Advance your career with in-demand Bitcoin expertise—enroll in the Certified Bitcoin Professional (CBP)™ Certification today.

- Comparisons

Georgia Weston

- on August 26, 2024

Digital Currency vs Cryptocurrency: Key Differences

Money has been one of the key elements in how the world works. Imagine the chaos in society without a store of value and means to exchange products and services. The evolution of money has led it to the point where currency has turned digital. Most of you would have heard about digital currency and cryptocurrency quite frequently in discussions about finance and technology.

Are they the same thing? Such questions arise from the fact that most people use the two terms interchangeably in various contexts. However, digital currencies and cryptocurrencies are poles apart in certain aspects, such as anonymity and centralization of control. Since cryptocurrencies are accessible in digital format, they are included in the domain of digital currencies. Let us uncover the digital currency vs cryptocurrency comparison.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

The Confusion between Digital Currency and Cryptocurrencies

Digital currencies represent an umbrella term that encompasses all types of currencies in digital format. On the other hand, cryptocurrencies are one of the subsets of digital currencies that leverage cryptographic principles to provide transaction security and operate on decentralized blockchain networks. You can notice a clear difference between digital currency and cryptocurrency from their basic definitions.

In simple words, not all digital currencies are cryptocurrencies, but all cryptocurrencies qualify as digital currencies. It is also important to note that the intricate differences between digital currencies and cryptocurrencies are crucial for regulators, investors, and users. A deep dive into the definition of both terms can help you find the ideal foundation for comparisons between them.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll now in the Crypto Fundamentals, Trading And Investing Course

Definition of Digital Currencies

Digital currencies are simply money in the digital form. You can decode the digital currency vs cryptocurrency debate by learning the fundamentals of digital currencies. You cannot store digital currency in your wallets like physical currency, such as coins and cash. As the name implies, digital currencies are completely online, and you can access them or use them for transactions only on computers or mobile devices.

Digital currencies are better than physical currencies as it is difficult to forge them. Physical currencies might have different unique features, such as watermarks and optically variable ink. However, these features don’t make physical currencies invulnerable to counterfeiting. On top of that, digital currencies also offer more efficient, secure, and instantaneous transactions. You can also use digital currencies to make faster and easier cross-border payments without paying hefty transaction fees.

Some examples of digital currencies include cryptocurrencies, stablecoins, and Central Bank Digital Currencies. Interestingly, CBDCs are a common highlight in every digital currency vs cryptocurrency comparison as they are the most credible form of digital currency. CBDCs are a type of digital currency issued by the government or national monetary authority of a country.

Generally, the central bank of a nation is the authority for issuing CBDCs. You can think of Central Bank Digital Currencies as the fiat currency of a country in the digital form. The government’s backing ensures that CBDCs enjoy wider adoption and can be used for daily transactions.

Definition of Cryptocurrencies

The next player in the digital currency vs cryptocurrency debate has caught the attention of everyone in the world of tech. Cryptocurrencies emerged as an innovative take on digital currencies and have transformed the conventional financial landscape. Since the arrival of Bitcoin in 2009, the cryptocurrency landscape has been expanding continuously with new and innovative crypto projects. According to Forbes, the adoption rate of Bitcoin might reach 10% by 2030, thereby implying that the number of Bitcoin users might cross 700 million.

The unique highlight of cryptocurrencies is the use of blockchain technology. Blockchain serves as a digital, distributed ledger that helps maintain a record of all crypto transactions with clear timestamps. Every blockchain is made of different blocks of transactions, which are added to the blockchain only after verification by majority of candidates.

The comparison between digital currency and cryptocurrency also focuses on the fact that all crypto transactions utilize wallet addresses. Almost all cryptocurrency transactions on public blockchains are traceable with the help of wallet addresses. However, it is difficult to find out the identity of the users involved in the transaction.

Transparency ensures safety from money laundering and terrorism financing with cryptocurrencies. Cryptocurrency owners can leverage the benefits of private keys for encryption of their assets while ensuring that no centralized authority gains control over distribution of cryptocurrencies.

