Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Cryptocurrency

Gwyneth Iredale

- on July 27, 2021

Understanding the Core Features of CBDC

Aspiring to know about the Core Features of central bank digital currency? If yes, you have reached the right place.

Central banks have been the most trusted source of money for the public for many years in accordance with their public policy objectives. However, the world has been changing considerably, and the domain of finance is not new to the scope for change. From a commercial perspective, digital payments have become faster and more convenient, especially with growing volumes and diversity.

Now, central banks are seeking out alternatives to offer digital currency to the public in the form of a ‘general purpose’ central bank digital currency. CBDC features have started to gain profound levels of attention in recent times. So, what do CBDCs or central bank digital currencies have to offer for changing the face of financial services as we know them?

Want to learn how digital currencies can improve your access to financial services? Enroll Now in the Central Bank Digital Currency (CBDC) Masterclass

What are CBDCs?

Before diving into an outline of central bank digital currency features, it is important to understand their definition. CBDC basically points out any digital variant of central bank money, which is different from the balances in traditional reserves or settlement accounts. The interest in CBDC has been growing substantially in recent times as central banks carry out research and experiments.

In addition, continuing private experiments with different types of digital money alongside conceptual variety delivered by new technologies could imply confusion in defining CBDCs. The easiest definition of CBDC suggests that it is a digital payment instrument with denominations in a national unit of account. Most important of all, it is a direct liability of the central bank.

In order to understand the features of CBDC, you should know that central banks offer two distinct types of money. Central banks also offer the necessary infrastructure for supporting the third type of money, i.e. private money. Physical cash is the first type of money that is commonly accessible and is peer-to-peer in nature.

The second type of money refers to electronic central bank deposits, also referred to as settlement balances or reserves. The central bank reserves are generally electronic in nature, and only eligible financial institutions could access them. CBDCs give way for a new type of money. In the new system, CBDC would entail the requirements of a central bank, operators alongside the participating payment service providers and banks.

Watch on-demand virtual conference on Digital Assets and Central Bank Digital Currencies (CBDCs) now!

Foundational Principles of CBDC

The understanding of features of central bank digital currencies also depends a lot on the founding principles of CBDCs. Different types of motivations drive the ongoing research with respect to CBDCs. However, central banks follow common policy objectives, thereby calling for agreement on common principles.

The common foundational principles for CBDC are essential for incorporating the core features in central bank digital currencies and the underlying system. Here is an outline of the foundational principles for CBDCs, which can offer an in-depth understanding of CBDC features.

-

Do No Harm

The first founding principle for CBDCs basically points out not doing any type of harm. Actually, the new variants of money supplied by the central bank should continue their support for fulfilling public policy objectives. Most important of all, the new form of money should not affect or intervene with the ability of a central bank to carry out necessary tasks for financial and monetary stability.

-

Coexistence

Another founding principle which forms the basis of features of central bank digital currencies refers to coexistence. Central banks have prioritized stability above everything else and move with caution in the new domain of CBDCs. Coexistence actually refers to the need for new and existing types of central bank money to complement each other. All the forms of central bank money should coexist for supporting public policy objectives. Furthermore, central banks must continue offering and supporting cash alongside the adequate public demand for cash.

-

Innovation and Efficiency

The final founding principle for CBDC refers to innovation and efficiency. Both elements are essential to keep users away from less safe financial instruments. Subsequently, the damage to monetary and financial stability with economic and consumer harm could follow. The existing payments ecosystem includes public authorities as well as private agents. With new ways for both of them to work together, CBDCs can definitely serve as a secure, efficient, and highly accessible system.

Curious to know the difference between crypto and CBDC? Here’s a guide to help you understand the differences of Crypto vs CBDC.

