Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Decentralized Finance

Hasib Anwar

- on October 21, 2020

Decentralized Finance Technology: A Comprehensive Guide

The blockchain ecosystem came from a desire to build a transparent and better digital infrastructure that includes anyone, anywhere. Our financial system is far behind in this scene, and it needs a change. To make that happen, decentralized finance technology is bringing new capabilities to the table with trustless global accessibility, quicker settlement time, granular asset control, and so on.

Before decentralized finance, our financial infrastructure was heavily centralized. More so, central authorities like BoE or Fed issues the currency and controls the supply and demand. As we are financial users, we also give financial organizations control over our assets in the hopes of getting more in return.

However, this infrastructure is highly flawed where the centralized authority manipulates the system as they please, along with a massive amount of human errors made every single day. Even for online banking systems, our assets aren’t safe because they use legacy networks that are no match for today’s cybercriminals.

As you can see, even though it’s our assets, we tend to have zero control over it. But now it’s high time to get rid of this flawed system and embrace the power of decentralized technology.

Thus, I will discuss the ins and outs of decentralized finance technology in this guide, and hopefully, you will understand why it’s so important for the economy.

Want to know more about DeFi? Enroll Now: Introduction to DeFi Course

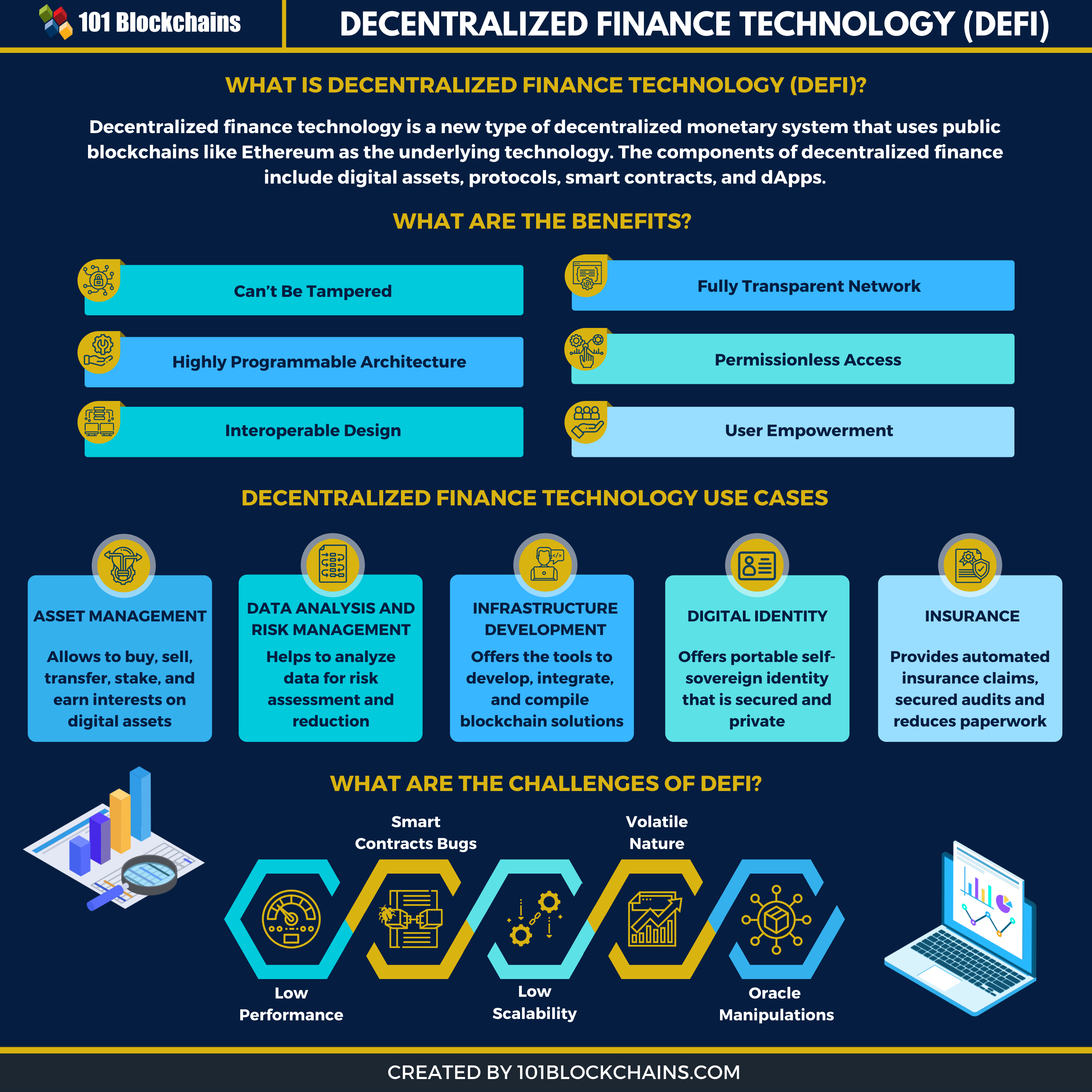

What is Decentralized Finance Technology (DeFi)?

Decentralized finance is the new type of decentralized monetary system that uses public blockchains like Ethereum as the underlying technology. Usually, the components of decentralized finance include digital assets, protocols, smart contracts, and dApps.

Although most of us see Bitcoin or Ethereum as only cryptocurrencies, very few actually know that these cryptocurrencies have a vast system that allows users to deal with financial activities without any central authority.

In fact, decentralized finance started using Ethereum at the very beginning to help develop this enormous ecosystem.

Now that decentralized finance technology is mainstream, many companies or individuals are interested in what this new system can do.

In reality, the primary goal of introducing this new system is quite straightforward. First of all, the target is to offer financial services to 1.7 billion people who don’t have access to it. Secondly, using the open system makes it easy to get rid of failures and errors and introduce a more transparent peer-to-peer network.

Also, as the DeFi technology is permissionless, so anyone can access the network when they want.

But enough, for now, let’s check out how DeFi performs against traditional systems.

