Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Ethereum

Georgia Weston

- on November 22, 2022

What Is Ethereum Staking And How Does It Work

Ethereum is one of the prominent additions to any blockchain glossary you can find today. It showcased the true potential of blockchain technology to the world with the features of smart contract programmability. As a result, Ethereum is one of the biggest blockchain networks for creating dApps, which have laid the foundations for a decentralized digital ecosystem. If you have been following recent news about Ethereum, you must have heard about Ethereum staking. What is Ethereum staking, and how does it affect Ethereum users or the blockchain landscape?

One of the most striking highlights of Ethereum is “The Merge,” which is a multi-stage upgrade for improving the security and scalability of the Ethereum network. The groundbreaking upgrade to Ethereum also marks its transition to a Proof of Stake consensus protocol from the existing Proof of Work consensus mechanism. The following post helps you uncover how the new consensus mechanism paves the path for staking in Ethereum. You can also learn about the basics of ETH staking alongside its benefits. In addition, the post also covers methods for staking Ethereum, along with answers to some common FAQs about Ethereum staking.

Excited to build your skill in Ethereum development by leveraging the ethers.js library? Enroll Now in Ethers.Js Blockchain Developer Course!

The Transition from Proof of Work to Proof of Stake

The original Ethereum network started off with the Proof of Work consensus protocol, just like the popular Bitcoin blockchain. Proof of Work helped the Ethereum network achieve better security, albeit with a formidable lapse in scalability. Ethereum 1.0 could only handle 15 transactions per second.

Considering the primary applications of Ethereum for processing financial applications, the transaction speed is massively insignificant in comparison to existing instruments. For example, Visa could process around 1700 transactions per second while MasterCard takes it up a notch higher with 5000 transactions per second.

The search for an Ethereum staking calculator and the discussion about Proof of Stake are closely aligned. Proof of Stake could offer a humongous improvement in scalability with a processing capacity of 100,000 transactions per second. As a result, it could open up avenues for new applications and projects on the Ethereum blockchain. In addition, Proof of Stake could ensure improvements in the energy efficiency of the Ethereum blockchain. The Ethereum Foundation blog has claimed that the new upgrade would reduce energy consumption by almost 99.9%.

Want to become a bitcoin expert? Enroll Now in Getting Started with Bitcoin Technology Course

What is Proof of Stake?

Before you learn about Ethereum staking, you need to learn about staking crypto and how it works. Proof of Stake consensus calls for staking a specific amount of cryptocurrency and assuming the role of validators. Validators could deposit their ETH in the network and become stakeholders alongside exercising their personal stake in maintaining the security and operations of the network.

Subsequently, validators could receive rewards upon verifying a new block or randomly selecting to create the next block. Validators in the Proof of Stake system could have better chances of earning rewards on the basis of their stake. Furthermore, upgrades to Proof of Stake itself can allow users to delegate their stake to other users, who would serve as validators.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

What is Ethereum Staking?

The basics of an ETH staking guide showcase how Ethereum staking is an inevitable aspect of the new ETH 2.0. With the PoS consensus protocol, staking would serve as an essential aspect of the Ethereum ecosystem. Any user with ETH could help in securing the network alongside earning the desired rewards in the staking process.

Staking refers to the process of contributing 32 ETH to enable validator software on the Ethereum blockchain. After activating the validator node, you would take on responsibility for data storage, transaction processing, and the addition of new blocks. As a result, Ethereum can maintain security alongside granting some rewards for validators in the form of new ETH.

Want to learn the basic and advanced concepts of Ethereum? Enroll in our Ethereum Development Fundamentals Course right away!

Reasons for Staking Ethereum

The answer to “how Ethereum staking work for users” would be quite complicated without any basic guidance. You should look into the reasons for staking Ethereum to find out whether it has any value or not. Here is an outline of the prominent benefits associated with ETH staking.

-

Possibilities of Rewards

One of the first things proving the importance of your stake in ETH2 is the assurance of rewards. ETH 2.0 guarantees reward for participants who work with good intention to help the network achieve consensus. Users can receive rewards for operating software that could batch different transactions into new blocks. In addition, ETH2 also offers rewards for verifying the contributions of other validators, which helps in maintaining secure operations of the chain.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in The Complete Ethereum Technology Course

-

Improved Sustainability

The shift of Ethereum towards Proof of Stake also brings the benefits of sustainability. You wouldn’t use high-end computing rigs guzzling up massive volumes of energy. On the contrary, a smartphone or a home computer could be enough to participate in a Proof of Stake blockchain. While staking crypto is generically beneficial for lowering barriers to entry for participants, it also helps in making Ethereum more environmentally responsible.

-

Enhanced Security

The Ethereum network would become stronger and more resilient against security attacks. How? When you stake more ETH in the network, hackers would need additional ETH to control the majority. If any individual wants to compromise the Ethereum blockchain in any way, they would need control over the majority of the ETH.

Start learning Ethereum with World’s first Ethereum Skill Path with quality resources tailored by industry experts Now!

