Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Cryptocurrency

James Howell

- on January 02, 2024

A Brief History of Crypto Bull and Bear Markets

The growth of cryptocurrencies as popular instruments in the world of finance has brought the possibility of similarities between the crypto market and the traditional finance markets. If you have been following the crypto industry up close, then you must know that the crypto market is not immune to bearish and bullish markets. Aspiring investors seek a crypto bull run history or bear run history to understand the way the crypto market behaves in different cycles.

Yes, the crypto industry works in cycles and presents different prolonged periods of rising prices or falling prices. The bear and bull markets in the crypto industry have a major impact on the direction of the portfolio of investors. Therefore, a clear understanding of the crypto bear and bull markets could help investors in making well-informed decisions.

The terms bull market and bear market history have been associated with the conventional financial markets. However, bull and bear markets also serve as viable indicators of the rise and fall in crypto market cycles. Which factor leads to the rise and fall of cryptocurrencies in each cycle? The answer would direct you towards Bitcoin, which occupies more than 45% of the crypto market.

It is responsible for determining the price movement in the cryptocurrency market. For example, the increasing prices of Bitcoin would lead to growth of the cryptocurrency market. On the contrary, a fall in Bitcoin prices would also lead to a fall in prices of the rest of the cryptocurrency market. Let us take a trip back to the history of bear and bull markets in the domain of cryptocurrencies.

Embrace the technological leap and global adoption that awaits in the upcoming bull run of 2024-2025 with Crypto Bull Run Ready Career Path.

Definition of a Bull Market

Before you dive into the details of a crypto bull run history timeline, it is important to learn about the definition of a bull market. Bull market refers to the market conditions in which asset prices increase continuously with scope for more growth. In the traditional finance market, bull markets point at market conditions where you find an upside of 20% or more in a broader market index over at least two months. The most noticeable trait of a bull market is the upward trajectory of economic conditions associated with positive investor sentiments. Furthermore, the continuous increase in asset prices also leads to improvement in employment levels alongside a strong economy.

In the case of cryptocurrencies, bull runs have been significantly higher than for equity markets. The top-performing assets would increase exponentially by a hundred or even a thousand percent in special circumstances. The review of crypto bull run history shows that crypto bull markets have showcased a steady rise in cryptocurrency prices. Crypto bull markets have also fostered trust in the market and growing coverage of crypto news in mainstream media.

Investors should have a clear impression of the time when the crypto market enters the bull market. The most notable factor responsible for crypto bull markets points to Bitcoin halving events. Bitcoin halving reduces the amount of newly mined Bitcoin, thereby reducing the speed of launching new Bitcoin into circulation. As the demand for Bitcoin increases, it will push up the price of Bitcoin.

Excited to know the use cases of crypto in NFTs, DeFi, and the metaverse, Enroll now in the Cryptocurrency Fundamentals Course!

Definition of a Bear Market

If a bull can propel you up in the air with its horns, the bear can strike you down with one jab of its claws. The bear market is characterized by falling prices, i.e., the complete opposite of a bull market. Asset prices decline continuously in a bear market and lead to negative investor sentiment alongside expectations for a further decline in pricing.

The details about bear market length history could point to how bear markets work in the traditional stock market for a minimum of two months. Bear markets generally lead to a downward trajectory for economic conditions alongside enforcing negative investor sentiment. The slower economic growth in a bear market results in a reduction of optimism of investors.

Bear markets are an important component in the crypto market cycles that you have witnessed in the last decade. The most noticeable characteristic of crypto bear markets is the continuous drop in prices over a long period of time. In addition, bear market history also points to the inevitable drop in investor confidence in the crypto market.

It would also reduce cryptocurrency coverage in mainstream media and limit chatter about crypto on social media. Generally, crypto investors look for opportunities to sell their cryptocurrencies in a bear market to avoid steep losses. At the same time, investors are also apprehensive about buying new crypto assets during bear markets.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects!

