Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Reviews

101 Blockchains

- on April 13, 2019

IEO: Initial Exchange Offering Guide

For much of 2018, the cryptocurrency market went through a period of massive decline. Notably, one of the reasons for the decline was the scamming of hapless investors in the name of Initial Coin Offering (ICO). However, the market seems to be maturing since the introduction of Initial Exchange Offering (IEO). This article will evaluate IEO vs ICO and distinguish them on the basis of trust and transparency.

What Is an Initial Exchange Offering (IEO)?

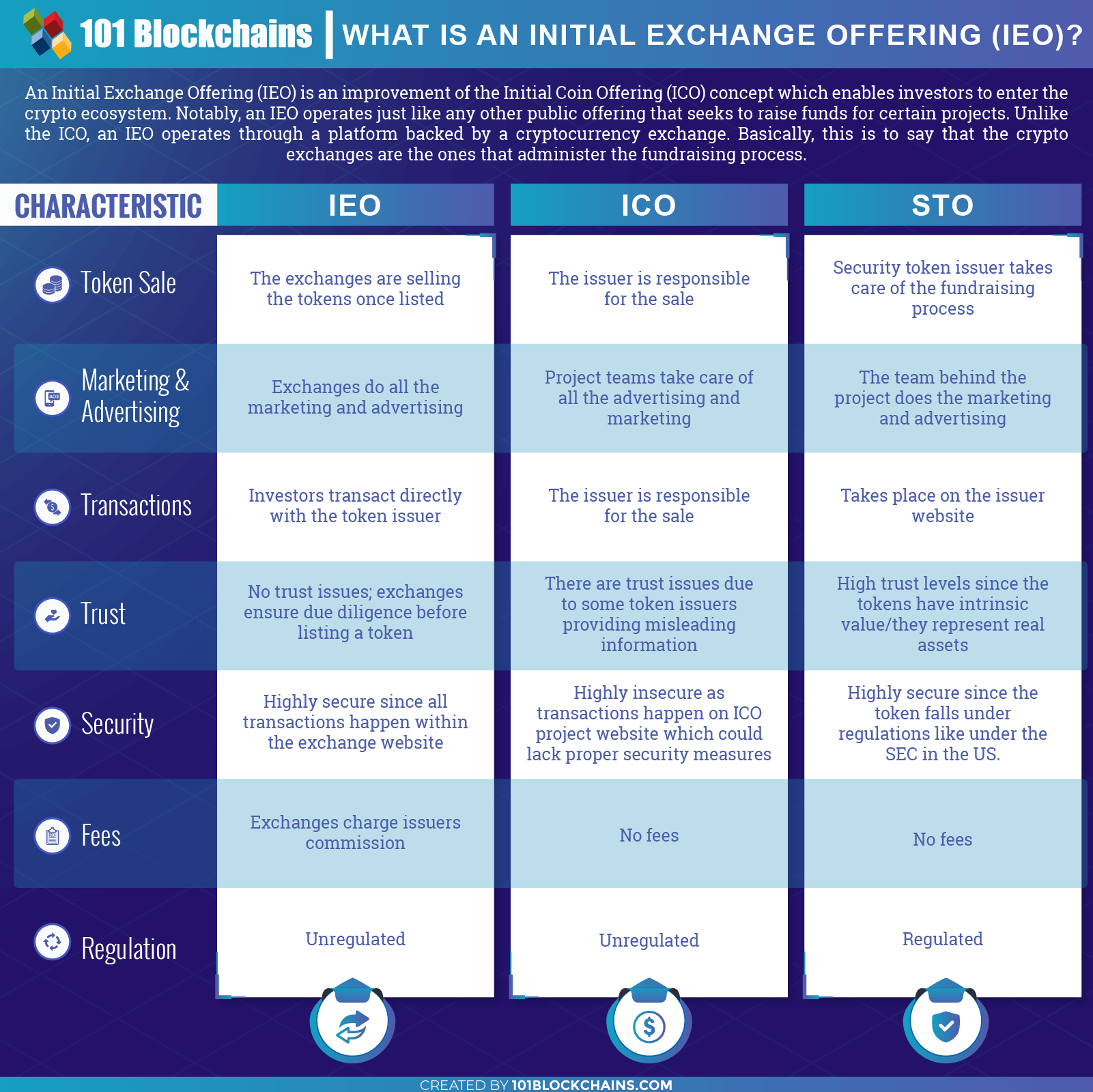

An Initial Exchange Offering (IEO) is an improvement of the Initial Coin Offering (ICO) concept which enables investors to enter the crypto ecosystem. Notably, an IEO operates just like any other public offering that seeks to raise funds for certain projects. Unlike the ICO, an IEO operates through a platform backed by a cryptocurrency exchange. Basically, this is to say that the crypto exchanges are the ones that administer the fundraising process.

In an IEO, the project teams behind a certain token do not have a direct correspondence with the investor. Instead, the project team approaches a cryptocurrency exchange and pitches the idea behind their token. Then, the crypto exchange conducts detailed research on the viability and feasibility of the project.

This background check seeks to achieve two objectives. First, it is obvious that an exchange which has a global presence has many users who trust its services. Therefore, people may follow any investment opportunity that pops up on the platform without asking questions. As such, it is the prerogative of the exchange to ensure that the project is real and it is an idea that can actually benefit investors.

Secondly, the background check aims to establish the risk profile of the project behind the given token. Interestingly, this is more or less a matter of the exchange hedging itself against any possible damage to their reputation if the project turns out to be a white elephant.

Essentially, an IEO happens through the facilitation of the cryptocurrency exchange. Notably, investors will not need to perform complicated transactions involving multiple cryptocurrency wallets to access the IEO. Instead, all they need is an account with the exchange and some cash in their deposit accounts. Already, major exchanges like Binance, OKEx, Bittrex, Bitmax, and Huobi and many more have platforms where investors can access IEOs.

Initial Exchange Offering (IEO) – Simply Explained

IEO vs ICO

