Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Reviews

Hasib Anwar

- on November 17, 2020

The Importance of Blockchain in Insurance Industry

Nowadays, the sheer complexity of the insurance industry is creating some visible gaps, which can easily be exploited. However, blockchain’s ability to offer transparency, high security, and immutability is changing the landscape. Let’s take a look at how blockchain can become a disruptive force in the insurance industry.

In the United States, insurance plays a pivotal role, especially in the economic sector and families and individuals’ well-being. In USA and in other parts of the world, different types of insurance are key cogs as well. Every year, this sector is responsible for billions of dollars’ worth of revenues.

However, it’s not always sunshine and rainbows when it comes to the insurance industry. In reality, most of the insurance companies are falling behind when the rest of the world is climbing towards a new era. The fraudulent activities, the costly premiums are taking a toll on the popularity of this industry.

But, blockchain can alter the scenario here. With blockchain, the insurance industry is projected to grow from $64.5 million to $1.39 billion by the year 2023. So, instead of viewing the blockchain as the enemy, the insurance industry can leverage this technology’s disruptive nature to regain its glory.

So, in this guide, I’ll mainly focus on how blockchain can disrupt this industry and why you should implement blockchain in insurance.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

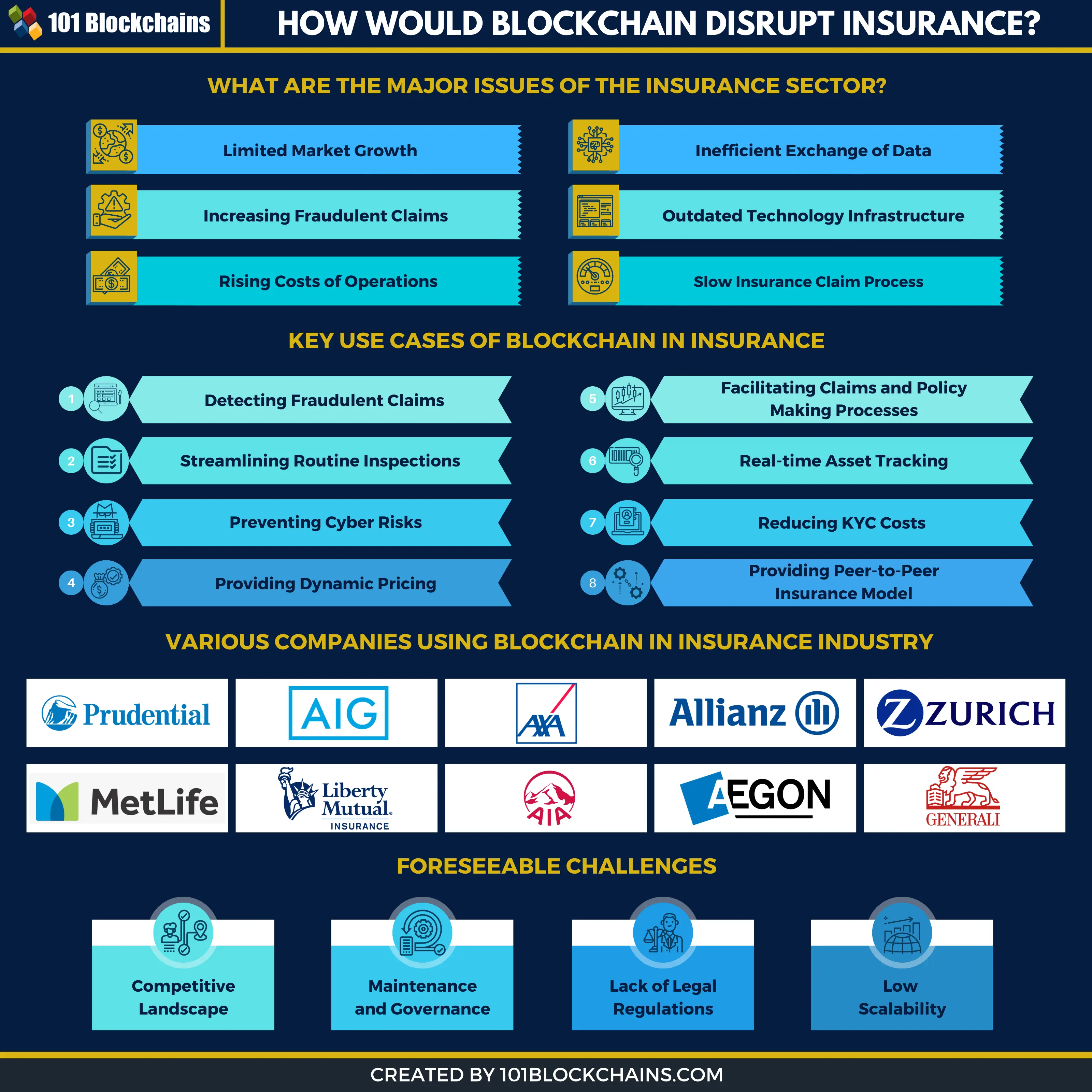

Blockchain In Insurance: What Are the Major Issues of the Insurance Sector?

The insurance industry is surely not perfect. So, if you get a career in this sector, you’ll notice how the traditional insurance processes are full of loopholes and security issues. Let’s see what kind of problems this sector is dealing with at the moment.

Limited Market Growth

The market growth over the past decade wasn’t that great for the insurance industry. In reality, in 2006, the growth rate was 12.5%, but it slowly decreased to 1% in 2010. Even though it did recover, still, it’s quite low.

In reality, this growth is slightly a bit higher than the global GDP, but it needs to change. Agents need to be smarter about their strategies and can’t take this growth for granted as it can go down at any moment. Also, since the economy is falling behind, not many businesses or individuals have the money to spend on insurance.

Inefficient Exchange of Data