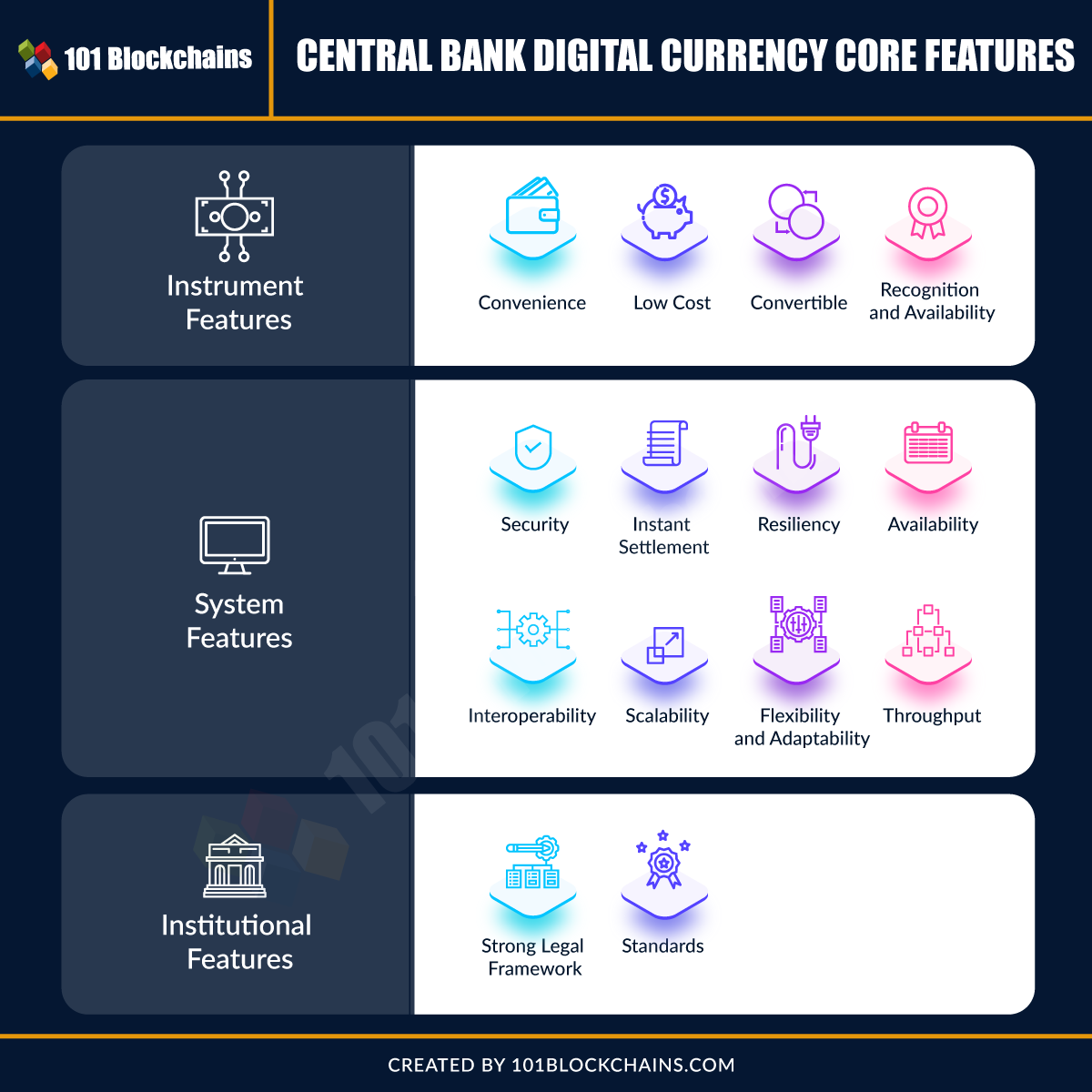

Understanding Central Bank Digital Currency Core Features

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2021/07/CENTRAL-BANK-DIGITAL-CURRENCY-CORE-FEATURES.png' alt='CBDC Core Features='0' /> </a>

The role of central bank digital currency features is clearly evident in the fact that they help in addressing the foundational principles. A new CBDC solution would need the core features with a specific focus on the instrument itself, the associated system and the wider institutional framework. So, one could find instrument features, system features as well as institutional features among the core features outlined for CBDC. Let us find out more about the features in each category.

Instrument Features

The first addition among core CBDC features would deal with the features that are specific to the CBDC instrument itself. Some of the core instrument features you can find in CBDC are as follows,

-

Convenience

CBDC payments should be highly convenient and as simple as using cash, scanning a QR code or swiping a card. With convenient payments, CBDCs could encourage accessibility and adoption.

