Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- FinTech

James Howell

- on May 05, 2023

10 Fintech Startup Ideas Worth Exploring

Fintech has achieved remarkable levels of growth within a shorter span of time. The exponential rate of progress in the fintech ecosystem with the arrival of new solutions and technologies has been a prominent highlight for users and businesses. The outline of notable fintech startup ideas which have made a mark on the industry proves how fintech can offer productive results.

As of now, the retail banking industry is one of the prominent use cases related to the domain of fintech. Other ideas for fintech solutions have not been successful in gaining the attention of mainstream media. At the same time, startup ideas in fintech have come up with exclusive advantages for the founders as well as users. Most important of all, startup ideas in the domain of fintech can help in empowering the broader fintech ecosystem.

Do you want to capitalize on the potential of technology for transforming financial services? If you want to find new ideas for fintech startups, you must clear your doubts regarding the profitability of fintech startups. You must notice how app development serves as an exclusive opportunity for entering the fintech space. Let us find out ten profitable ideas for your own fintech app which can generate a sturdy income stream for you.

Excited to explore the impact of technology on financial services? Enroll Now in the Certified Fintech Expert (CFTE)™ Certification Course Now!

How Profitable Is a Fintech Startup?

The obvious question in the mind of users interested in creating their own fintech startup is the profitability of fintech startups. Interestingly, you can find many responses to “How do I start a fintech startup?” with emphasis on the potential of the fintech market. For example, the global digital payments market could be processing transaction volumes ranging up to $11.29 trillion by 2026.

One of the most important drivers for fintech adoption refers to the growing usage of mobile devices. As the number of people using mobile devices continues increasing, mobile applications and related tech solutions will become the top priorities in the fintech industry. You can also present answers to doubts like “Are fintech startups profitable?” by pointing out the radical pace of growth in the industry. Some market reports indicate that the global fintech industry will have a market capitalization of almost $306 billion by the end of 2023.

What are the important factors responsible for driving growth in fintech? If you want to ride on the wave of innovative developments in fintech, you must quash all your doubts regarding the potential of fintech. Before you find out how to start a fintech company or project, you must find answers to your concerns about the growth of fintech. McKinsey has reported that retail payments are responsible for almost 25% of all services in the fintech market. On top of it, e-commerce is also one of the formidable drivers of fintech.

Learn the basic and advanced concepts of Fintech. Enroll now in Fintech Fundamentals Course!

Existing State of Fintech Startups

The evolution of technology and innovation has opened the doors for creating new startups in the fintech industry. Fintech startups were the leaders in receiving funding in the first quarter of 2023. Around 4000 startups in India raised almost $1.28 billion as funds in Q1 2023. If you are looking for fintech startup ideas, you must prepare for entry into a market with over 30,000 startups worldwide. Most of the startups which receive funding from investors are late-stage fintech startups. Therefore, you have better chances of success and attracting new sources of funding in the domain of fintech as a startup right now.

Trends in Fintech You Need to Consider for a Startup

The journey of creating a startup in the domain of fintech can be a challenging one without a clearly guided direction. You must take the initiative to set a new milestone with your own fintech startup for offering innovative solutions. The arrival of new technologies such as cloud computing, IoT, blockchain, and artificial intelligence has been one of the prominent reasons for creating fintech startups. How can you ensure that your fintech startup can stand the waves of change introduced through the arrival of new technologies? Here are some of the prominent trends in fintech you need to consider for setting the foundations of your startup.

Want to understand the fundamentals of the Internet of Things (IoT)? Enroll now in the IoT Fundamentals Course!

-

Blockchain and Web3

The most significant technology trend which has been introducing revolutionary reforms in financial services is blockchain technology. It has opened up the routes for improved security and control of financial services and data in the hands of users. Blockchain has served as the foundation for many startup ideas in fintech with the value advantages of decentralization, immutability, and security. The applications of blockchain technology can also play a vital role in safeguarding sensitive user data from unauthorized access.

-

Decentralized Finance

Based on the principles of blockchain and web3, decentralized finance or DeFi aims to offer easier access to financial services. As a matter of fact, decentralized finance or DeFi is a popular fintech trend, which can introduce different traditional financial services and investment instruments to the blockchain.

-

Artificial Intelligence

The next prominent consideration among technology trends for fintech would refer to artificial intelligence. Interestingly, the ideas for fintech startup development with AI in the equation can have better chances of success. How? AI can serve explicit value advantages of improved user experiences, better security, and faster services through automation.

One of the most prominent examples of the applications of AI in fintech refers to AI-based chatbots. Artificial intelligence enables the creation of automated robotic advisors, which can offer guidance on investment options and banking services. As a result, the advantages of AI can help in avoiding the need for extensive paperwork.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Best Ideas for Your Fintech Startup

The journey of creating your startup in the fintech industry starts with one small step. You need to identify how the ideas for creating your own startup in fintech can work in the long term. Aspiring entrepreneurs in the fintech industry must learn about the advantages of building a fintech startup as well as the emerging fintech trends. Here is an outline of different types of startup ideas which can work wonders in the fintech industry.