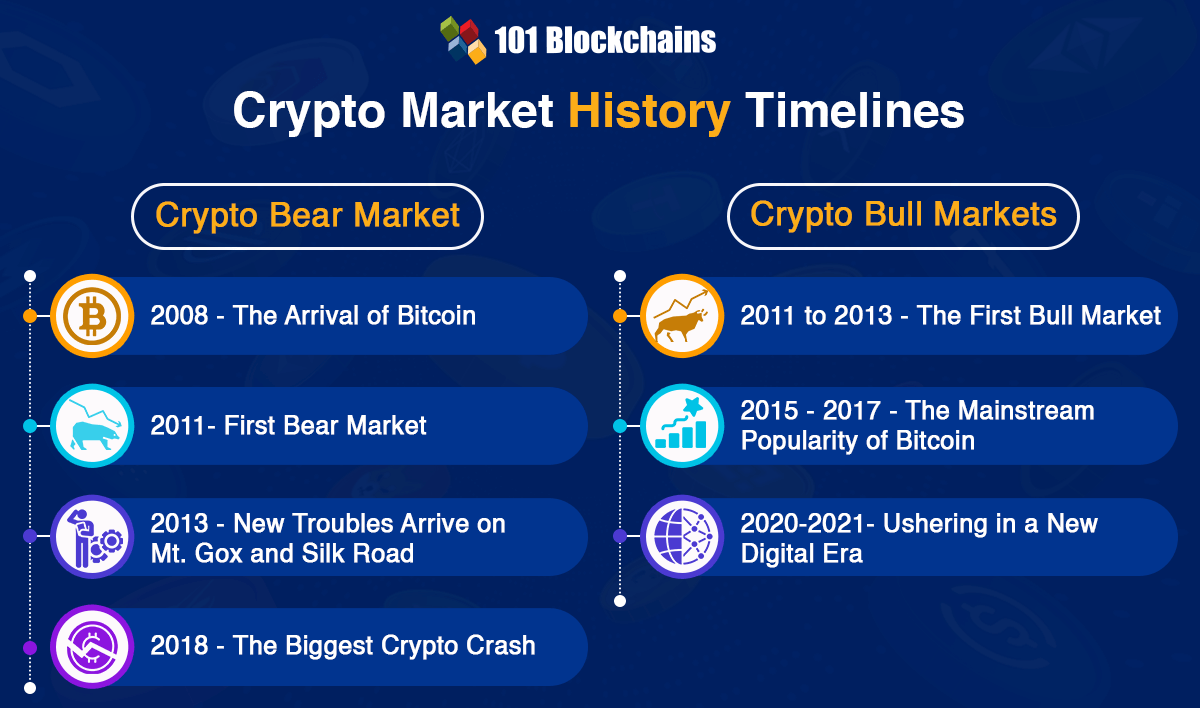

Crypto Bear and Bull Market History Timelines

Timeline for Crypto Bear Markets

Cryptocurrency markets have been known for extreme price volatility. Within a short period of their inception, crypto markets have experienced multiple bear markets characterized by crypto winters. In the case of traditional markets, investors would generally expect almost 14 bear markets over an investment time span of 50 years. Let us find out more about the timeline of bear markets in the crypto industry with the important details.

-

2008- The Arrival of Bitcoin

The first step in navigating the bear market length history points to the arrival of Bitcoin. The Bitcoin network came into existence in 2009, with the first block mined by Satoshi Nakamoto on January 3, 2009. It became the first ever cryptocurrency without any method for establishing the market price of Bitcoin. The birth of Bitcoin set the beginning for different bear and bull runs in the crypto market. Bitcoin achieved exchangeable value for the first time with the creation of Mt. Gox in 2010. In the period from 2010 to 2013, Bitcoin surged from almost zero to $150 per BTC.

Enroll now in the Bitcoin Technology Course to learn about Bitcoin mining and the information contained in transactions and blocks.

-

2011- First Bear Market

The first bear market in the crypto industry lasted from June 2011 to November 2011. It is one of the foremost highlights in bear market history for the staggering decline of almost 93%. Interestingly, the bear market gained momentum at a time when most of us did not know about Bitcoin or cryptocurrencies. The beginning of 2011 presented promising news for Bitcoin as it enjoyed a meteoric start.

As a matter of fact, it had reached an all-time high of $42.67 as of June 8, 2011. However, the upward trend for Bitcoin pricing did not last. Why? A hacker compromised Mt. Gox, the popular crypto exchange, on June 19, 2011. In the attack, the hacker stole more than 850,000 with almost 750,000 of them in the ownership of clients of Mt. Gox.

The hacking attack led to a downward trend in price of Bitcoin. By November 18, 2011, Bitcoin had lost almost 93% of its value, dropping down to almost $2.91. It is one of the most cruel bear markets in history, as it created concerns regarding the credibility of cryptocurrencies. During the first-ever bear market, Bitcoin was in the stages of infancy, and Mt. Gox managed over 70% of all Bitcoin transactions. Therefore, the attack on Mt. Gox created setbacks for large-scale cryptocurrency adoption.

