Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Comparisons

Georgia Weston

- on July 03, 2024

Bull Market vs Bear Market: Key Differences

An understanding of financial markets would help you familiarize yourself with terms like bull and bear markets. What are animals doing in the world of financial services? Interestingly, the terms bull and bear markets have transitioned effectively from traditional financial services to the crypto landscape.

The bull market vs bear market comparison with respect to cryptocurrencies can lead to a better understanding of the crypto market. Terms like bull and bear markets describe the performance of stock markets, depending on whether the value is increasing or decreasing. For example, a declining market can be called a bear market, while a growing market is a bull market.

The crypto market is significantly volatile, and it changes frequently in a day. Therefore, the bull and bear market difference helps in defining the longer periods of upward and downward movement in the market. The modifications that can lead to classification of crypto markets into bull and bear markets are generally substantial, ranging up to 20% in any direction. Let us uncover the bull market vs bear market difference in the cryptocurrency space.

Embrace the technological leap and global adoption that awaits in the upcoming bull run of 2024-2025 with Crypto Bull Run Ready Career Path.

Definition of Bull Markets in Crypto

Bull markets generally focus on favorable economic conditions. It suggests that the market is growing and involves positive investor sentiments regarding the crypto market. Another important trait of bull markets is the sustained growth in asset prices alongside higher employment levels and a stronger economy.

You can understand the difference between bull and bear markets in the crypto space by identifying how bull markets work in crypto. Interestingly, the crypto market witnesses more consistent and stronger Bull Runs. In most cases, a 40% growth in price of crypto assets over a period of one to two days might induce a bull run. Crypto markets are smaller than conventional financial markets and showcase more volatility.

The bullish sentiments in any market showcase optimism regarding the continuous growth in value of assets. In the crypto space, you can expect the same as favorable economic conditions lead to growth of cryptocurrencies. As a result, investors seek opportunities to capitalize on continuously expanding crypto portfolios.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects!

How Can You Identify Bull Markets in Crypto?

The identification of a bull market in the crypto industry focuses on identification of different signals, such as real-life indicators and trading signals. You can review the history of bear and bull markets to recognize the pointers that differentiate bull markets from bear markets. First of all, you must notice the rise in stock prices during a bull run in the crypto market. You can identify a bull market directly by monitoring the price movement of the popular cryptocurrencies alongside the performance of general crypto market. For example, if you notice the prices increasing for a few months or weeks, you can confirm the rise of a bull market.

The next important differentiator in a bear vs bull market comparison is the growth of trading volume. Significant surges in trading activity can serve as a clearly visible signal for the rise of bull markets. Furthermore, you can also identify a bull market in the crypto space by staying updated with the latest trends in the crypto industry. Positive news and sentiments in the market can improve investor confidence, thereby leading to the formation of bull markets. Speaking of market sentiment, you can determine the level of optimism in crypto markets by using specialized tools such as the Crypto Fear & Greed Index.

Most important of all, a comprehensive review of bear and bull market history can also help you identify bull markets. Historical market trends show that bull markets happen in cycles. You should determine the average duration of the bull market and review it with respect to existing market conditions to anticipate the timing of the next bull market.

Learn the fundamentals, working principle and the future prospects of cryptocurrencies from Cryptocurrency Fudamentals Ebook

Definition of a Bear Market

The bear markets are opposite of bull markets and indicate a decline in the value of crypto assets. You can distinguish a bear market by checking for decline in the value of cryptocurrencies. In bear markets, the value of crypto assets might fall by a minimum of 20% and continue declining. The most famous example of a bull market in crypto refers to the cryptocurrency crash in December 2017. The notorious Bitcoin crash witnessed the fall of the biggest cryptocurrency by a huge margin within a few days. With the downward trend in the bull market, investor confidence would also fall, thereby strengthening the downward pattern.

You might wonder about queries like “Why is it called a bear market?” while figuring out the reasons and factors influencing the bear market. The patterns in a bull market are similar to the fighting style of a bear. The bear market starts at a high point and then pushes down with all its might, like a bear, as it claws down on the prey.

In the bear market, you would notice slow economic growth and higher unemployment rates. The conditions of the bear market might emerge from geopolitical crises, natural disasters, popping of market bubbles, and poor economic policies. Most importantly, bear markets feature limited optimism from investors due to negative sentiment.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll now in Crypto Fundamentals, Trading And Investing Course.

How Can You Identify Bear Markets in Crypto?

The process of recognizing bear markets in crypto is almost similar to that of recognizing bull markets. You can find out the bull and bear market differences by checking different real-life signals and trading indicators. Just like bull markets, a bear market would showcase a similar trend, albeit with a downward pattern.

Bear markets showcase a continuous decline in performance of crypto assets for a long period of time. If you notice an abrupt and long-lasting downturn, then you can expect that it might be a bear market. On top of it, signs of rising unemployment rates could indicate downfall of the broader financial market.

The next crucial sign of a bear market is the exponential growth in market volatility. Sharp price declines of crypto assets, especially the big players, might suggest the possibility of an impending bear market. You must also compare the bull market vs bear market by evaluating important economic indicators. The notable economic indicators you must watch out for to predict bear markets include inflation and interest rates. It is also important to look out for negative developments in the crypto space, such as security breaches or regulatory crackdowns.

Start learning about Cryptocurrencies with World’s first Cryptocurrency Skill Path with quality resources tailored by industry experts Now!

