Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Analyst Corner

Gwyneth Iredale

- on May 18, 2021

What are the Digital Asset Custody in 2022

Retail and institutional investors all over the world have started investing more interest in digital assets, thereby leading to more demand for digital asset custody options. The continuous evolution of digital assets has resulted in the arrival of different types of custody options. At the same time, new players in the market want to build structures and controls that are aligned perfectly with their target markets and value propositions.

The constantly changing definitions of custody of digital assets alongside emerging structures have led to formidable uncertainties in the regulatory frameworks for custodians. Furthermore, the changing landscape of the digital asset custody market has also invited the addition of more controls to the existing frameworks. The following discussion attempts to reflect on the potential of solutions for custody of digital assets in 2022. Let us find out what 2022 holds for custody of digital assets.

Enroll Now: Central Bank Digital Currency Masterclass

Digital Assets and Their Significance

According to the International Monetary Fund (IMF), digital assets serve as digital representations of value through the technological advantage of cryptography as well as distributed ledger technology. Digital assets have denominations in their own units while also offering the ease of transferring in a peer-to-peer approach without intermediaries.

The basic interpretation of digital assets points out towards assets existing on virtual platforms. Although it is reasonable to recognize digital assets as intangible, many assets are gradually being associated with real-world assets.

As of June 2020, the overall value of the digital asset market easily surpassed $239 billion. Subsequently, the gradually increasing mainstream adoption of digital assets would lead to profound improvements in the value. With the scope for formidable growth in the digital asset market, it is inevitable to focus on the custody of digital assets.