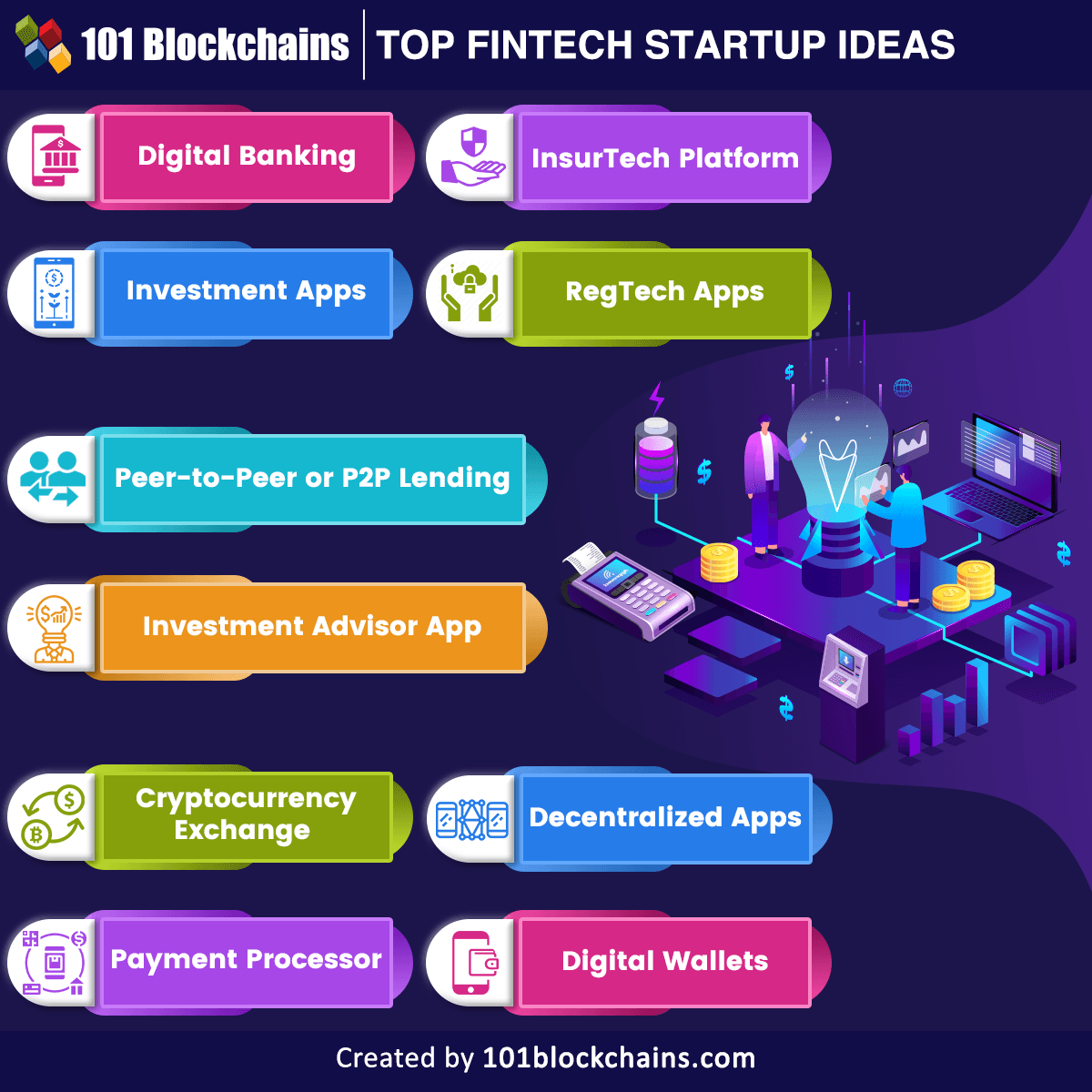

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2023/04/Top-Fintech-Startup-Ideas.png' alt='Top Fintech Startup Ideas='0' /> </a>

1. Digital Banking

Digital banking is one of the biggest disruptors in the banking industry. You can capitalize on digital banking as a reliable answer to “How do I start a fintech startup?” with many successful examples. The basic premise of digital banking solutions as fintech startups revolves around delivering flexible access to banking services. Almost every leading bank in the world has a dedicated mobile banking app or is under development.

In addition, digital banks have gained significant levels of popularity among younger working professionals for easier accessibility of financial services. If you want to build a fintech startup, then you can create a powerful digital banking app in collaboration with a renowned bank.

Eager to learn how digital currencies can improve your access to financial services? Enroll Now in Central Bank Digital Currency (CBDC) Masterclass Course!