-

Low Cost

Another critical entry among central bank digital currency features refers to the availability of CBDC payments at extremely low or zero costs for end-users. In addition, CBDC must also ensure the limited requirement of technological investment for end-users.

-

Convertible

CBDC should be easily exchangeable at par with private money or cash for maintaining the uniqueness of currency.

-

Recognition and Availability

CBDC should be applicable in all types of transactions that use cash, such as person-to-person or point-of-sale transactions. Furthermore, CBDC should also offer the ability for making offline transactions, generally for limited periods and with predefined thresholds.

Watch on-demand webinar on Institutional Adoption of Digital Assets and The Role of Custody now!

System Features

The system features are particularly associated with the CBDC system or the platform hosting the solution. The important system features of CBDC are as follows,

-

Security

The infrastructure, as well as participants in a CBDC system, should maintain formidable levels of resistance to cyber attacks as well as other threats. CBDC should ensure effective safeguards against counterfeiting.

-

Instant Settlement

CBDC should facilitate instant or near-real-time settlement for all end-users of the system.

-

Resiliency

Features of central bank digital currencies should also include the facility of higher resilience towards operational failure and disruption due to electrical outages, natural disasters, or other possible reasons. In addition, end-users should also have the ability for making offline payments when network connections are not available.

-

Availability

End-users of the CBDC system should have the ability to make payments 24 hours a day, seven days a week, and 365 days a year.

-

Interoperability

The system should have the capability to deliver adequate interaction mechanisms alongside private sector digital payment systems and arrangements to simplify the transfer of funds among systems.

-

Scalability

The features of CBDC system should have the ability for expanding to address the need for potentially large volumes in the future.

-

Flexibility and Adaptability

You should also look for flexibility and adaptability in a CBDC system to ensure that it fits well with changing conditions alongside policy imperatives.

-

Throughput

The CBDC system must have the capability for processing a considerably large number of transactions.

With so much hype about CBDC all around, are you wondering about the advantages of CBDC? Check this guide to learn the top advantages of central bank digital currency.

Institutional Features

The final set of features of central bank digital currencies refers to the institutional features. Institutional features actually refer to the overall environment in which CBDCs have to operate. The notable institutional features pertaining to CBDC are as follows,

-

Strong Legal Framework

Central bank should impose clear precedents and guidelines for exercising its authority in the process of issuing a CBDC.

-

Standards

The CBDC system, including the infrastructure and all the participating entities, must comply with all the relevant regulatory standards. For example, entities responsible for transferring, storing or maintaining custody of CBDC must have accountability to regulatory and prudential standards followed by firms offering the same services for cash or digital money.

Here’s a guide to help you understand the differences between Retail vs Wholesale CBDC?

Opportunities and Risks of CBDC

The understanding of CBDC features gives a comprehensive impression of their potential. At the same time, it also gives the foundation for determining the opportunities and risks associated with CBDC. First of all, CBDC could enable opportunities that are unlikely with cash. With the help of an accessible and convenient CBDC, users can have an alternative to possibly unsafe variants of private money.

In addition, it ensures user privacy while enabling fiscal transfers and reducing illegal activity. On the other hand, the introduction of CBDC could also present some implications for financial stability. For example, the possibility for digital bank runs during times of stress or the long-term consequences associated with bank funding.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Bottom Line

Central bank digital currencies or CBDCs have the capability to serve an important role in helping central banks. CBDCs can change the ways of addressing public policy objectives of central banks. At the same time, they also help in facilitating evolution to the next step of digitalization in daily lives. The attention of the core features of CBDC focuses on strengthening usability while also safeguarding monetary and regulatory stability.

Simultaneously, it is also important to maintain a clear emphasis on design and technology trade-offs for security or offline transactions. Other important trade-offs you must consider are related to privacy or compliance and programmability or performance. The research on CBDC and its relevant features would continue, especially with collaborative efforts from renowned industry players. Learn more about CBDCs and their implications with the CBDC course for the broader financial landscape!