Learn the fundamentals of Decentralized Finance (DeFi) with DeFi Flashcards

Decentralized Vs. Traditional Finance: How Are They Different?

Technically, decentralized finance is an advanced version of the typical finance structure. It follows the same protocols or receiving and giving money. However, there are some fundamentals differences at work.

More so, all decentralized finance technology companies tend to add their own touch in their finance solutions. So, let’s see what the new features are.

-

No Humans Needed:

The first characteristic of this technology is that it doesn’t need any employees or institutions to operate. Mainly everything runs on code written for that environment. You can always add your own rules to smart contracts, but the overall sequence of working is the same.

-

Code Transparency:

The main difference is the use of code and how transparent the process is. In traditional banking applications, you won’t see any transparency for the codes. However, in DeFi, you are free to audit and verify the codes. So, the users will always know what they are working with and how the contracts function.

-

Emergence of dApps:

The decentralized finance technology ecosystem is full of dApps for finance. More so, all of the applications are designed to be globally accessible from the very start! So, it won’t matter what’s your geographical location may be; you can access these DeFi networks at any time from anywhere.

-

Accessible to All:

There are no restrictions on who can develop these applications or who can create their accounts in these. So, unlike how our financial system works, there are no specific guidelines or authority to restricts your rights to having financial facilities. Therefore, you can just have a crypto wallet and use smart contracts or other features to get the benefits from your assets.

-

Open-Source Algorithms:

You can mix different decentralized finance applications and come up with a brand new one in the process. Most of their algorithms are open-source and free for people to use. More so, you can even build a platform that can access multiple applications from one point. This is something you won’t get from the traditional finance system.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

What Are the Benefits of Decentralized Finance?

Decentralized finance technology companies use public blockchain’s principles to increase overall financial transparency and security. More so, using this, they can unlock a vast amount of opportunities along with liquidity and come up with a standardized financial system.

Anyhow, there are many benefits to this technology. Let’s see what these are –

-

Can’t Be Tampered

Just like blockchain technology, these applications are also immutable. In reality, you can’t alter or delete the data once it gets stored. So, every single element gets audited properly to ensure security.