Get familiar with the terms related to cryptocurrency with Cryptocurrency Flashcards.

What are the Differences between Digital Currencies and Cryptocurrencies?

The basic descriptions of digital currencies and cryptocurrencies provide a clear impression of how they are different from each other. It is important to understand that they both have unique features, and the line of difference between them is blurry. Here is a breakdown of the other key differences between digital currency and cryptocurrencies.

-

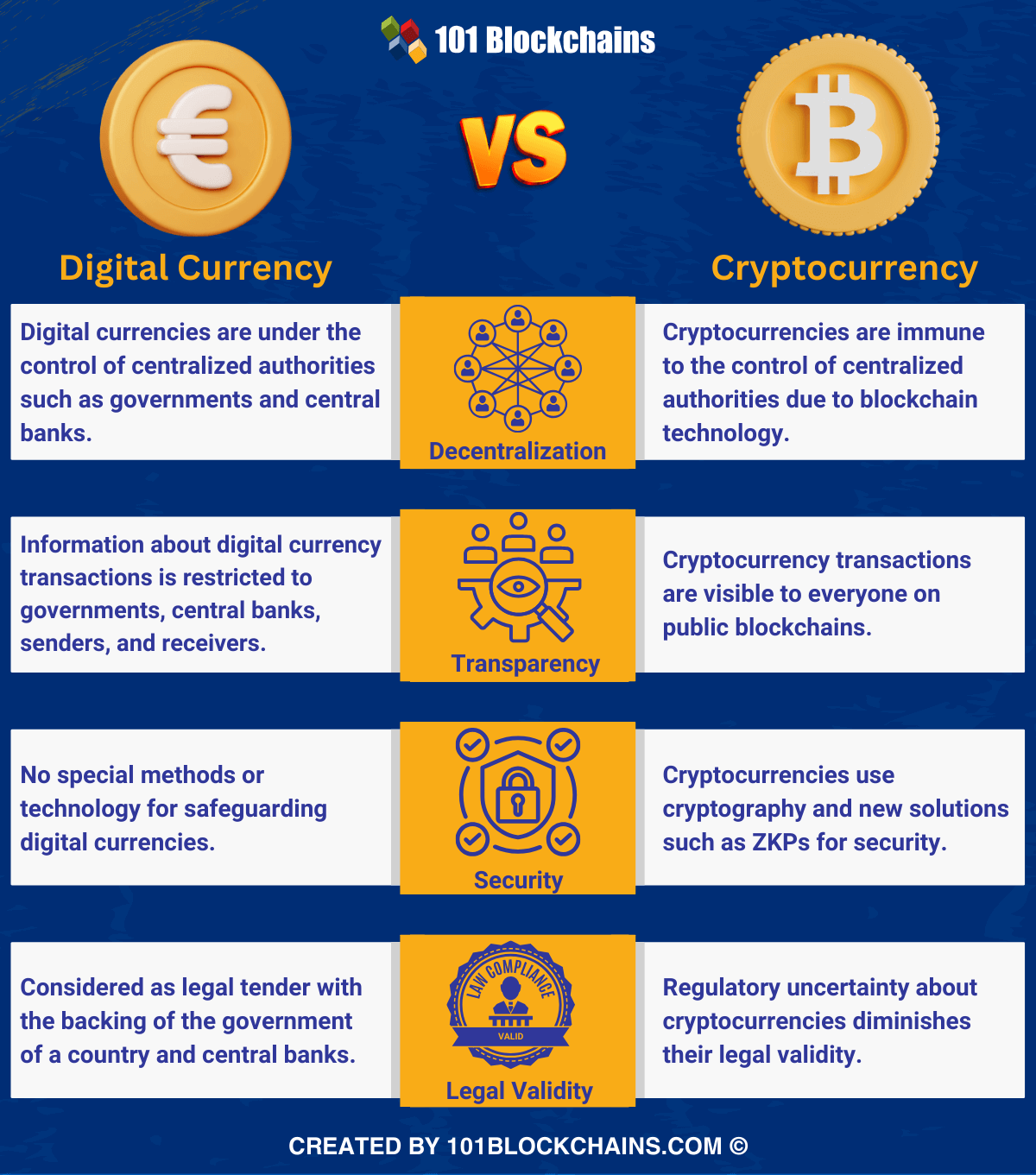

Decentralization

One of the most prominent highlights in any digital currency vs cryptocurrency debate is decentralization. It refers to the element of control over the value of the assets that you own. Digital currencies, such as CBDCs, are centralized and regulated. It implies that the government of a country, central banks, and other financial intermediaries control digital currencies. For example, the government or central bank establishes the value of digital currencies. Digital currencies are also at risk of collapse during changes in the political status of a country.

Interestingly, cryptocurrencies are free from the control of any central authority like the government or a central bank. First of all, you have blockchain technology as the foundation for decentralization of cryptocurrencies. Cryptocurrency transactions might be completely transparent.

However, they work according to a predefined set of rules agreed upon by the network participants. Every process in cryptocurrency transactions, including mining and transfer of crypto assets, In addition, the value of cryptocurrencies is immune to any geopolitical problem. You must also note that you will find some centralized cryptocurrencies that are operated by the development teams.

-

Transparency

The lack of decentralization in digital currencies creates issues with their transparency. The major difference between digital currency and cryptocurrency suggests that the details of digital currencies are under the control of the service providers, senders, receivers, and banking authorities. Therefore, conflicts in the domain of digital currencies require the intervention of law and bureaucracy.

Cryptocurrencies register all information about transactions on the blockchain record. Therefore, the details of all cryptocurrency transactions stay in the public domain. Anyone can access information about the transactions and learn all the details without any bureaucratic or legal hurdles.

Start learning about cryptocurrencies with world’s first Cryptocurrency Skill Path with quality resources tailored by industry experts!

-

Security

