Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- FinTech

James Howell

- on April 21, 2023

How to Become Fintech Certified Expert?

Fintech has become one of the most talked about terms in the world of business right now. Many candidates aspiring to become fintech certified expert want to learn about fintech and capitalize on promising career opportunities. What is fintech? You can find a basic answer in the term itself by breaking it down into ‘finance’ and ‘technology.’

Fintech represents the innovative combination of finance and technology for ensuring new value improvements alongside automation of financial services. Some of the notable use cases of fintech, such as mobile payment systems, peer-to-peer lending, cryptocurrencies and tools for personal finance management, have transformed the financial services landscape. Therefore, a fintech expert can identify promising opportunities for career growth in the future.

While the career prospects in fintech are quite appealing, it is important to identify the necessity of training and certification. You can become fintech professional with a structured career path, focused on a detailed understanding of available career roles and best practices for career development. The following post serves as an outline of some important pointers you need to become a fintech expert.

Excited to explore the impact of technology on financial services? Enroll Now in the Certified Fintech Expert (CFTE)™ Certification Course Now!

Why Should You Become a Fintech Expert?

Before you learn about the pointers required to become a fintech expert, you must have some doubts regarding a career in fintech. Financial technology started with cross-border financial exchanges and also included the growth of ATMs, credit cards and digital banking. The necessity of a fintech certification in present times is a clear indication of the dominance of fintech. New technologies such as blockchain, AI and machine learning have created a disruptive influence on the financial sector. On top of it, NFTs and DeFi introduce transformative changes in the modern financial services landscape.

Interestingly, financial institutions and businesses worldwide have shown positive attitudes toward fintech adoption. Almost 80% of financial institutions worldwide have joined fintech partnerships. The total amount of investments in fintech companies amounted to almost $210 billion in 2021. Another important factor that determines the decisions of candidates to become fintech certified expert is the expected salary estimate.

The average annual salary of a fintech expert in entry-level roles could be around $120,000. As you gain experience or switch roles to executive positions, the average annual salary can climb up to $150,000. In addition, the favorable predictions for fintech industry growth also present viable reasons to pursue the career path of fintech experts.

In-Demand Roles for Fintech Experts

The reasons for becoming a fintech professional prove the potential of the fintech market for powering up your career opportunities. Most of you would be curious about answers to “How do I become a fintech expert?” and best practices for the same. However, you need to take a look at another important aspect before beginning your preparations for becoming a fintech expert. The domain of fintech offers a variety of job roles for fintech experts based on education, professional background and technical expertise. The Global Fintech Talent Report 2022 by the Robert Walters Group revealed that the top in-demand job roles in fintech include the following.

- Software engineer

- Business analyst

- Product Manager

- UI/UX designer or developer

- Customer success professional

Some of the other roles you can explore with a professional fintech certification include data scientist, fintech lawyer or consultant, business operations manager and risk and compliance manager. Awareness of top job roles for certified fintech experts can help in effective planning of career objectives. Here is an overview of some of the most preferred job roles for fintech experts.

-

Data Science or Analytics

Fintech experts can explore career roles as data scientists or data analysts for evaluating the massive volumes of data in the fintech world. The capability of fintech experts to monitor consumer behavior patterns and market trends can help fintech companies achieve competitive decisions.

Learn the basic and advanced concepts of Fintech. Enroll Now in Fintech Fundamentals Course!

-

AI and Machine Learning

The list of in-demand fintech skills in 2023 would highlight AI and machine learning as top priorities. Why? AI and machine learning can introduce the benefits of intelligent automation for financial services. Fintech professionals with the skills for creating AI tools to serve the financial services industry can work in AI and ML roles.

-

Blockchain Developer

The influence of blockchain on the financial services industries has been massive. Cryptocurrencies, NFTs and smart contracts have offered new definitions to many conventional precedents in the world of finance. The career path to become fintech professional would obviously feature blockchain as a prominent attraction.

Many financial institutions and tech companies have invested billions of dollars in different blockchain-based projects. Blockchain-based roles in fintech could involve responsibilities ranging from optimizing transactions to creating efficient data storage and contract management infrastructure.

-

RegTech and InsurTech

Fintech experts can also explore promising career opportunities in the domains of RegTech and InsurTech. Fintech professionals can help financial services companies address their needs for regulatory compliance through technology. On the other hand, InsurTech leverages the skills of fintech experts to improve the efficiency of insurance services.

-

DeFi Lending

Peer-to-peer lending or DeFi lending is also another promising area you can explore as a fintech expert. Candidates seeking answers to “How do I become a fintech expert?” should notice how peer-to-peer or P2P lending platforms have garnered worldwide adoption. Therefore, fintech experts can find job opportunities in new DeFi projects or engineering roles in existing projects.