The sad reality is that the data exchanged throughout all the elements of the insurance industry is full of errors. As the sector relies on paper-based documents a bit too much, there are lots of human-made mistakes. Also, many times, wrong parties can just alter the contents of documents to cheat the system.

Therefore, in many cases, people end up with misinformation, which leads to delays in their insurance claims. More so, the companies even have to deal with false information regarding new clients. Overall, this collectively causes a lot of losses to the sector. If this continues then, this sector will slowly start to die out.

Increasing Fraudulent Claims

This is one of the most major issues the insurance industry deals with at the moment. You can’t even imagine the lengths people will go to just to get the insurance money. One of the most common is false accident claims where the party claims to be in an accident, but that never happened. Also, the party can even stage an accident themselves.

In reality, this type of fraudulent attempt tries to exploit the nature of the insurance contracts, and most of the time gets away with it. There is no proper detection process in place; the company is bound to pay for the party.

However, this also goes both ways. There are lots of insurance scams as well where the company is the perpetrator. In reality, the system is not transparent, so companies can scam people into getting insured but leaving a lot of loopholes that prevent them from ever getting their money back.

Poor Data Handling

Another major issue is the handling of data in the insurance industry. In reality, most of the insurance company is not equipped to handle such sensitive data effectively. As a result, there are lots of data thefts and identity theft issues.

In most cases, the KYC protocols collect sensitive information about their customers, and without proper supervision or security in place, the data gets stolen.

It’s a serious issue, and with cybercrimes on the rise, it’s not going away anytime soon. Thus, without setting up a proper networking channel, companies can’t offer protection for collecting data.

Outdated Technology Infrastructure

The industry runs on an outdated or legacy networking system. Furthermore, this type of infrastructure is definitely not capable of handling the increased workload with great output. Most of the time, it hinders the growth of the insurer.

More so, it also can’t offer regulated operational costing, meeting customer satisfaction, and business demands. The world is moving on and becoming more dependent on advanced technologies. In this scenario, using legacy networks will only affect negatively.

Without proper backup and security protocols, there is no way companies can keep up with customer demands.

