Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Comparisons

Georgia Weston

- on January 13, 2022

Uniswap vs SushiSwap – Key Differences

Want to learn about the factors that differentiate Uniswap from SushiSwap? Go through this detailed Uniswap vs SushiSwap comparison to understand the differences between the two.

Whenever you think of cryptocurrency and the transactions involving cryptocurrencies, you are most likely to encounter cryptocurrency exchanges. The conventional design of cryptocurrency exchanges has been centralized, which does not align with the basic principles of blockchain and cryptocurrencies.

Therefore, decentralized exchanges such as Uniswap have emerged in the crypto market as promising alternatives to centralized exchanges. Decentralized exchanges differ a lot from centralized exchanges in terms of design, such as with the inclusion of automated market makers or AMM systems that take order books out of the equation.

However, the continuously emerging DEX solutions have led to debates on Uniswap vs SushiSwap, another notable entry among decentralized exchanges. The debate over which one is the better-decentralized exchange can shed further insights into the value of decentralized exchanges. Let us dive deeper into the SushiSwap vs Uniswap debate in the following discussion.

Want to become a Cryptocurrency expert? Enroll Now in Cryptocurrency Fundamentals Course

Understanding Decentralized Exchanges

Before you start moving toward the differences between Uniswap and SushiSwap, it is important to understand what they are. The first idea one must build about these platforms is that they are decentralized exchanges. However, crypto enthusiasts are always bothered about identifying the better DeFi platform from these two options.

Although comparing both DEXs could provide a viable response, it is important to understand each platform before comparing them. So, let us begin with an overview of Uniswap to build the perfect foundation for differentiating it from other DEXs. Similarly, the discussion would also offer an overview of SushiSwap for setting the perfect stage for comparing two renowned DeFi platforms.

Want to know more about DeFi? Enroll Now in Introduction to DeFi Course

What is Uniswap?

If you navigate the existing DeFi ecosystem, then you are most likely to come across Uniswap as a top DEX. It is presently the world’s most popular decentralized exchange, which allows users to deposit money in liquidity pools. Users can also leverage the DEX platform for swapping between currencies for a small transaction fee.

The liquidity pools in Uniswap serve as representatives of a token pair with two Ethereum-based cryptocurrencies. People who contribute to the liquidity pools are termed liquidity providers who receive fees from the swaps in the pools. The liquidity pools in Uniswap are basically Ethereum smart contracts that help in the automation of market-making. Furthermore, the liquidity pool smart contracts also support automatic management of all the swap features.

Want to learn the basic and advanced concepts of Ethereum? Enroll Now in Ethereum Development Fundamentals Course

What is SushiSwap?

The next player in the Uniswap vs SushiSwap is also one of the popular decentralized exchanges in the existing market. As a matter of fact, SushiSwap has emerged as one of the top competitors to the biggest decentralized exchange. Interestingly, the origins of SushiSwap come from its competitors. It developed as a fork or copy of Uniswap with a few modifications.

Launched in late August 2020 by an anonymous developer “Chef Nomi,” it was successful in grabbing the limelight from Uniswap. How? While the top decentralized exchange had completed certain token distribution benefits, SushiSwap continued providing the benefits. As a result, it offers temporarily lucrative prospects for liquidity providers to offer liquidity in the SUSHI liquidity pools.

Similarities between Uniswap and SushiSwap

After a clear basic overview of the two popular decentralized exchanges in question, you can go for SushiSwap vs Uniswap comparison. However, it is important to observe the similarities between the two platforms to exclude any possibilities of confusion in comparing them. The first similarity between the two decentralized exchanges would refer to the use of AMM or Automated Market Makers. Rather than using the traditional order book model for facilitating transactions, these exchanges use the AMM model for facilitating trades. As a result, users don’t have to wait for another party to carry out trades or exchange their crypto assets.

Another important point of similarity between Uniswap and its competitor would point towards the use of liquidity pools. Both decentralized exchanges have liquidity pools in their design with tokens of two distinct cryptocurrencies. Users have the flexibility of swapping one token for another in the liquidity pool for a specific fee. On the other hand, users can also turn into liquidity providers on SushiSwap or its competitor to earn incentives on contributions to liquidity pools.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