-

2013- New Troubles Arrive on Mt. Gox and Silk Road

The longest bear market in history gained momentum in December 2013 and lasted till August 2015. During the second bear market, Bitcoin had to endure drops in prices for almost two years. As a matter of fact, Bitcoin lost around 84% of its value during the bear market from December 2013 to August 2015. The primary culprit for setting off the bear market was Silk Road.

The FBI took down the Silk Road in October 2013 on the grounds of operating an online black market. Even if the closure of Silk Road did not have an immediate impact on the rise of the bear market, the collapse of Mt. Gox exchange added the final blow. On top of it, hackers also targeted different companies in the cryptocurrency space, which gained more momentum in 2014.

The outcome of different issues led to a bear market, which lasted for almost 630 days. During the bear market, the value of Bitcoin dropped to $255.56 from $1653.81. As it redefined the bear market length history, the period of 630 days also shed light on many other aspects. For example, the collapse of Mt. Gox and shutting down Silk Road did not affect Bitcoin only. The bear market also led to the downfall of other altcoins, which rallied close to the trajectory of Bitcoin.

-

2018- The Biggest Crypto Crash

Another notable addition to the history of crypto bear markets emerged in 2018. The bear market, also known as ‘the great crypto crash,’ resulted in a drop of 83% in the value of Bitcoin within a year. It has become a notable milestone in the crypto bear market history as the first mainstream crypto crash. How? The cryptocurrency market had received significant improvements in mainstream coverage alongside attention from the media in the preceding bull run. It led to the participation of more people than ever and also exacerbated the impact of the crash in the bear market.

The most prominent factor responsible for the biggest crypto crash was the ICO bubble of 2017. As the number of new ICOs continued to increase, more investors showed their interest in the ICOs. However, it did not offer long-term sustainability as most of the ICOs did not have any real value. The demand for ICOs declined rapidly due to popping of the ICO bubble, thereby leading to the crypto market collapse.

The bear market surpassed the longest bear market in history in terms of impact. How? The ICO bubble led to the rise of new types of exit scams, Ponzi schemes, and ICO scams, which had a negative influence on investor confidence. On top of it, the government of China introduced new laws that banned the use of crypto exchanges. The compounded effect of these events led to a crash in Bitcoin prices and fuelled the bear market.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll now in the Crypto Fundamentals, Trading And Investing Course

Timeline for Crypto Bull Markets

Bull markets in the domain of cryptocurrency provide a significant opportunity for aspiring investors. Most beginners follow the simple principle of buying assets in the bear market at low prices and selling them for profits in bull markets. Let us take a look at some of the notable bull runs in crypto history.

-

2011 to 2013- The First Bull Market

The bull market from November 2011 to April 2013 is not exactly the first bull run in crypto. However, it is the first crypto bull run that has been motivated by prominent geopolitical factors. It is a notable addition to the crypto bull run history for its unique origins in the 2011 European Recession and the emerging financial crisis in Cyprus. The adoption of Bitcoin gained momentum as an alternative to traditional financial instruments for safeguarding finances.

-

2015-2017- The Mainstream Popularity of Bitcoin

The bear market resulting from the collapse of Mt. Gox and closure of Silk Road slowed down in 2015. During this time, the prices of Bitcoin ranged from $200 to $300. However, in late August 2015, Bitcoin experienced a radical surge in activity, and by December 2017, the price of Bitcoin had increased to $670. The rise in Bitcoin prices during the 2015-2017 bull run can be attributed to the mainstream media coverage of cryptocurrencies. It marked one of the prominent milestones in the history of the performance of Bitcoin.

-

2020-2021- Ushering in a New Digital Era

The meteoric growth of Bitcoin marks the crypto bull run history timeline from September 2020 to November 2021. The digital landscape achieved continuous growth during the COVID-19 pandemic. Some of the notable highlights during this period include the rising demand for digital payments, which pushed cryptocurrencies to the limelight. However, the phenomenal increase in prices during this bull run was followed by the crypto winter of 2022.

Start learning about cryptocurrencies with world’s first Cryptocurrency Skill Path with quality resources tailored by industry experts!

Conclusion

The review of bear market history and bull runs in the past showcases that you would have different cycles in the working of the crypto market. You have to adapt to the different trends as an investor and understand the unique factors that drive bull and bear markets in crypto. For example, the 2017 ICO bubble and hacking attack on Mt. Gox exchange played a crucial role in initiating bear markets. On the other hand, increasing media coverage and institutional investment in cryptocurrencies fuelled bull markets in crypto. Learn more about crypto bull and bear markets for finding the ideal direction through the volatility of cryptocurrencies right now.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!