Rising Costs of Operations

This is directly connected to using legacy networks. In reality, as the insurance industry keeps using outdated technology, they need more resources to get everything done. Thus, they end up with a more complex natured business model, which hogs up time, money, and resources. Also, these companies have to update and work with government agencies too.

Spending this much money just on human resources gives rise to errors and slow output. So, the best way, in this case, is to start using technologies that can take on the burden and get things done in a clean and efficient way.

Too Much Regulation

Over time, the insurance industry is becoming harder and harder to deal with. In many cases, big companies find a hard time getting insurance because of all the regulations in place. In reality, if the regulations are making it difficult to connect with the customers, then why would companies stay within the regulations?

Obviously, you will need regulations in the insurance space in order to run the industry. But imposing too many regulations can go both ways. In any case, if regulations start to demand too much capital, then companies will take risks overseas.

Also, it’s not actually the best practice to attract business.

Sluggish Insurance Inspection

Another issue is the slow and cumbersome process of insurance inspections. There are inspectors that check out whether the claim is authentic or not in case of any insurance claim. But the overall process is really slow. In many cases, it may even take a month to fully inspect and audit the situation.

This not only decreases the customer satisfaction level, but the company also falls behind massively. More so, due to human errors, the inspection results in failure many times, and the customer has to request for reevaluation. Unfortunately, without proper channels in place, this issue will continue to persist.

Slow Insurance Claim Process

There are just too many steps to make mistakes in an insurance claim. First of all, it starts by filling a lot of paperwork, getting in line, and submitting them. Then the company will review it and then begin the inspection process. But most of the time, insurance companies lack the manpower or automated processes to keep up with the overwhelming customer demands.

As a result, it may take a lot of time to get to your claim and then assign human resources to aid you. In most cases, it takes an emotional toll on consumers as well, when they are trying to get the insured money after they lost one of their loved ones.

Want to know more about blockchain’s influence in the insurance industry? Check out our guide on blockchain for insurance use cases and applications now!

Key Use Cases of Blockchain In Insurance

Blockchain in insurance comes with its own set of perks. Even though this technology is still in the early phase of development, it can already solve a lot of issues of insurance. Let’s see what these are –

Detecting Fraudulent Claims

As you know, fraudulent claims are plaguing the industry for a long time. Well, it’s not like insurers aren’t doing anything to stop the fraud. They are using advanced technologies to fight it, but unfortunately, it’s no help at all.

Yet, somehow the percentage just keeps on rising. In reality, most of these frauds happen in health/life insurances. Other types of insurances also have fraudulent claims issues, but these 2 types have the highest percentage of it.

Specifically, blockchain in life insurance or health insurance can help to minimize fraudulent claims. As blockchain keeps track of all the information, leaving no breadcrumb for the corrupt party to follow, it helps to detect any fraudulent claims.

So, you can use blockchain for your company to reduce the drastic amount of fraudulent activities.

Facilitating Claims and Policy-Making Processes

Well, the insurance sector is the primary example of how inefficiencies and errors happen during claim and policy-making processes. In reality, it can substantially increase the costs, which becomes a nuisance for the customer and the company.

It’s only a matter of time when human middlemen need to adapt or get replaced by technologies that don’t make all these errors. Therefore, blockchain can help out in this regard. Using smart contract features, it can quickly review the set of rules before either paying out or denying the claim. It’s more efficient and time saving for both parties.

Especially blockchain in health insurance can help streamline the process, thus, assisting patients as quickly as possible.

Streamlining Routine Inspections

Insurance companies need to inspect various aspects such as documents, properties, and assets daily to keep up with the claims process. Also, without proper investigation, fraudulent activities start to rise rapidly. However, this insurance industry is awfully understaffed for it. In reality, the industry is not equipped to streamline the inspection process, and many times they even make various mistakes.

Therefore, it’s only logical to start using blockchain in health insurance or any other kind of insurance to properly streamline the routine checkup processes. So, if one’s information is kept on the database and it gets updated every time there’s a change, it’s much easier to keep track of the progress, isn’t it?

This is how blockchain can truly help out.