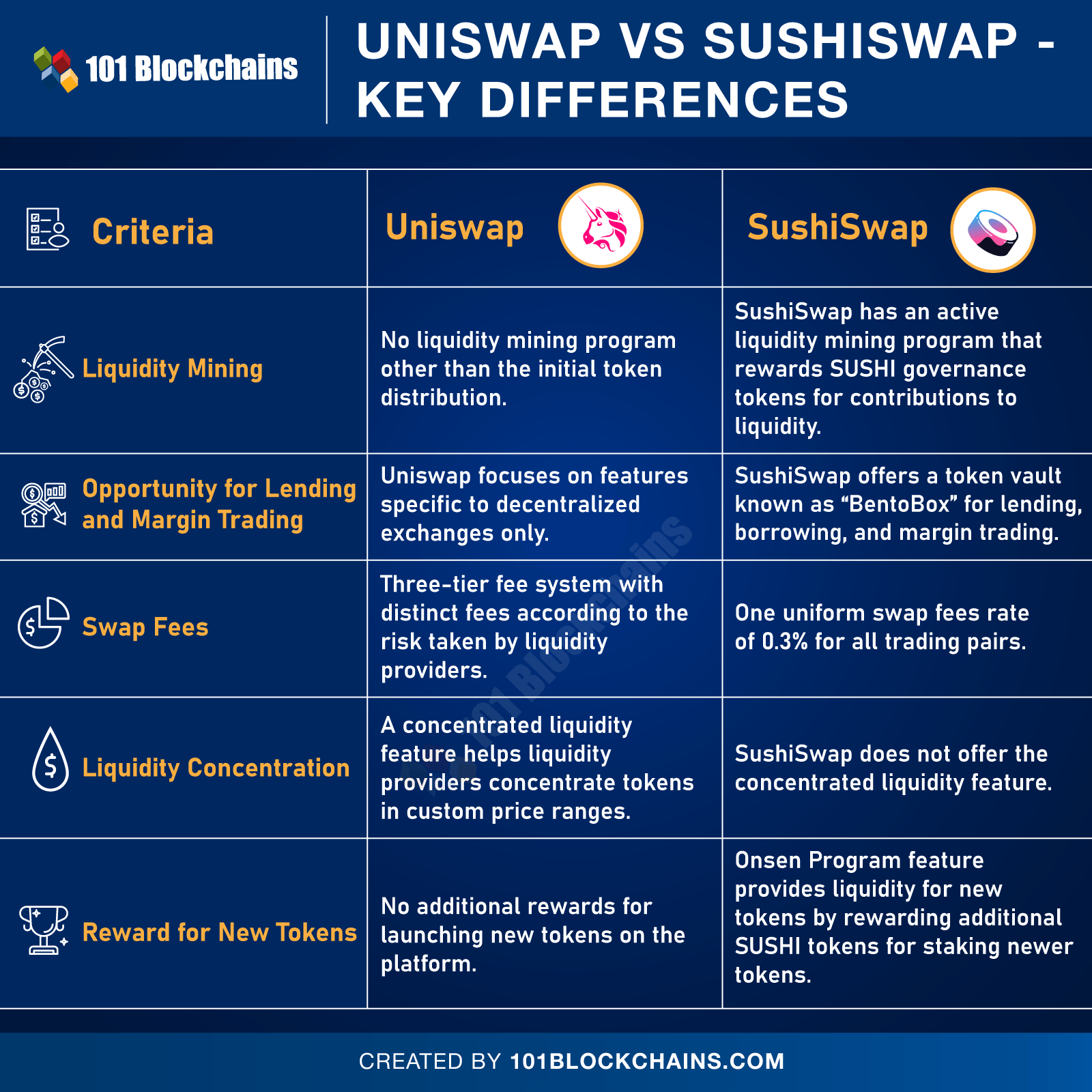

Differences between Uniswap and SushiSwap

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2022/01/Uniswap-vs-SushiSwap-Key-Differences-_17th-Dec-2022.png' alt='Uniswap-vs-SushiSwap='0' /> </a>

The similarities between Uniswap and its competitor in this comparison offered a reliable base for discussion about their differences. Here are some of the notable factors that showcase the difference between SushiSwap and the popular DEX alternative.

-

Liquidity Mining

Uniswap does not feature any liquidity mining program. At one point in time, it distributed shares of UNI tokens as incentives for liquidity providers through liquidity mining. However, the liquidity mining program was short-lived and never materialized completely. Therefore, users don’t have any additional approach for earning UNI tokens after the initial token distribution. On the other spectrum of Uniswap vs SushiSwap, you can discover the advantage of liquidity mining. Users can avail the benefits of the active liquidity mining program of SushiSwap by staking their tokens for earning SUSHI governance tokens.