Also Read: How to Audit the Next Generation of Digital Assets

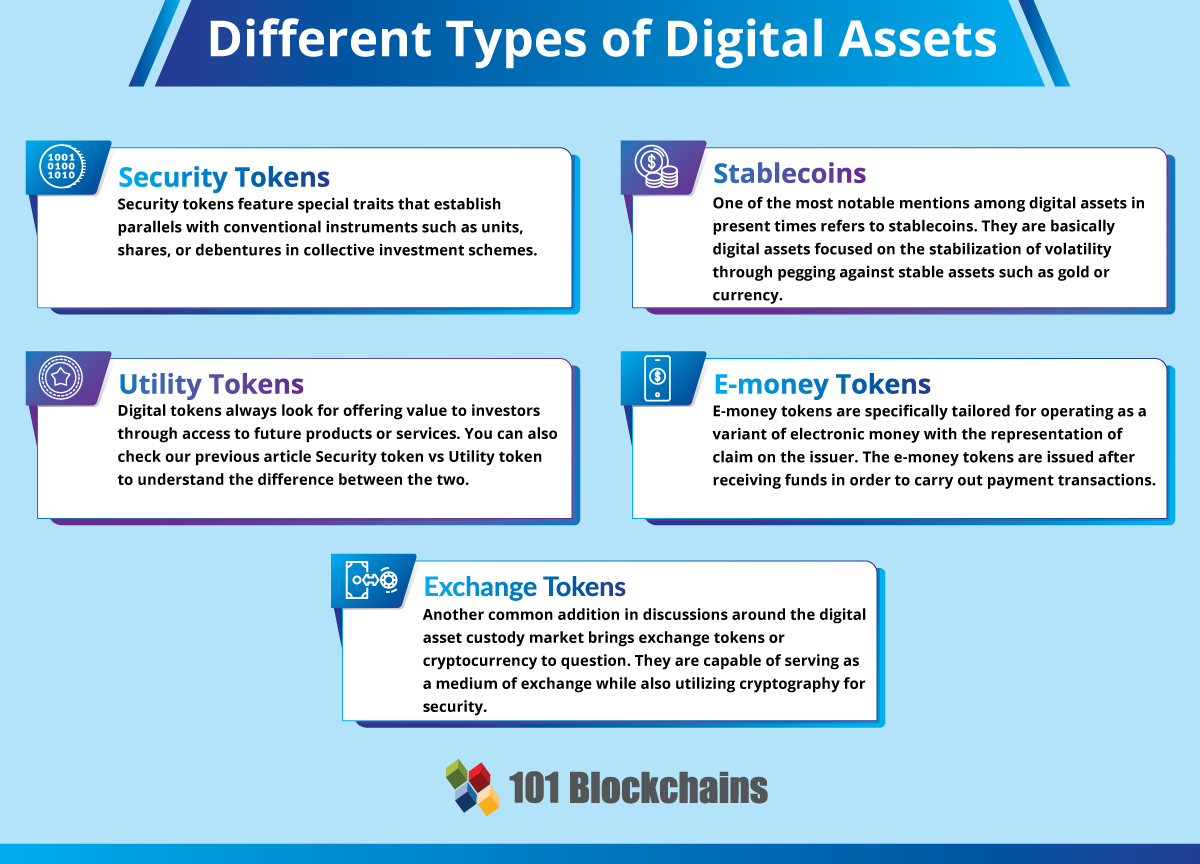

Different Types of Digital Assets

For a basic understanding of the definition of digital assets, it is important to take a look at the categories of digital assets. The different types of digital assets that you will come across in digital asset custody include the following,

1. Security Tokens

Security tokens feature special traits that establish parallels with conventional instruments such as units, shares, or debentures in collective investment schemes.

2. Utility Tokens

Digital tokens always look for offering value to investors through access to future products or services. You can also check our previous article Security token vs Utility token to understand the difference between the two.

3. Stablecoins

One of the most notable mentions among digital assets in present times refers to stablecoins. They are basically digital assets focused on the stabilization of volatility through pegging against stable assets such as gold or currency.

4. E-money Tokens

E-money tokens are specifically tailored for operating as a variant of electronic money with the representation of claim on the issuer. The e-money tokens are issued after receiving funds in order to carry out payment transactions.

5. Exchange Tokens

Another common addition in discussions around the digital asset custody market brings exchange tokens or cryptocurrency to question. They are capable of serving as a medium of exchange while also utilizing cryptography for security.

You have so many digital assets available in the market, and custody solutions are important for storing digital assets while ensuring their security and ease of trading with the assets. So, what do you exactly mean by custody of digital assets?

Read Now: A Complete Guide to Asset Tokenization

Definition of Digital Asset Custody

If you want to understand custody in the age of digital assets, it is important to view it from the perspective of conventional capital markets. In the basic sense, custodians are basically institutions offering a wide range of financial services such as trade settlements, corporate action execution, clearing, and trade exchanges. However, the primary function of a custodian focuses on safeguarding the assets of investors.

They serve as vaults for storing the assets of investors in digital and physical forms while charging investors with a fee for the secure maintenance of their assets. Conventional asset custodians engage in agreements with investors which specify that the assets would stay temporarily in the safekeeping of the custodian. Investors could easily retrieve their assets with requests to the custodian. Most important of all, custodians use their market skills and knowledge to reduce risks associated with theft, loss, or fraud.

Read Now: Blockchain-Enabled CBDC vs Crypto

Understanding the Role of Custodian

Is the role of a custodian the same in digital asset custody just like traditional asset custody? The custody of digital assets follows the similar approach adopted for traditional financial markets. The primary responsibility of custody for digital assets focuses on safekeeping the digital assets of customers. Digital asset custodians are able to achieve this through secure key management for the cryptographic security of digital assets.

Ownership of the asset is validated on the basis of holding the private key of an asset on behalf of the asset holder. In addition, custody of digital assets also focuses on restricting access to private keys. Furthermore, custodians must also ensure that the digital asset is related to an actual asset in the real world, thereby enabling ease of issuing a new digital asset or token.