From the discussion above, an IEO is simply a type of ICO whose administration is not in the hands of the issuer. Since the advent of the cryptocurrency mania, people wanted to get their hands on the fortune that the sector minted. On the other hand, entrepreneurs were in dire need of funds to push their projects through.

Therefore, the entrepreneurs launched what they christened ‘Initial Coin Offerings’ were investors would purchase a stake in the value of the projects. Just like Initial Public Offerings (IPOs), investors would reap the premium on their investments once the projects hit the ground and begin generating revenue.

Curiously, the projects behind the offerings ran their ICOs and there was no way for investors to determine the viability of the projects. Some unscrupulous entrepreneurs came up with fictitious projects complete with heavily plagiarized white papers. Soon, investors were crying since the entrepreneurs absconded with their investments. That way, ICOs became unpopular and the harbinger of the fraudulent side of the cryptocurrency market.

Therefore, the coming of IEOs is a way for legitimate entrepreneurs to try and invite back the investors with the promise that their projects are valuable. Herein lies the differences in IEO vs ICO comparison. First, it is clear that the issuers of the tokens do not have any direct influence on the administration of IEOs. On the contrary, the issuers of ICOs actively engage with investors and they are actively involved in wooing the investors.

Secondly, issuers of IEOs have to convince the crypto exchange that their project is worth investing in before the exchange allows it on its platform. On the contrary, project teams behind ICOs only have to pitch their project to investor who will then decide if it is worthwhile to put in their money. Therefore, the difference here is that the onus is on the investor to conduct due diligence on the ICO.

IEO vs STO

Once the ICO wave began to wane due to the incidences of fraud, entrepreneurs came up with an alternative called the Security Token Offering (STO). The main idea behind the STO was for the crypto industry to regain investor trust.

For starters, ICOs had one fundamental problem that made it so easy for scammers to weave their way through the market. Notably, there were no clear regulations covering the assets because of the lack of a clear definition of digital tokens. Interestingly, depending on the nature and purpose of the tokens, some would pass as securities while others would pass as digital currency, some both.

On the contrary, a security token is one which behaves like a real security and thus it falls under the purview of regulatory bodies like the US Securities and Exchange Commission (SEC). Also, this is to say that the tokens obtain their value from tradable sources like commodities and even stocks.