Want to explore an in-depth understanding of DeFi projects? Become a member and get free access to Decentralized Finance Course Now!

How Can You Become a Fintech Expert?

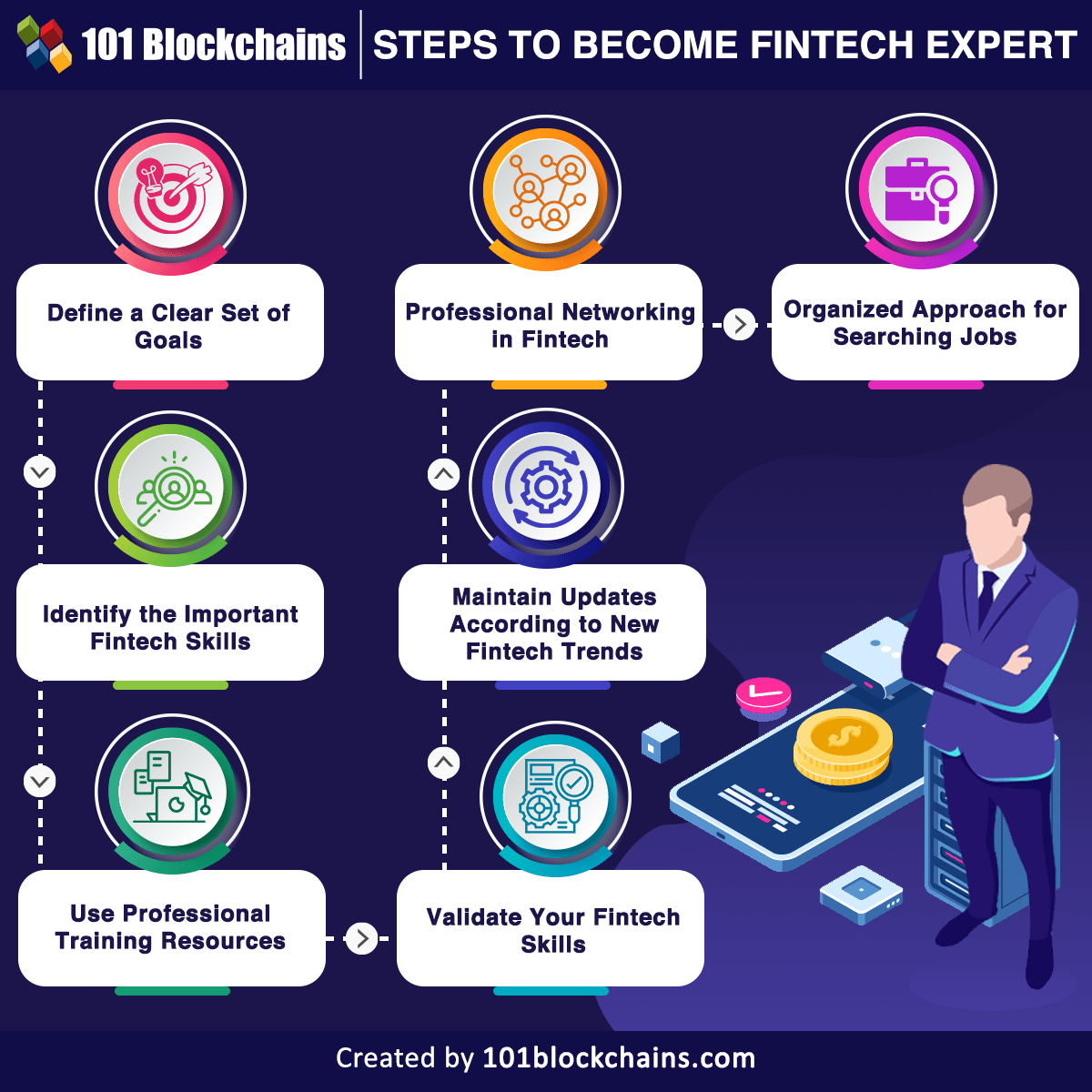

The different job roles for fintech experts showcase the range of opportunities you have for building a career in fintech. At the same time, you should notice that you need to build a credible identity in the fintech domain to access career development opportunities. The journey to become fintech certified expert is not an easy one. However, you can find your way to top jobs in the fintech industry by following certain best practices. Here is an outline of the different steps for becoming a fintech expert.

-

Define a Clear Set of Goals

The first thing you need to become a certified fintech expert is a clear set of goals for career development. A career in fintech is obviously lucrative for any individual. However, you need to identify why you want to pursue a fintech certification and a career in fintech expert roles. You need to reflect on certain important aspects, such as your commitment to lifelong learning in fintech and interest in innovative fintech developments.