-

Lending and Margin Trading

The next important pointer for SushiSwap vs Uniswap comparison would refer to prospects for lending and margin trading. One would definitely wonder about the functionalities of participating in DeFi on each platform. In the case of Uniswap, you cannot find any specific opportunities for lending and margin trading. It has maintained a strict emphasis on serving specifically as a decentralized exchange, thereby introducing relevant features.

However, SushiSwap does not present any limitations as it explores other areas related to DeFi. Interestingly, you can discover a feature termed “BentoBox” on the decentralized exchange, which serves as a token vault. The “BentoBox” also works as an “App Store” for dApps or decentralized applications. Presently, you can find only one dApp known as Kashi in BentoBox. The Kashi app utilizes the tokens in BentoBox for lending and borrowing as well as margin trading.

Want to explore in-depth about DeFi protocol and its use cases? Enroll in Decentralized Finance (Defi) Intermediate Level Course Now!

-

Swap Fees

One of the notable highlights in the Uniswap vs SushiSwap debate would obviously point toward the concerns of liquidity. The decentralized exchanges offer liquidity pools of crypto token pairs where you can swap crypto for a certain fee. It is important to note that you can use the swap fees as a crucial factor for differentiating between Uniswap and SushiSwap.

When you take a look at Uniswap for the swap fees, you can discover three distinct fee tiers. The fee tiers include rates of 0.05%, 0.3%, and 1%, based on the risk taken by liquidity providers with respect to expected volatility in the pools. SushiSwap, on the other hand, charges a common swap fee of 0.3% on all trading pairs. The liquidity providers receive 0.25% of the swap fees, while SUSHI token holders could receive the rest 0.3% of the fees.

-

Liquidity Concentration

Another significant factor for the SushiSwap vs Uniswap comparison would bring concentrated liquidity into the equation. Interestingly, Uniswap had envisioned the concept of concentrated liquidity. According to the concept, liquidity providers could have the ability to concentrate the tokens in custom price ranges.

As a result, they could develop personalized price curves. Escalated liquidity levels at the expected price range of a specific trading pair could encourage users to make larger swaps. On the other hand, SushiSwap does not have any feature for concentrated liquidity without any plans to launch one soon.

Learn the fundamentals of Decentralized Finance (DeFi) with DeFi flashcards, and enhance your knowledge as a blockchain professional.

-

Reward for New Tokens

The Uniswap vs SushiSwap debate could also find some promising insights from a review of conditions for rewards to introduce new tokens. You could not find any additional rewards for launching new tokens on Uniswap. On the contrary, SushiSwap includes the “Onsen Program” feature, which serves as a system for providing liquidity to new tokens.

The platform can leverage the Onsen system to help newer projects of smaller magnitudes with additional SUSHI rewards for staking their new tokens. The additional rewards on SushiSwap for introducing new tokens can encourage other users to procure newer tokens for staking. As a result, the additional rewards could provide formidable support for speeding up project growth effortlessly.

-

Total Value Locked

The Total Value Locked or TVL basically means the total liquidity or the total amount of assets locked in DeFi smart contracts. It can provide a clear impression of the value for users on a platform. Interestingly, SushiSwap was able to take the lead in TVL at the time of its launch. However, Uniswap introduced the UNI token and countered its competitor in terms of TVL. As of July 2021, the TVL of Uniswap was $4 billion, while its competitor had a TVL of $3.4 billion.

-

Trade Volume

The trade volume is also another crucial point of difference in SushiSwap vs Uniswap comparison. Trade volume basically shows the total value of trades carried out on a specific platform. It serves as an exceptional metric for describing the success and growth of a platform. Presently, the weekly trade volume of Uniswap is almost $7.7 billion. When compared to this, the weekly trade volume of SushiSwap is 700% lesser at just around $1 billion.

Start learning Blockchain with World’s first Blockchain Skill Paths with quality resources tailored by industry experts Now!

Final Thoughts

The evolution of decentralized exchanges such as Uniswap presents many favorable opportunities for expanding the DeFi landscape. However, it is too soon to assume one top solution among decentralized exchanges, especially when you have alternatives like SushiSwap. The comparison between both the decentralized exchange platforms shows a clear reflection of the long-term state of DeFi.

The Uniswap vs SushiSwap comparison shows how both the decentralized exchanges present new prospects for capitalizing on DeFi. SushiSwap offers adequate scope for adoption with additional rewards and better scope for liquidity mining as well as lending and margin trading. However, Uniswap has a higher TVL and trade volume, thereby showcasing proof of the trust of users in the platform. Learn more about the platforms to understand their differences clearly.