Compared to IEOs, STOs offer little trust for investors. This is because, despite their regulated nature, the fundraising for the STOs is solely under the control of the issuer. This is to say that investors have the burden of doing due diligence and that they might fall into a scam without comprehensive research.

Further, investing in STOs is complex as traders will have to complete transactions using the smart contracts run by the token issuer. As such, one needs to have a crypto wallet and has to understand the complex method that goes into digital transactions. Conversely, investors of IEOs, like earlier discussed, only need a deposit account with the exchange conducting the token sale.

Additionally, there is a huge difference between IEOs and STOs in terms of their nature. Here is an explanation. An STO is an asset that extends ownership of value to the investor. This is to say that whoever owns a security token owns a stake in some asset which is capable of earning the investor some profit. By extension, the investor can get losses if the value of the security token falls.

Interestingly, the STO fever is just catching on as analysts tout it as the replacement for ICOs. Notably, knowledgeable observers believe that STOs are the next frontier that will further cement the place of the cryptocurrency market in global trade. On the other hand, the concept of IEO is just emerging and many market enthusiasts are still not aware of it. Therefore, much of this year might hear a lot about STOs than IEOs.

Learn more about ICO vs STO, here.

Upcoming and recent IEOs

The popularity of STOs does not imply that IEOs are not a hit. To be sure, there various IEO token sales that have already taken place. Further, there those that are still ongoing and others that will come up at a later date.

Upcoming IEOs

Traceto.io

There are a number of upcoming IEOs where each project focuses on a unique offering. One of them is traceto.io. According to their web page, traceto.io aims to build a solution that focuses on the KYC segment in the cryptocurrency market. As per the team behind the project, the proliferation of scams in the crypto ecosystem is down to a KYC framework that is not robust enough.

Notably, the team will use a combination of artificial intelligence and smart contracts to create a solution that will streamline the KYC process. In particular, the solution targets investors who are the perennial targets for fraudsters who pose as legitimate entrepreneurs. The team hopes to revolutionize the industry by plugging the existing disparity between the virtual and physical identities of market participants.

Top on the list of issues Traceto.io would like to correct is the lack of a watertight KYC framework which paves the way for bad actors to flourish. Secondly, the team behind the project thinks that little emphasis goes toward compliance due to budget constraints and low priority. The third issue in focus is the assumption that the need for market participants to remain anonymous overrides compliance to CTF and anti-money laundering laws (AML).

To that extent, the project is developing novel solutions based on an innovative KYC framework. Notably, the solution will ensure that KYC processes satisfy existing regulations. Further, the solution will enable regulators to do proper due diligence. According to the people behind the project, Traceto.io will go live in early April.

Matic Network

In just 18 days, Matic Network will go live in India. Behind the idea of the project is the need to easily scale the applications in today’s blockchain networks. Notably, developers find it hard to fully optimize their decentralized applications (dApps) due to this scalability issue.

Secondly, the project aims to improve the speed of block confirmations while reducing gas fees, especially on Ethereum blockchain network. As such, the ultimate purpose of their solution is to improve the scalability of Ethereum platform as well as speeding up the transaction speeds. Also, the solution will further simplify the user experience of the blockchain network to make it simply awesome.

Notably, the Matic Network utilizes the Plasma framework that is inherent in the Ethereum platform. As such, the solution will have faster speeds that that experienced in the mainchain Ethereum. In particular, the architecture fuses to the mainchain by way of PoS checkpoints. As such, the Matic Network is able to transact at 2 16 transactions per block.

From the foregoing, one can easily deduce that the Matic Network token is a utility token. Basically, it will enable blockchain users to have better experiences while utilizing the technology. Notably, the native token will go by the name MATIC. As per the information from the developers of the network, one MATIC will be worth $0.00263 and with a hard cap of $5 million.

Since the network will run on Ethereum platform, the Matic Network will be able to accept Ether. Further, the developers will use the Binance Launchpad to conduct the fundraising.

Evedo

Blockchain technology is proving useful for almost every industry imaginable. For instance, Evedo is a project that seeks to leverage the technology in event organizing. Notably, the platform brings together all the participants and businesses that make up the event organizing ecosystem.