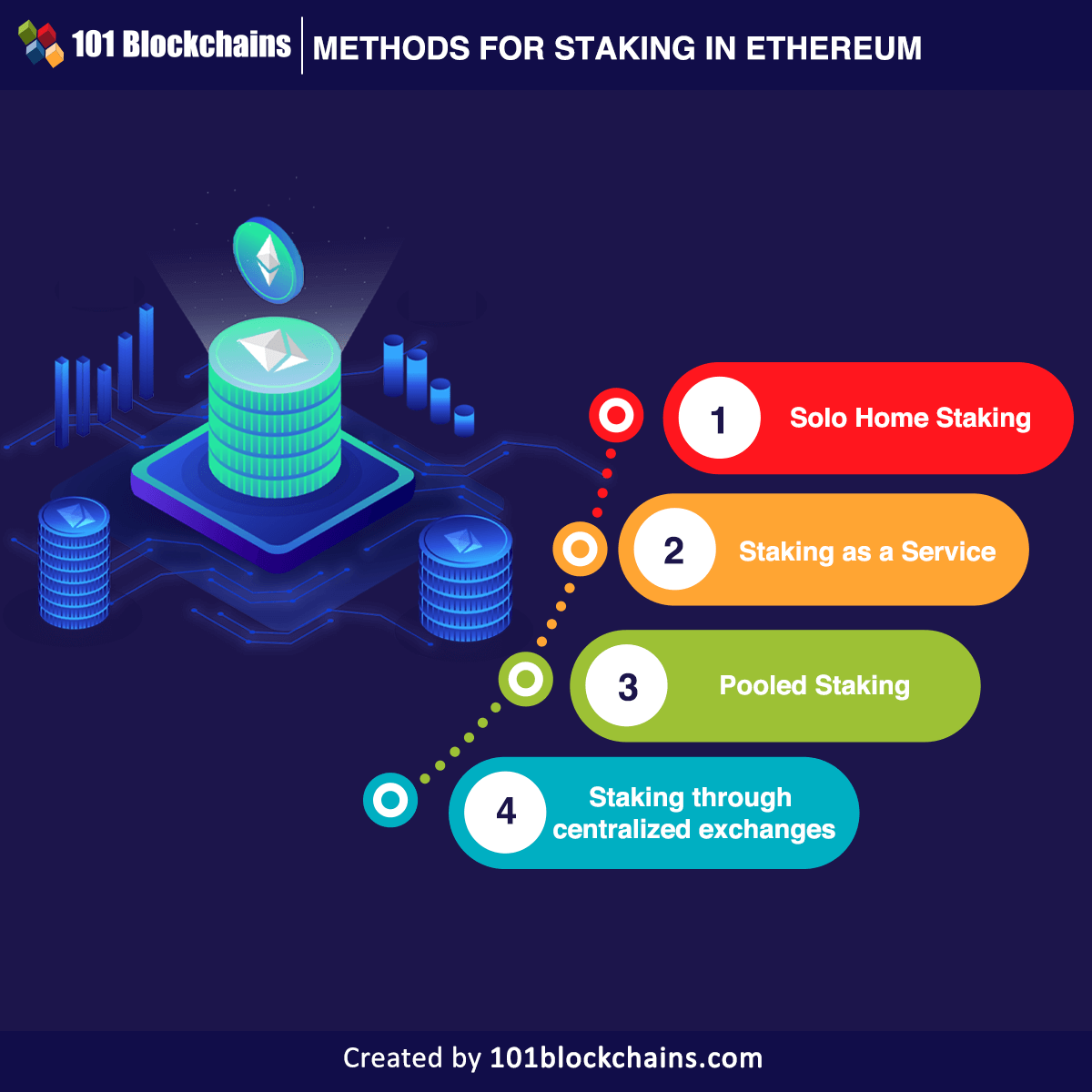

Working Mechanisms of Staking in Ethereum

The next important highlight in an introduction to ETH staking would focus on “Is staking ETH profitable?” and similar doubts. Interestingly, you can find a credible answer in the outline of different methods for staking ETH. You can choose one of the following methods for staking in Ethereum.

-

Solo Home Staking

The first and most common type of approach for staking in Ethereum refers to solo staking, often considered a benchmark for staking applications. Solo home staking could guarantee significant participation rewards alongside improving the decentralization of the network. Most important of all, you don’t have to worry about centralized custody of your funds or data. However, you must follow two important conditions to stake ETH2 with the solo staking approach. First of all, you would need at least 32 ETH for solo staking.

On top of it, you must have a dedicated computer solely for staking and ensure that it remains connected to the internet around the clock. In addition, you need technical know-how of staking and blockchain mechanics. At the same time, users can rely on easy-to-use tools to simplify the process.

-

Staking as a Service

Running a computer 24/7 and maintaining a constant internet connection can be tough tasks for some users. In such cases, you might think of the best approach in an ETH staking guide for using your 32 ETH. Staking as a Service could help you delegate your hardware management worries in staking to the service provider.