Not sure how to build your career in enterprise blockchains? Enroll Now in How to Build Your Career in Enterprise Blockchains Course

Preventing Cyber Risks

This is another one of the benefits of blockchain in insurance. In reality, the industry is still too much reliant on old generation technologies. That’s why they can’t fight back any cyber-attacks when they really need to because they don’t have the proper tools for that. In reality, data theft and information theft can cost the companies to pay up billions and billions of dollars.

However, with blockchain in the mix, preventing cyber risks is really easy. Furthermore, blockchain can offer the cutting-edge technology needed to stop cyber-attacks. Blockchain already proved that it can offer better security, and it can also prevent a lot of high scale cyber-attacks.

On-Demand Insurance

On-demand insurance is a new type of option at the moment and is getting the momentum it deserves. Here, users can get insurance right from their mobile devices or even computers whenever they need it. Although it’s already in place, the virtual experience can be significantly improved if the companies start to use blockchain.

Significantly, blockchain in health insurance can help to automate the whole process more effectively. For example, companies can put together smart contracts with underlying rules in place of their original paper-based forms. The users can directly access the smart contracts, go through all the necessitates, and then choose the one they need.

It will only take a few minutes at its best!

Real-time Asset Tracking

Insurance companies have a lot of premiums regarding property or casualty insurances. However, these are a bit harder to track or manage. However, gathering all the information on properties, assets, or individuals is a time consuming and costly approach.

But with blockchain in the mix, they can track the assets in real-time to see the changes in ownership, conditions, or any other standards they need to maintain. More so, as all the information on the blockchain is verified, it saves a lot of time and money for the companies.

Especially, blockchain in life insurance can track all the liabilities and streamline the insurance claim process faster.

Blockchain technology is one of a kind technology, which can offer its usefulness to almost every industry. Check out our list of 20+ blockchain technology use cases right now!

Providing Dynamic Pricing

This is a new take on insurance, as companies are trying to foresee factors that alter consumer behaviors towards insurance. For example, only having a static placeholder in place at all times, even when the economy is terrible, will make people not go for insurances.

So, social and economic factors play a huge role in defining the pricing of these insurance policies. This is one of the benefits of blockchain in insurance, as it can forecast consumer behavior change and the market value at all times.

So, insurance companies can leverage the data and make changes to their pricing based on a real-world scenario.

Reducing KYC Costs

Well, a customer will not keep taking insurance from a single insurance company. Usually, they like to take their options and go for the best ones from various companies. However, every time they have to go through the same KYC procedures, which takes up a lot of time.

As the information is the same across each organization, it’s only more efficient if they can interchange the data from one source to another. So, if interoperability is in place, the consumer will only need to fill up the information once and then use it for all other companies.

In reality, it saves up a lot of costs from the companies as well.

Providing a Peer-to-Peer Insurance Model

This is a different kind of model and much more effective with blockchain in place. In reality, here, members can pool their money and keep the premiums to themselves instead of insurers. Usually, members can pool all of their funds in one digital wallet and then use that money to invest in the insurance sector.

If someone makes a claim, then the investment is used up, and if no one makes a claim, all the funds are returned. More so, there are already many applications in place, specifically in the Defi space for this purpose.

This is another one of the concrete benefits of blockchain in insurance.

Want to know more about DeFi? Enroll Now: Introduction to DeFi Course

Various Companies Using Blockchain In Insurance Industry

Many real-world enterprise companies are investing a lot of money in blockchain in insurance projects. Let’s check out some of them right now.

AIA Group

AIA Group is working on a variety of insurance blockchain projects, and one of them is for bancassurance solutions. Here, they are working with other partnered banks to share documentations live with each other.

MetLife

Metlife is working for the healthcare insurance sector at the moment. More so, their innovation base company LumenLab is the one behind the project. In reality, they are offering insurance funds for deceased loved ones, and it can also determine if they had any life insurance to begin with.