The blockchain technology enables users to interact on a peer to peer (P2P) basis. This is to say that if user A wanted to transact with user B, they will be able to do so without the need for a central authority to facilitate the interaction. In centralized ecosystems like the current financial industry, for user A to send money to user B, they will have to meet through a financial institution like a bank.

On the contrary, blockchain technology enables a decentralized ecosystem where users can interact without the need for a central authority. Notably, the fundamental structure of the technology though smart contracts enables automatic trust and hence no need for a central authority to enforce trust.

Using the same concept, Evedo connects participants and businesses within the events organizing ecosystem such that they can interact in a decentralized manner. Interestingly, the event organizing industry is now worth a little over $850 billion and that means that eliminating intermediaries will free more revenue for businesses.

According to the developers, the Evedo token is EVED. From the foregoing, the token will be a utility token. Although the launch period is yet unknown, the IEO will go live in Bulgaria and the fundraising will happen on the Bitforex Launchpad. Further, one EVED will equal 0.0005 ETH and the hard cap is 28,000 ETH.

Recent IEOs

The IEO niche, as discussed earlier, is quite new. However, a number of fundraising for IEO projects already happen. Some of them include:

Bit Agro

According to the team behind the Bit Agro project, the agro-industrial market is among the sectors whose importance will only increase with time. However, there is little innovation in the sector in terms of bringing the participants and businesses together. In this light, the project created a B2B platform where participants can interact in a decentralized manner.

Of importance to note is that users will have the ability to trade agricultural and food products. Also, the users will access opportunities to invest in agro-focused ventures undeterred by production geolocation. In particular, users will utilize the smart contracts within the platform to interact to uphold trust. To facilitate the intra-network transactions, the platform comes with a native coin called Agrocoin. Also, the token will facilitate in the valuation of the registry of each product within the network.

The Bit Agro Network runs on Ethereum blockchain platform. As such, users should expect faster transaction speeds, tight security and high transparency. Notably, the team behind the project launched the network using Exmarkets Launchpad. The hard cap for the platform is $72 million. The IEO launched in Estonia and is still ongoing until 90 days from today.

VenusEnergy

This is another ongoing IEO which will close in 55 days from today. At the heart of the VenusEnergy project is the need to support the renewable energy campaign. The project acknowledges that the rise of blockchain threatened an increase in electricity demand. Notably, the consensus algorithms that rely on mining to verify transactions are very energy intensive and as more people join the industry, energy consumption will skyrocket.

Notably, the project will lead a campaign where all crypto-related energy demand uses renewable energy sources. The platform runs on Ethereum and uses smart contracts to facilitate inter-peer transactions. Further, the platform includes a native coin called VENUS where one unit equals 0.00225 EUR. The hard cap for the token is slightly above 30 million EUR. Also, the token is utility in nature and its launch happened in Estonia. Nonetheless, citizens of the US and China cannot access the platform.

PUBLISH

Utilization of blockchain technology would be sub-optimal were the media sector not on board. Luckily, someone has that taken care of. PUBLISH is an innovative platform that brings press to the most revolutionary technology of our time. According to the team behind the project, their core objective is to support uncompromised journalism in the age of fake news.

Notably, the project will leverage the easily accessible nature of blockchain to enable journalists to post their work and reach many people at the same time. As a test run, the project is working with South Korea’s TokenPost. In particular, the initial utilization will focus on dissemination of blockchain-related news.

The network’s native token is NEWS and peers use it to settle in-network transactions. During the IEO period, the price of one NEWS token was $0.0100. The offering period kicked off on 26th March 2019 and ended on 30th March 2019. Notably, the project went live through Probit Launchpad.

