypto use-cases, including investing, lending, spending, and others.

Reserve: Another stable coin that offers stable decentralized currency. It offers three types of assets for better-decentralized currency, including reserve stablecoin, collateral tokens, and reserve share tokens.

Dai: Dai is pegged against USD. It utilizes the Ethereum network, and the MakerDAO system governs Dai.

TrueUSD: TrueUSD is the first regulated stablecoin that is backed against the US dollar at 1:1. Moreover, it offers easy redemption, transparency, liquid, ethical, and so on.

Want to know more about stablecoins? Enroll Now: Stablecoin Fundamentals Masterclass

Infrastructure

0x: 0x offers a decentralized infrastructure that offers peer-to-peer exchange of digital assets.

Settle: It is a web-native operating system designed for decentralized finance. It takes advantage of the DeFi protocols.

Connext: It scales Ethereum with the help of state channels. It is a P2P micropayment infrastructure. It is also open-source.

OxCert: OxCert is an open-source framework that lets developers manage, create, and swap digital assets(ERC-721). It also works with the ERC-20 value tokens. It offers a complete toolset for building scalable and secure dApps.

Investment

Set: TokenSet enables investors to manage their crypto investment on a single platform. It offers Asset Management Strategies. By using the tool, the trader can save effort and time, stay in control, and utilize proven strategies.

Harbor: Harbor is a digital platform that lets you manage your investment subscriptions and automate them. It also enables the investor to do proper investor management.

Betoken: Betoken is a Crowd-powered asset management protocol that lets you automate your investment. Furthermore, its key features, including active management, user-owned, user-governed, full collateralization, and no fees.

Polymath Network: Polymath Network tokens offer the infrastructure to create, manage, and issue digital securities.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll Now in Crypto Fundamentals, Trading And Investing Course.

Liquidity and Exchanges

Uniswap: Unisawp protocol automates the Ethereum token exchange. Its key feature includes a formalized model, an open-source front-end interface, and a free platform to use.

Marble: Marble offers Lending on Ethereum.

IDEX: IDEX is a decentralized Ethereum token exchange platform that offers real-time trading on the blockchain.

Airswap: Airswap offers peer-to-peer trading on the Ethereum network. Moreover, it is easy to use with key features such as no fees, no deposits, no sign-ups, secure, intuitive, and liquid.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in The Complete Ethereum Technology Course

Derivatives

bZx: bZx is an open finance protocol that can be used to build applications to empower traders, borrowers, and lenders. Its key features include passive income, minimal risk, and lower fees.

MARKET Protocol: MARKET Protocol lets the user trade traditional assets, cryptocurrencies, and trade stocks.

VariabL: VariabL offers derivatives on Ethereum in a trustless, efficient, and secure way.

dYdX: It is a traditional open-source crypto assets trading platform.

KYC

Bloom: Create a reusable digital identity that is secure, reliable, and universal.

Civic: Civic is a secure identity solution where individuals and businesses can use it to protect and control their identities. It is a secure ID platform and offers reusable KYC.

SelfKey: SelfKey enables the user to do their KYC process once and store it on their wallet. The KYC information can then be used as your digital identity on any platform that utilizes digital identity.

Sovrin: Sovrin is yet another digital ID platform that lets users manage their digital ID online. It lets you create a self-sovereign identity.

Want to explore an in-depth understanding of security threats in DeFi projects? Enroll in DeFi Security Fundamentals Course Now!

Marketplace

Gitcoin: GitCoin enables developers to do crowdfunding for open-source software projects. It is an ecosystem for

Bounties Network: Bounties Network helps participants to create projects on the Ethereum network. Participants can then contribute and then paid through the network.

Origin: Origin is aimed to build decentralized marketplaces.

TruSet: TruSet enables participants of a community to collect, share, validate business-critical reference data. It is based on the Ethereum blockchain.

Lending and Credit

ETHLend: ETHLend is a landing platform that is built on top of the Ethereum network. The user can take loans and also define the loan request terms. Once the loan is secured, you will then receive the funds. It comes with low fees, a yearly loan duration of 1 to 12 months, and 3% minimum yearly interest.

SALT: SALT is another popular lending platform that provides comprehensive coverage, collateral wallets, loan health, and more. Furthermore, it offers loans backed by XRP, Dash, Dogecoin, Bitcoin Cash, Pax Gold, Crypto, Ether, and Bitcoin.

Compound Finance: It’s an algorithm-driven open-source protocol for efficient money markets based on Ethereum.

NUO: NUO enables a non-custodial way of borrowing and lending cryptocurrency. You can borrow with Leverage, lend & earn interest. Moreover, some of the key features include multi assets, customizable, collateralized, smart account, Meta Tx, Instant.

Want to develop expertise in the Bitcoin Space? Enroll Now: Getting Started With Bitcoin Technology Course

Prediction Market

Bodhi: Bodhi is a decentralized prediction market solution. It offers windows, Mac, and Linux desktop applications. It also comes with a web version.

Augur: Augur is a no-limit betting platform. They are releasing their new app that has no-limits, DAI/USD betting, universal access, and community discussion.

Gnosis: Gnosis offers a new market mechanism that believes in a redistributed future. Furthermore, it helps the distribution of incentives, assets, ideas, and information.

Veil: Veil is a prediction market that offers peer-to-peer prediction. In reality, it is built on top of open protocols. This means that you can create your own prediction markets.

Wallets

MetaMask: MetaMask is a popular Ethereum wallet that runs on the browser. It is a browser extension that can connect to the Ethereum network and dApps running on the browser.

Argent: Argent is a modern wallet that is available on AppStore and GooglePay. Furthermore, it lets you store ERC-20 tokens and also interact with decentralized apps.

Trustology: Trustology offers a customized way to store crypto assets.

Zerion: Zerion offers a simple interface to access decentralized finance. It enables users to invest, borrow, and earn interest in crypto assets.

Insurance

Nexus Mutual: Nexus Material offers insurance for smart contract failure. Furthermore, it is a blockchain-based solution. The user needs to get a quote to purchase the smart contract cover.

Etherisc: Etherisc is a decentralized insurance protocol that enables businesses and developers to build insurance products.

iXledger: The platform offers groundbreaking insurance platform using the blockchain technology.

VouchForMe: VouchForMe utilizes social network power to lower insurance costs. In reality, the user who takes insurance can gather vouchers from social media and reduced insurance premium costs.

Want to know learn more about DeFi applications? Check out more from our Decentralized Finance Applications guide now!

Conclusion

For beginners who wants to pursue a career in DeFi or wants to learn to develop these DeFi projects, we are recommending our decentralized finance course. Start your blockchain journey now!

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

![30+ Best Decentralized Finance Applications [Updated] best decentralized finance (DeFi) applications](https://101blockchains.com/wp-content/uploads/2020/10/decentralized-finance-applications.png)