Prudential Financial

It’s one of the largest insurance blockchain projects that is soon going to change the scenario. In reality, Prudential Financial wants to leverage this technology to get rid of fraudulent activities, offer a better customer experience, and process documentation. More so, it can track the progress of a contract as well.

AIG

Collaborating with International Business Machines Corp, the American International Group is working on a solution for developing a smart insurance platform. Therefore, this platform is perfectly equipped to handle international insurance issues.

Aegon

Aegon is also working on one of the insurance blockchain projects. In reality, they are taking part in the B3i initiative that uses Corda to leverage blockchain for insurance purposes. Furthermore, this project is capable of handling the workload of the reinsurance and insurance process.

AXA

AXA is introducing one of the most outstanding blockchain applications in insurance. They are introducing Fizzy’s application that will help you get automated and secured insurance for your delayed flights. So, this company is mostly offering insurance that covers the aviation sector.

Allianz SE

The insurance giant Allianz SE is working on a solution that will facilitate international insurance payments for all of their corporate customers. Anyhow, the system is tokenized at the moment, and they offer these tokens for the payment of the insurance claims.

Assicurazioni Generali

Generali is also another big company working with Accenture for the insurance industry. In reality, they are developing a solution that will offer the reinsurance process for captive insurance services. More so, with the progress so far, this is going to become one of the best blockchain applications in the insurance sector.

Zurich

Zurich is working with Accenture to come up with a solution that will manage surety bonds. Usually, these bonds are necessary to guarantee performance in certain business transactions. So, these are extremely important for insurance markets.

Liberty Mutual

Liberty Mutual is also working on different types of blockchain applications in the insurance sector. At present, they have a solution to increase efficiencies between the data management of cedents and reinsurers.

Start your blockchain journey Now with the Enterprise Blockchains Fundamentals

Foreseeable Challenges

Competitive Landscape

Well, blockchain is a new technology, and it’s slowly gaining traction over the years. So, any competition regarding the insurance market is going to compete for a new realm. Many companies are already investing in blockchain, and they fear that enterprise companies may take all the glory.

So, in that sense, startups won’t have a choice but to invest in costly blockchain solutions. But if those solutions don’t perform well enough, they can even go bankrupt. So, you see, the more company tries to integrate blockchain, the more competitive the market will become.

Maintenance and Governance

This is one of the limitations of blockchain in insurance. In reality, blockchain doesn’t come with a governance system in place. It’s decentralized and distributed in nature, so there isn’t any need for a governance system. But enterprise companies can’t work without any governance models.

Their business processes or models can’t function that way. More so, the maintenance of the blockchain is also a massive point of concern because the companies will need experts to maintain this new technology. Therefore, there is no way to bypass both of these parameters and still use the technology.

Lack of Legal Regulations

Another one of the major limitations of blockchain in insurance is the lack of regulations. More specifically, legal terms. Well, the whole concept of insurance revolves around legal environments. Without proper regulations or laws, the system can’t function. For example, consumers and companies need the option to seek help from courts and lawyers.

How can they solve the issue in any kind of dispute if there is no concept of law or regulation? But blockchain does not offer that type of feature. So, this is also a huge challenge the sector needs to overcome.

Low Scalability

I believe this one of the ultimate limitations of blockchain in insurance. In reality, blockchain is still in the early phases of development. Although there are many solutions available at the moment in most cases, they can’t get rid of the scalability problem.

So, when there are too many participants in a network, the performance of that network will drastically fall. This will lead to slower output and transactions. Obviously, no company wants that. But at the moment, there aren’t many options to choose from. So, if blockchain wants to get global recognition, it needs to solve the scalability issue for good.

Start learning Blockchain with World’s first Blockchain Career Paths with quality resources tailored by industry experts Now!

Ending Note

Blockchain in insurance can open up a realm of new opportunities and innovations. This sector has fallen behind in the race of economic stability. So, it’s now high time for this sector to embrace the features of this technology.

Once companies start to implement blockchain in insurance, they will slowly change the scenario from worse to better. If you are eager to further learn about blockchain technology or want to start working on a project, we will suggest you check out our free blockchain course.