Cryptocurrency takes the upper hand over digital currencies in terms of encryption features. Digital currencies are basically another form of electronic or digital cash that does not need any special encryption methods. However, the digital currency vs cryptocurrency comparison in terms of security shows that cryptocurrencies use cryptography to their advantage for security.

For example, public-private key cryptography or innovative solutions such as zero-knowledge proofs help strengthen the security of cryptocurrencies. On top of it, certain cryptocurrencies also rely on their community to maintain safety and reliability.

Embrace the technological leap and global adoption that awaits in the upcoming bull run of 2024-2025 with Crypto Bull Run Ready Career Path.

-

Legal Validity

The legal validity of digital currency and cryptocurrencies also serves as a major highlight of the differences between them. One of the clearly visible highlights in a digital currency vs cryptocurrency debate is the control of governments and central banks over digital currencies.

Digital currencies such as CBDCs have the support of the government and are subject to all the relevant financial regulations. Therefore, investors are likely to consider digital currencies as trusted financial instruments. Traditional frameworks backing the legality of digital currencies help people gain their trust.

On the other hand, cryptocurrencies are free from any type of centralized control. It is also important to note that regulatory uncertainty regarding cryptocurrencies places users at risk. For example, you cannot approach any court for loss of crypto funds to a scam.

At the same time, the number of crypto investors is growing continuously despite the regulatory uncertainty. Interestingly, governments in some countries have been actively working on developing and implementing regulations for cryptocurrencies. It can play a crucial role in achieving legal validity for crypto transactions throughout the world.

Here is an overview of the differences between digital currencies and cryptocurrencies.

Final Words

The comparison between digital currency and cryptocurrency reveals that they are two distinct classes of financial assets. It is important to identify the differences between them to identify scenarios that would be suitable for using them. Digital currencies and cryptocurrencies are new types of financial instruments with unique features and distinct advantages.

However, the differences between them suggest that cryptocurrencies offer more control to users and benefits of security for their assets. On the contrary, digital currencies such as CBDCs provide the assurance of legal validity alongside the backing of governments and central banks. Discover more information about digital currencies and cryptocurrencies to understand their differences with better clarity.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!