Highly Programmable Architecture

You can customize the smart contracts as you please. Therefore, it gives you the flexibility to develop a new financial asset or instrument.

-

Interoperable Design

In reality, most of the decentralized finance technology uses Ethereum’s protocols and standards. Thus, it’s easier to make them interoperable as they tend to have similar architecture. More so, developers can now build new features on top of any existing DeFi application. So, this also ensures the interoperability of this type of technology.

-

Fully Transparent Network

As the DeFi technology uses public blockchain for the technology, it will follow every single feature of this type of blockchain. For example, in public blockchains, all the users verify the transactions, and everything is broadcasted to them. Therefore, the level of transparency here is massive, and, in most cases, there isn’t an option to make these transactions private. Also, their source code is open for anyone to use, view, and audit.

-

Permissionless Access

Typically, traditional finance doesn’t offer permissionless access. Therefore, many individuals around the world still don’t have access to their financial rights. But in DeFi, they can get access without any restrictions. So, it won’t matter where they are or their location; they can use the facilities that come with this new ecosystem.

-

User Empowerment

All of the DeFi applications empower users rather than organizations. By using crypto wallets, you can interact with the network and take control of your assets. So, you will have sole custody of your personal data and assets.

Decentralized Finance Technology Use Cases

-

Asset Management

Many decentralized finance technology companies developed applications for asset management. Basically, using these applications, you can buy, sell, transfer, stake, and earn interests on your digital assets.

As you know, here you will own the data and no one else. So, these applications are necessary to help you manage all your digital assets without any issues. For example, Gnosis Safe, MetaMask, and Argent are applications that can help you manage assets.

-

Know-Your-Transaction (KYT) Mechanisms

Typically, in traditional finance, Know-Your-Customer guidelines are extremely necessary for countering-the-financing-of-terrorism (CFT) and anti-money laundering (AML) schemes. Without these schemes, stopping terrorism or fraudulent activities is not possible.

However, decentralized finance takes it to a different level. Here, you will get know-your-transaction (KYT) mechanisms. In reality, it will focus on the behaviors of the participating users rather than their identity.

-

Decentralized Autonomous Organizations

Another popular use case of DeFi is the DAOs. Without DeFi, the concept of DAO would never be possible. In reality, the decentralized autonomous organization follows blockchain protocols and eliminates the need for a centralized authority.

It’s a unique concept of organizational structure and quickly became popular. Although there were some ups and downs along the path, it’s still one of the primary use cases of DeFi protocols.

Excited to develop fluent knowledge of the DAO ecosystem? Enroll Now in DAO Fundamentals Course!

-

Data Analysis and Risk Management

You can use the features from decentralized finance to analyze data and make decisions around new opportunities. More so, you can also use them for risk assessment and reduction. Usually, DeFi offers high transparency around network activity and data.

You can use that feature to analyze the data and predict any risky activities within the network. Defi Pulse or Codefi Data are some of the popular applications made solely for this use case.

-

Tokenized Derivatives

Using the smart contracts of decentralized finance, you can develop tokenized derivatives. More so, the derivatives will get their value from an underlying asset. Obviously, you will also need to agree on some terms with the other party before tokenizing these derivatives.

Furthermore, the best part is that you can make any real-world asset as derivatives. For example, bonds, fiat money, and even commodities can become derivatives.

-

Infrastructure Development

There are lots of applications that offer the tools you need for infrastructure development. This is another popular use case of this technology. More so, you can use these tools to develop, integrate, and compile your algorithms to make your very own blockchain solutions.

For example, a truffle suit consists of frameworks, a testing environment, front-line libraries, and so on. So, any developer can use this tool to develop their very own blockchain project.

There are so many blockchain tools that can help you develop your blockchain projects a lot faster. Check out the top blockchain tools that developers love to learn more about these.

-

Decentralized Exchange

Another one of the wonderful decentralized finance technology use cases is the decentralized exchange. Decentralized exchanges can make your cryptocurrency trading a lot easier as it doesn’t have any central authority.