Do you have a knack for coming up with innovative ideas to empower the fintech sector? Are you looking for a career spanning multiple disciplines, such as finance, business, tech and marketing? The clarity regarding your goals for building a career in fintech offers effective results in planning your career development approach.

-

Identify the Important Fintech Skills

The most crucial part of your journey to become fintech professional is the identification of important fintech skills. A broad range of skills can serve as the boost required for better career prospects in the fintech space. You would need technical as well as soft skills to ensure higher possibilities of landing jobs in fintech.

Some of the most important technical skills required for fintech experts include machine learning, artificial intelligence, programming, data analytics, cybersecurity and troubleshooting. On top of it, the list of in-demand fintech skills also includes operations management and data mining. Another crucial technical skill required for fintech experts refers to blockchain and smart contract development expertise. Candidates for fintech expert roles should develop skills in using Solidity, Hyperledger Fabric and Ripple.

The skills for fintech experts also include soft skills, such as interpersonal skills, leadership skills and communication skills. In addition, candidates aspiring for the roles of fintech experts should also have the flexibility to adapt to dynamic environments. Some of the other essential soft skills for fintech professionals include problem-solving and time management skills. Most important of all, fintech experts should have an innovative mindset and ability to work in collaboration with other teams.

-

Use Professional Training Resources

After identifying the important career goals and skills required to become fintech certified expert, you need to develop your expertise. Starting from the fundamentals of fintech to the technological concepts of smart contracts and blockchain, you have to cover a broad range of topics in fintech. Therefore, you need to choose credible training courses which can help you learn different technologies for fintech.

For example, 101 Blockchains can serve as a reliable platform for learning about blockchain technology, smart contracts, cryptocurrencies, NFTs and DeFi. The benefit of professional training resources is evident in the credibility of training materials curated by subject matter experts. In addition, you can also use online fintech training courses as an effective instrument for developing your skills.

-

Validate Your Fintech Skills

The next step in the journey of building your career as a fintech expert focuses on choosing a certification. A professional fintech certification could help you achieve recognition for your skills in fintech. In the long run, the certification could serve as a vital tool for updating your skills with new developments. Therefore, it is important to choose a certification that focuses on comprehensive aspects of fintech. 101 Blockchains has come up with a new Certified Fintech Expert or CFTE certification training course, which can offer an effective solution to your search.

-

Maintain Updates According to New Fintech Trends

The fintech industry is gradually evolving with new technological advancements driving the force of innovation. Candidates need more than in-demand fintech skills to establish their claim for top job roles in the fintech industry. You have to stay informed about the latest innovative developments and digital trends in the domain of fintech. Most important of all, knowledge of the latest trends could serve as a valuable asset for candidates in fintech interviews. Some of the most prominent trends which dominated fintech in 2022 include web3 and embedded finance.

Web3 presents the conceptual foundations for decentralization of finance by using blockchain technology. Your efforts to become fintech professional should also pay attention to embedded finance, an innovative concept for integration of financial technologies in non-financial organizations. As the scope of fintech industry expands further, fintech professionals have to familiarize themselves with many new trends and technologies.

-

Professional Networking in Fintech

The response to “How do I become a fintech expert?” would be incomplete without mentioning the importance of professional networking. Career development in fintech without professional networking can be a challenging task. However, connections with industry experts and other professionals could help you access feasible opportunities for career growth in any domain.

One of the best ways recommended for expanding your professional network points at LinkedIn. You can use the professional networking platform to connect with fintech professionals, evangelists and industry leaders. In addition, fintech events such as conferences and job fairs, as well as virtual fintech communities, can also ensure promising results for professional networking.

-

Organized Approach for Searching Jobs

The journey to become fintech certified expert also involves the best practices for finding fintech jobs. No one would offer you a job just because you have a certification in fintech. You need to approach the top fintech companies and projects with your resume to find jobs as a certified fintech expert.

The most challenging task in searching for fintech expert jobs is the creation of a resume. You need an impressive resume featuring key details such as educational qualifications, certifications and professional experience. Aspiring fintech professionals could also try opportunities for internships in the domain of fintech before approaching top companies.

Get familiar with the terms related to Fintech with Fintech Flashcards

Bottom Line

The guide to becoming a certified fintech expert showed vital information about best practices for building a career in fintech. As a fintech expert, you can find the opportunity to work in multiple job roles. At the same time, the lucrative appeal of fintech jobs alongside the growth of fintech industry validates the urgency of seeking career opportunities in fintech.

If you want to become fintech professional, you need to find effective training resources for developing fintech skills. Apart from a broad set of technical skills, fintech experts must also have soft skills for addressing important responsibilities in different roles. Learn more about fintech fundamentals and validate your skills with a professional fintech certification right now.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!