IEO List

From the foregoing, IEO blockchain is slowly gathering pace. After a short, the market is likely to see a new IEO token which focus on specific issues. Up until now, there is a very long list of tokens that belong to the IEO crypto niche. Below is a list of the IEOs that are upcoming, ongoing and ended.

| # | IEO Project | Token | Progress |

| 1 | Matic | MATIC | Upcoming |

| 2 | Evedo | EVED | Upcoming |

| 3 | Bit Agro | AGRO | Ongoing |

| 4 | VenusEnergy | VENUS | Ongoing |

| 5 | MultiVAC | MTV | Ongoing |

| 6 | Windham Energy | WHM | Ongoing |

| 7 | Menapay | MPAY | Ongoing |

| 8 | TerraGreen | TGN | Ongoing |

| 9 | REDi | REDI Token | Ended |

| 10 | VeriBlock | VBK | Ended |

| 11 | PUBLISH | NEWS | Ended |

| 12 | KIZUNA GLOBAL TOKEN | KGT | Ended |

| 13 | HUNT | HUNT | Ended |

| 14 | CharS | CHARS | Ended |

| 15 | Celer Network | CELR | Ended |

| 16 | Levolution | LEVL | Ended |

| 17 | WeGen | WGC | Ended |

| 18 | Decimated | DIO | Ended |

| 19 | Percival | XPV | Ended |

| 20 | Fetch.AI | FET | Ended |

| 21 | BitTorrent | BTT | Ended |

IEOs on exchange platforms

As at now, there numerous exchange platforms that facilitate IEOs. Notably, the platforms go by the name Launchpad as they help in the launch of the token sale process. Interestingly, almost every large cryptocurrency exchange has the Launchpad. Here is a list of some of the most popular IEO Initial Exchange Offering platforms in existence:

| Exchange | IEO Launchpad |

| Bittrex | Bittrex International IEO |

| Bitmax | Bitmax Launchpad |

| Binance | Binance Launchpad |

| Huobi | Huobi Prime |

| KuCoin | KuCoin Spotlight |

| OKEx | OKEx Jumpsmart |

| ExMarkets | ExMarkets Launchpad |

| PROBIT | Probit Launchpad |

| LATOKEN | Latoken Launchpad |

IEO vs. ICO – what are the differences?

Like earlier discussed, there are significant differences between IEO and ICO. See the table below.

| Characteristic | IEO | ICO |

| Token sale | The exchanges are responsible for selling the tokens once listed | The issuer is responsible for the sale |

| Marketing & advertising | Exchanges do all the marketing and advertising | Project teams take care of all the advertising and marketing |

| Transactions | Investors only need an account with the exchange | Investors transact directly with the token issuer |

| Trust | No trust issues; exchanges ensure due diligence before listing a token | There are trust issues due to some token issuers providing misleading information |

| Security | Highly secure since all transactions happen within the exchange website | Highly insecure as transactions happen on ICO project website which could lack proper security measures |

Summary/closing remarks

The cryptocurrency sector is evolving at a very fast pace. Just last year, the market was under existential threat from the issues arising from trust and regulations. To be sure, ICOs were defrauding unsuspecting investors and governments were using that as the stick with which to beat the sector out of existence. Luckily, developers came up with STOs which changed the narrative about the sector.

Today, IEOs are furthering the impetus for the market and there is a possibility for expedited adoption of the industry. However, there is a huge difference among IEOs, STOs and ICOs. See the summary below.

IEO vs. ICO vs. STO summary

| Characteristic | IEO | ICO | STO |

| Token sale | The exchanges are responsible for selling the tokens once listed | The issuer is responsible for the sale | Security token issuer takes care of the fundraising process |

| Marketing & advertising | Exchanges do all the marketing and advertising | Project teams take care of all the advertising and marketing | The team behind the project does the marketing and advertising |

| Transactions | Investors only need an account with the exchange | Investors transact directly with the token issuer | Takes place on the issuer website |

| Trust | No trust issues; exchanges ensure due diligence before listing a token | There are trust issues due to some token issuers providing misleading information | High trust levels since the tokens have intrinsic value/they represent real assets |

| Security | Highly secure since all transactions happen within the exchange website | Highly insecure as transactions happen on ICO project website which could lack proper security measures | Highly secure due since the token falls under regulations like under the SEC in the US. |

| Fees | Exchanges charge issuers commission | No fees | No fees |

| Regulation | Unregulated | Unregulated | Regulated |

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. Do your own research!