Factors that Affect the Custody of Digital Assets

One of the most critical factors that can dictate the market for custody of digital assets refers to security. Investors are considerably worried about security assets before entrusting them to a specific custodian. On the positive side, digital assets feature inherent security traits that offer a specific level of protection.

First of all, the digital asset custody market relies on distributed ledgers for representing digital assets as random binary digits. Therefore, the record of digital asset transfers could be documented easily on an independent ledger that is immune to modifications. The second important factor pointing towards security in the custody of digital assets refers to the use of public and private keys. Users could access public and private keys for using a particular digital asset.

Watch our on-demand webinar on the Institutional Adoption of Digital Assets and the Role of Custody!

Types of Solutions for Custody of Digital Assets

You could come across different choices for custody in the age of digital assets. Individual investors, as well as institutions, could opt for different custody methods according to their requirements. Let us take a look at the three different options to find out a suitable option.

-

Self Custody

Self custody solutions could refer to hardware, paper wallets, or software that you can use for storing private keys. The practice of digital asset custody with self custody solutions allows better scope for control while ensuring comparatively better security. On the contrary, self custody solutions for digital assets impose the burden of taking care of the asset on your own. In addition, self custody solutions present higher vulnerabilities to loss of assets or hacking.

-

Exchange Wallets

Exchange wallets have also created a profound impression in the digital asset custody market. These wallets are solutions in which investors trust an exchange for controlling and managing public and private keys. On the other hand, the exchange wallets also continue maintenance of access through online wallets.

The trusted exchange holds ownership of private keys, and as a matter of fact, it holds the concerned digital asset. Therefore, you could find the benefits of simplicity and ease of access with exchange wallet solutions. However, exchange wallets are subject to counterparty risks and commingling as the downsides for custody of digital assets.

-

Third-Party Custodian

Third-party custodians are basically service providers storing digital assets on behalf of customers. The third-party custodian generally uses clearly outlined features and controls for certainty regarding safeguards for digital assets. Generally, third-party custodian solutions are suitable for institutional investors. So, you can reasonably expect better scope for institutional-grade insurance and security.

The notable advantages of third-party custodian solutions include clarity regarding rules, flexibility, and additional security advantages. However, retail investors would face considerable cost burdens for using third-party custodians. Furthermore, you have to deal with the concerns of regulatory uncertainty.

Watch the full on-demand, think-tank webinar on DeFi and the Future of Finance.

Reasons for the Importance of Custody of Digital Assets

The concept of custody in the age of digital assets has gained considerable levels of attention in recent times. So, what will drive the growth of solutions for custody of digital assets in 2022? Here are some of the key factors to look out for in custody solutions for digital assets.

- Custody of digital assets provides promising opportunities for reducing risks and complications that are associated with taking care of assets on your own. Digital asset custodians offer profound ease of use, an overall reduction in risk alongside improved security.

- Another promising advantage with custody of digital assets is the advantage over traditional exchanges, which are vulnerable to hacking attacks.

- Custodians employ the necessary resources for addressing various security risks associated with digital assets, thereby ensuring safer and highly regulated storage platforms.

- Digital asset custodians could also help consumers by utilizing technology and regulatory expertise to encourage the participation of investors.

Check out the exclusive Research Report on Digital Assets and Central Bank Digital Currency!

Bottom Line

On a final note, it is quite clear that the digital asset custody market would grow profoundly in 2022. Digital custody solutions provide the capability for private key storage, thereby enabling better control and transparency regarding the provenance and security of digital assets. However, the question over approaches for controlling private keys matters significantly for the long-term future of digital custody solutions.

The most important setback in the case of digital custody solutions is identified in the lack of a regulatory framework. Without a regulatory framework, investors would face a difficult time trusting digital custody solutions. On the contrary, the substantial growth in the digital asset market directly points out the promises for custody of digital assets. To learn more about digital assets and digital custody solutions, enroll in the Central Bank Digital Currency masterclass and start learning to enhance your skills.