Participants could continue earning native block rewards by signing up for Staking as a Service provider. Such types of services include a workflow with common steps such as developing validator credentials and uploading the signing keys of users to the credentials.

Subsequently, users need to deposit their 32 ETH in the platform, thereby granting permission to the service for validating as your representative. However, the biggest requirement in opting for the Staking as a Service approach is trust in the service provider. The keys for withdrawing ETH stay in the possession of the user, thereby reducing counter-party risks.

-

Pooled Staking

Another notable answer for ‘how Ethereum staking work in different ways’ would refer to pooled staking. Users could capitalize on many pooling solutions without the need for staking 32 ETH. Pooled staking is suitable for users who are not interested in staking all of their 32 ETH.

Most of the pooled staking solutions feature liquid staking, which includes an ERC-20 liquidity token for representing the staked ETH. The foremost benefit of liquid staking is the ease of moving out your staked assets anytime. Liquid staking ensures that you can stake your assets with the same ease as a token swap. In addition, liquid staking also enables users to hold custody of their assets in their own ETH wallet.

However, it is important to note that pooled staking does not have any native association with Ethereum. As of now, third-party services are offering pooled staking solutions with their individual sets of risks.

Excited to find out the important predictions about the future of Ethereum staking, Read here : The Future of Ethereum Staking

-

Centralized Exchanges

If you want to find a precise Ethereum staking calculator, you can rely on staking through centralized exchanges. Most of the centralized exchanges offer staking services for users who cannot take responsibility for their ETH in their own wallets. Centralized exchanges are an ideal choice for beginners in staking as they can help in earning reasonable yields on their ETH stake with limited efforts and oversight. On the other hand, it is also important to notice the trade-offs that come with centralized exchanges.

The foremost setback with centralized exchanges is obvious in the fact that they are “centralized.” Therefore, some authority could exert their control or custody over your data. Imagine a centralized exchange going out of order permanently. You are bound to lose everything you had on the exchange.

Centralized exchanges also collect massive pools of ETH for the operations of a humongous network of validators. The pool itself could serve as a massive target for attackers, and a single point of failure could result in disastrous consequences for the security of your staked ETH.

Technical Foundations of Ethereum Staking

The most relevant highlight for an ETH staking guide would point to the technical details of the working of ETH staking. Proof of Stake blockchains collect 32 different transaction blocks in a bundle for every validation round. Each validation round lasts for almost 6.4 minutes, and the bundles are referred to as “epochs.”

An epoch can be finalized upon the addition of two more epochs following it, thereby rendering the transactions within an epoch irreversible. The validation or attestation process involves the random grouping of staking participants into committees. Each committee features 128 members, and they would be assigned to a specific shard block.

Every committee follows a specific time for the proposal of a new block alongside the validation of transactions within them. The transactions are referred to as slots in the epoch, thereby implying the need for 32 committees for the validation of each epoch. After completing the allocation of the committee for a specific transaction block, one random member of the committee would receive exclusive rights for proposing the creation of a new transaction block.

The other 127 members of the committee express their vote on the proposal and verify or attest to the transaction. Once the committee approves the new block with the majority, it can be added to the blockchain. Subsequently, the user who had been selected for proposing the new block receives the reward.

Want to learn blockchain technology in detail? Enroll Now in Certified Enterprise Blockchain Professional (CEBP) Course

Ethereum Staking FAQs

1. Can Ethereum Staking Guarantee Profits?

Most people ask the question, “Is staking ETH profitable?” owing to uncertainty about staking. The reward for staking participants depends on their stake alongside the number of validators working in the network.

2. What is a Validator?

A validator is a computer or a virtual entity on the Ethereum network and works towards achieving consensus within the Ethereum protocol. Validator identity finds recognition through a public key, balance, and other traits.

3. What is the Importance of Staking?

Staking brings the user’s funds into the network and grants them the responsibilities of a validator. Validators could not follow dishonest behavior owing to the risk of losing their funds at stake. The financial consequences of malicious behavior in staking can ensure better security.

4. Can I Own and Stake ETH2?

No, you cannot own or stake ETH2 because there is no such token. Ether or ETH will continue as the native token in the new Proof of Stake consensus Ethereum blockchain.

Curious to know how to build your expertise in Ethereum technology? Check the detailed guide Now on How To Advance Your Ethereum Skills?

Final Words

The introduction to ‘what is Ethereum staking‘ offers clarity about the new phenomena in the Ethereum ecosystem. Ethereum is going through a massive change to ETH 2.0, and Proof of Stake is an integral highlight of the change. Staking can enable users to become active contributors to the network’s security, sustainability, and efficiency.

You can also find multiple approaches to pursue Ethereum stakings, such as solo staking, pooled staking, and centralized exchanges. As staking gains momentum on Ethereum, you need to prepare for the upcoming changes in the Ethereum blockchain. Learn more about Ethereum technology in detail now

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!