Therefore, there is no asset manipulation or losing control over your assets. Using this, you can transact assets directly with another peer and take control of your own assets.

It also helps to maintain token liquidity compared to traditional exchanges.

-

Gaming

In-app purchase is one of the major aspects of the gaming industries. Now with the new technology, this industry can start to use decentralized finance coins as an alternative to fiat money.

More so, these gaming companies can also introduce innovative incentive models and reward policies where users will get rewarded with DeFi coins. This can quickly attack more users and ensure increased revenue for this sector.

-

Digital Identity

You can pair blockchain-based identity systems with decentralized finance protocols to make a self-sovereign identity. This is a new type of digital identity where you will be responsible for your own identification and data. More so, DeFi can offer you open access to these platforms and make you portable identities that you can use anywhere and anytime.

In reality, it’s one of the prominent use cases of this technology, and it can really the way we deal with digital identities at the moment.

Want to understand the concept of decentralized identity? Enroll now in the Decentralized Identity Fundamentals Course!

-

Insurance

Insurance is another major industry for integrating decentralized finance technology use cases. DeFi can offer insurance industries zero paperwork, automated insurance claims, and audits. Not to mention, it can ensure a secure and transparent process of insurance claims.

Here, solutions like Nexus Mutual, Opyn, and VouchForMe can offer sharing insurance risks and offer securities released to insurance policies.

-

Borrowing and Lending Protocol

DeFi introduces a new type of borrowing and lending protocol that can help you lend or borrow directly with another peer without needing any intermediaries. More so, the interest rates for lenders are also great, and there are manageable options for borrowers as well.

Compound is one of the lending and borrowing tools that offer autonomous interests in lending.

-

Margin Trading

Typically, margin traders have to borrow money from brokers, but in DeFi, margin trading can take a new turn. In reality, these are mainly powered by non-custodial lending protocols. So, you won’t have to borrow money from a broker for trading.

More so, smart contracts can also automate brokerage activities, changing the way how traditional trading works.

-

Online Marketplace

Online marketplaces are blooming because of decentralized finance. At present, there are multiple online platforms that offer their services globally, selling products to services. Everything is peer-to-peer here, and you can directly purchase a product from the brands or individual sellers.

-

Payments

Decentralized finance technology is suited for global payment systems. It’s one of the foundational uses cases of DeFi. Using applications in this space, you can directly send and receive money anywhere around the world. You won’t need any middlemen or whatsoever. Thus, it’s becoming a new pioneer for the unbanked and underbanked population.

-

Prediction Markets

Prediction markets can use the power of DeFi to predict future events. In reality, these applications can store a lot of information, and prediction markets can analyze them and enable users to trade value on a future event.

Solutions like Augur can offer you predictions on sports games, economic events, election results, and so on.

-

Savings

Decentralized finance technology solutions can help you save up quite faster than traditional banking systems. In reality, traditional accounts do offer interests but only to a certain extent. Compared to that, DeFi seems to offer great interest policies that can increase the amount of your savings fast. Apps like Dharma, PoolTogether offer no-loss saving options for you to try out.

-

Stablecoins

Stablecoins are one of the types of decentralized finance coins where it’s backed up by a stable asset. Mainly these are backed by fiat money, silver, gold pr even other stable cryptocurrencies. Thus, you can use this type of coin to reduce the crypto ecosystem’s volatile nature and ensure a better viable payment solution.

Want to learn the basic and advanced concepts of Stablecoin? Enroll in our Stablecoin Fundamentals Course Now!

-

Synthetic Assets

Synthetic assets are more or less like stablecoins. But in this case, this type of asset is a combination of another asset to make it more stable. More example, you can combine gold, fiat money to make a synthetic asset so that any price hike or drop can balance out with other assets.

-

Tokenization

Decentralized finance technology solutions come with tokenization. Thus, tokens are a form of digital asset that holds value within a blockchain network. You can use tokens for a network to function or even use them to transact with one another. In reality, it’s a new form of digital asset.