2. Peer-to-Peer or P2P Lending

The second addition to the world of fintech startups would point to peer-to-peer lending or P2P lending. Market research reports have pointed out that the P2P lending market could cross the market cap of almost $558 billion by 2027. One of the notable reasons to choose P2P lending is the opportunity for profitability with limited risks.

As a P2P lending platform provider, you would connect borrowers and lenders directly on a massive marketplace. At the same time, you should also pay attention to answers to “Are fintech startups profitable?” with the removal of intermediaries. P2P lending solutions can work as effective solutions in the world of fintech for simplifying one of the most common banking services without relying on banks.

3. Investment Advisor App

The massive waves of change in the domain of fintech have also changed the traditional perspectives on investment. Investors are ready to take on more risks, albeit with an emphasis on structured and insightful guidance. You can find how to start a fintech app with a robotic advisor app based on an algorithm for automated recommendations related to financial planning and investment.

The best thing about an investment advisor app is the possibility of achieving global reach for the app. In addition, you can also incorporate other interactive tools, such as calculators and videos, for providing personalized investment guidance according to the user’s needs.

Aspiring to make a lucrative career as a Fintech expert but not sure how? Check the detailed guide Now on How To Become A Fintech Expert

4. InsurTech Platform

The next promising choice among ideas for creating your own fintech startup points at InsurTech. It is one of the most noticeable additions among startup ideas in the fintech industry, with massive potential for disrupting the insurance industry.

The most basic recommendation for capitalizing on new startup ideas for the InsurTech platform is the option for comparing and purchasing insurance policies. In addition, the support of data and analytics can help in creating a personalized experience for customers with InsurTech apps.

5. Investment Apps

Another popular choice among ideas for creating your own fintech startup would point to investment apps. Investment applications have become one of the top favorites of micro-investors. As a matter of fact, searches for investment apps on Google have increased by almost 110%.

You can choose investment apps as a viable solution for how to start a fintech app with desired value benefits for users. The global online trading market has been growing gradually, and fintech startups can capitalize on the trend to establish their presence in the market.

Curious to know different categories of interview questions for fintech jobs? Check the detailed guide Now on Top 20 Fintech Interview Questions And Answers

6. RegTech Apps

The list of ideas for creating fintech startups also includes RegTech apps, which are important tools for ensuring compliance. Financial corporations have to deal with multiple challenges in regulatory compliance. You can serve as a solution to such problems with innovative startup ideas such as RegTech apps. The responses to “Are fintech startups profitable?” would have a positive note in the case of RegTech apps. RegTech startups such as Chainalysis have served a major role in reshaping finance alongside registering steady growth.

7. Decentralized Apps

The next promising recommendation for entrepreneurs seeking ways to build fintech startups would point at blockchain-based dApps. You must learn about the functionalities of blockchain in transforming the financial services industry. Blockchain expertise can help you come up with innovative decentralized applications which provide alternative means of accessing financial services.

For example, decentralized apps have proved effective in creating solutions with independent economies. Axie Infinity is one of the best examples of how dApps can serve the role of fintech startups with flexibility for exchanging value.

8. Cryptocurrency Exchange

Speaking of dApps, you can choose the most common idea for using blockchain technology in creating fintech startups. You can rely on cryptocurrency exchanges as one of the promising ideas for fintech startups that could deliver long-term career benefits. Interestingly, many cryptocurrency exchanges have become the top destinations for crypto users to deal with crypto trading.

With a simple interface and easily understandable controls, you can have an appealing solution for millions of crypto users. At the same time, you need to think about possibilities of innovation for introducing unique traits to separate your exchange from the crowd.

9. Digital Wallets

The popularity of fintech in 2023 rides largely on the shoulders of progress in cryptocurrency and blockchain technology. Digital wallets can help in storing keys for cryptocurrency, and you can design them for working with specific cryptocurrencies or multiple alternatives. One of the promising advantages of digital wallets is the advantage of easier and more secure implementation.

10. Payment Processor

Some of the notable startup ideas in fintech would also refer to payment processors. The payment processors can work as an exclusive solution for offering the technology and infrastructure required for accepting and processing electronic payments. You can create a payment processing solution with new value advantages by following the important prerequisites. For example, you would need domain expertise, desired financial resources, and a clearly articulated business plan.

Want to become a Cryptocurrency expert? Enroll now in Cryptocurrency Fundamentals Course

Conclusion

The review of the different ideas for creating your own fintech startup provides answers to “Are fintech startups profitable?” with clear explanations. Every idea for creating fintech startups serves prolific advantages for users and the project founders. However, it is important to learn more about fintech and the new trends such as blockchain and web3. You must stay updated with the latest innovative practices and trends in fintech to ensure that your startup is relevant for the target audience. Learn more about fintech fundamentals and how blockchain and web3 can help you build your fintech startup from scratch.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!