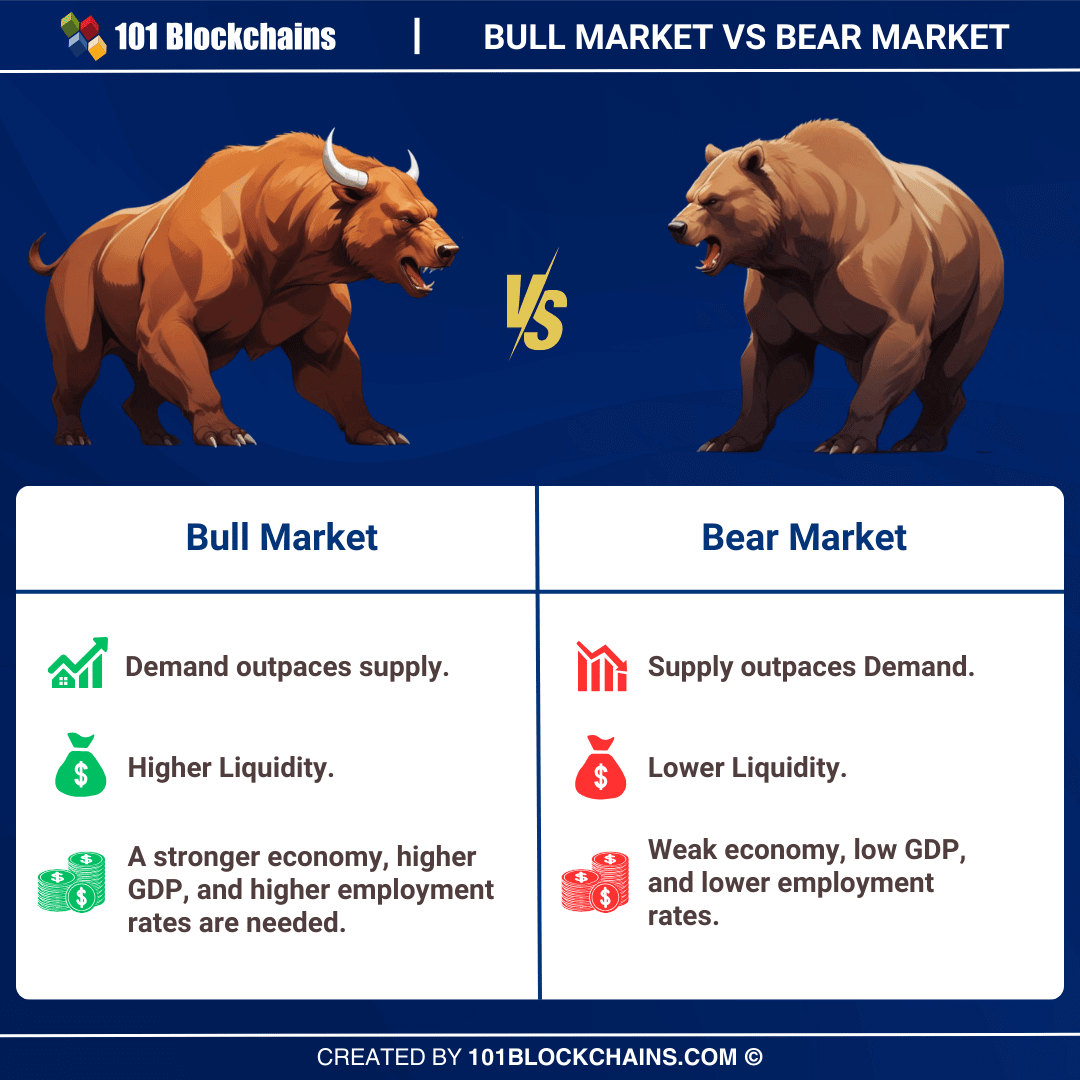

What are the Differences between Bull Markets and Bear Markets?

The comparison between bull and bear markets largely revolves around the direction of prices of cryptocurrencies. However, you can pay attention to specific factors that can mark the difference between bull markets and bear markets in crypto. Here are the notable highlights you can find in a comparison between bull and bear markets in the crypto space.

-

Supply and Demand

The demand for cryptocurrencies is strong in bull markets owing to positive investor confidence. It can lead to rising prices of crypto assets as investors compete against each other to buy available crypto assets. On the other hand, people are more inclined to sell their crypto assets in a bear market. With supply outperforming demand, bull markets are generally characterized by declining prices of crypto assets.

-

Liquidity

Another notable aspect of the difference between a bull and bear market is liquidity. You can notice higher liquidity in a bullish market as crypto assets are tradable at lower transaction fees. However, bear markets in crypto have lower liquidity due to the lack of trust in the market condition.

-

Market Outlook

You can distinguish a bear market from a bull market by the impact on the economy. In bear markets, you can notice declining levels of GDP, while bull markets indicate possibilities for a rise in GDP. Increasing GDP in a bull market also accompanies growth in companies’ revenue alongside better employment prospects. Therefore, it leads to better and positive market sentiment.

On the other side, falling GDP levels would lead to economic recessions and failure to meet revenue goals. It would subsequently lead to negative market sentiments, and people would hesitate before investing in crypto assets. Bear markets are also known for lowering employment levels that, subsequently, extend the duration of bear markets.

Here is an overview of the differences between bear and bull markets.

Final Words

The differences between bull markets and bear markets in the crypto space show a different aspect of cryptocurrencies. You should learn more about the bull vs bear market comparisons, as they can help you find the ideal ways around the crypto market. The volatility of the cryptocurrency market is one of the biggest concerns of investors.

However, the ability to identify bear and bull markets can help you avoid doubts regarding uncertain trends in the crypto market. The simplest explanation for the difference between bear and bull markets is the difference in pricing trends of cryptocurrencies. Find out more about the history of bull and bear markets in the crypto industry.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!