Want to learn the fundamentals of tokenization and its practical implications? Enroll Now: Tokenization Fundamentals Course

-

Trading

Trading in this space can range to a variety of activities such as margin trading, derivatives trading, crypto trading, token swaps, and so on. Anyhow, crypto trades can use decentralized exchanges to get lower cuts, faster transactions, high security, and asset ownership.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll in Crypto Fundamentals, Trading And Investing Course.

What Are the Challenges of DeFi?

-

Low Performance

DeFi uses blockchain technology, and these are slower compared to centralized systems. So, when you are using blockchain for it, you are getting a slower output.

There’s a way to increase the performance, but for that, you have to go for private blockchains. So, developers need to take this issue into account and make changes to tackle it.

-

High User Error

In the DeFi network, you are responsible for your own data and transactions. So, there will be no intermediaries to take on the responsibility for you. Thus, it comes with both positive and negative outcomes.

For example, if a user makes an error in transactions, there’s no way of deleting it or reversing it. But making sure every single user is careful enough for the network to work properly is tough. So, DeFi still has a long way to go.

-

Bad User Experience

Currently, users have to put extra effort into using decentralized finance applications. In reality, the technology itself is quite new, and many are finding it hard to comprehend how it works.

Thus, if it really wants to become a vital element of the global economy, then it needs to offer additional benefits to attract more users.

-

Scattered Ecosystem

There are too many applications suite for a single task in the DeFi ecosystem. Therefore, finding the best one that goes with your needs is a daunting task. Anyhow, expecting users to find the best choices on their own is not logical as well.

So, the developers need to think about a strategy that can directly guide all users to applications they need and not forcing too many options on them.

-

Smart Contracts Bugs

DeFi ecosystem is now based on quantity rather than quality. In many cases, developers roll out decentralized finance applications without properly checking or testing out faulty codes within the algorithms.

As a result, many smart contracts come with bugs that harm the experiences of the users. These are also susceptible to cyber-attacks. So, many users can lose the security of their contracts.

-

Low Scalability

Scalability is a massive issue when it comes to DeFi. In reality, public blockchains are not scalable enough to offer their services to the global economy. When there are too many participants on the network, the overall performance becomes poor and cumbersome.

However, if it wants to make its debut as an alternative to our traditional banking system, it needs to be scalable.

-

Oracle Manipulations

DeFi is still dependent on oracles to fetch information from outside the network. But these oracles are heavily centralized and, therefore, quite vulnerable to attacks.

So, as you can see, the oracles are massive security flaws of the applications that use them. If decentralized finance technology wants to offer 100% security, it needs to stop using centralized oracles for fetching information.

-

Volatile Nature

Decentralized finance uses digital assets or crypto assets, which are highly volatile. Although they may use stablecoins to back it up, controlling their value completely isn’t possible as of this moment. So, the whole network of applications that deals with these assets become a volatile ecosystem, which is a great hinder for economic growth.

-

Storage Issues

Blockchain does not offer a large storage facility. However, for a finance application, it needs to offer unlimited storage as millions of people may use it.

But, in reality, users face downtime, insufficient storage problems when they try to use any decentralized finance application. To combat this, developers need to come up with a better strategy to offer every user a good amount of storage capacity without ruining the performance of the platform.

Want to learn about more risks in DeFi? Check out our guide to risks in DeFi and how you can manage them right now!

Ending Note

Decentralized finance is helping us set a better economic structure and ensure a transparent financial system. With DeFi altering our traditional systems, new opportunities are quickly coming to light. Although the technology still has a lot of flaws, still there’s no way to undermine the benefits as well.

You can use this new growing economy for a better career opportunity. Therefore, if you can harness your DeFi skills, you can also become a part of a global revolution. So, it’s only reasonable that you will use a reliable source to learn more about it. I will recommend checking out our decentralized finance course as the first step for your blockchain career.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

![30+ Best Decentralized Finance Applications [Updated] best decentralized finance (DeFi) applications](https://101blockchains.com/wp-content/uploads/2020/10/decentralized-finance-applications.png)