Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Cryptocurrency

Gwyneth Iredale

- on October 21, 2021

Central Bank Digital Currency: Know the Architecture of Retail CBDC

Want to learn about the design and architecture of retail CBDC? Here we cover the detailed guide on the different variants in the retail CBDC architecture.

The concerns regarding the possibilities of central banks issuing a digital currency for the general public have gained profound attention recently. One of the most prominent aspects of potential changes in the modern digital currency landscape refers to Central Bank Digital Currencies. Without any clear stance on their definition, CBDCs are considered as a new variant of digital currency with the support of central bank liability.

The continuously growing popularity of CBDCs has called for an unprecedented rise in interest regarding CBDC architecture. CBDCs have the capability to revolutionize the speed, cost, and efficiency of domestic as well as cross-border payments. Therefore, many people want to find out the underlying mechanism in CBDCs. They want to know how CBDCs help in transforming currency and payments as we know them. The following discussion offers you a detailed overview of Central Bank Digital Currency architecture, with a specific focus on retail CBDCs.

Want to know how digital currencies can improve your access to financial services? Enroll Now in Central Bank Digital Currency (CBDC) Masterclass

Different Variants of CBDCs

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2021/10/Central-Bank-Digital-Currency-Know-the-Architecture-of-Retail-CBDC-1.png' alt='cbdc architecture='0' /> </a>

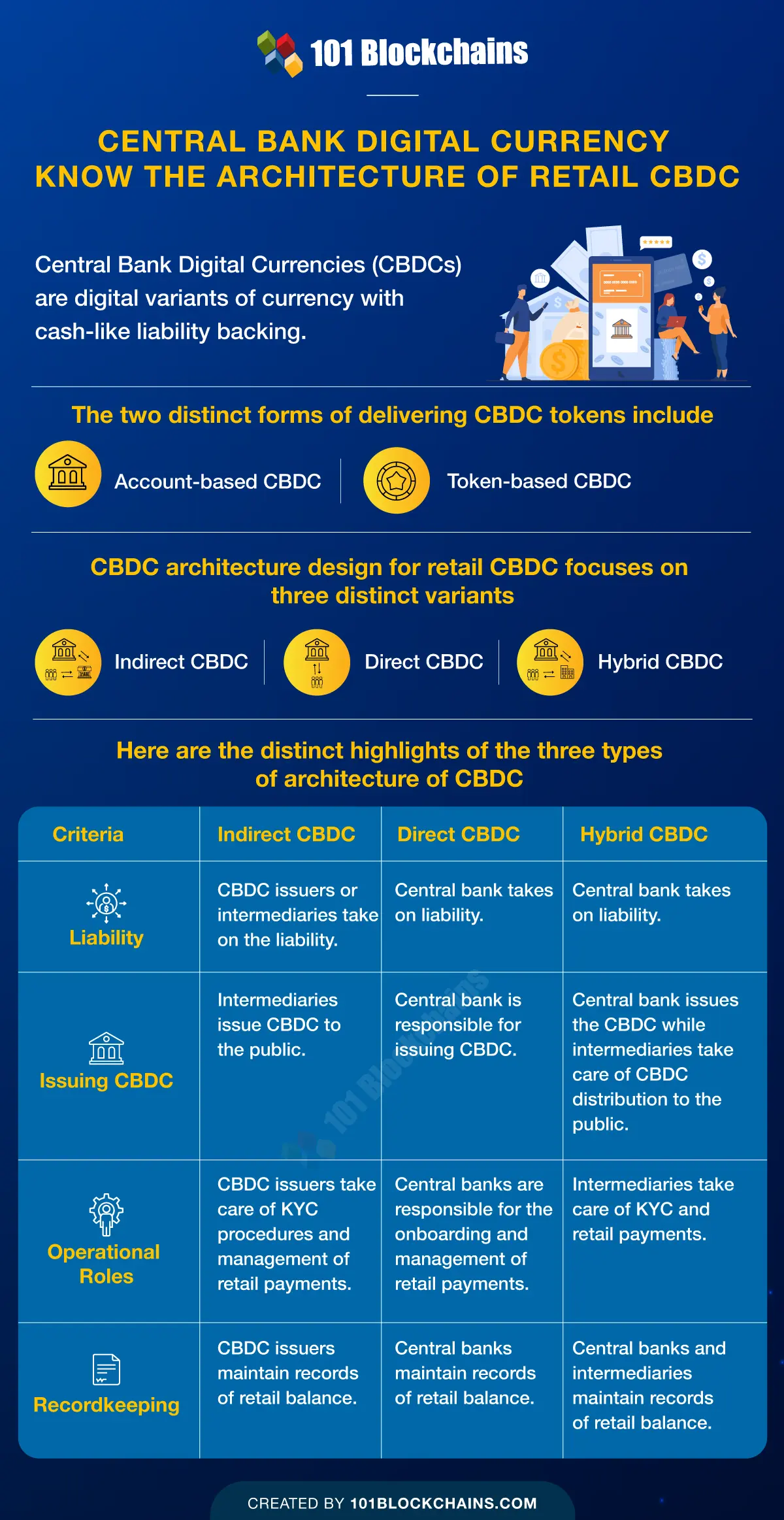

Before diving into an outline of the architecture of central bank digital currencies, it is important to know the categories. CBDCs are classified into two distinct categories of retail and wholesale CBDCs. Wholesale CBDCs are the variants of CBDCs designed for financial institutions which have reserve deposits in a central bank.

On the other hand, retail CBDCs are tailored for the general public. The two most common forms of retail CBDC offerings provide a basic impression on the architecture of CBDC in retail offerings. Retail CBDC can include two different types such as account-based retail CBDC and token-based retail CBDC. Let us shed some light on the two distinct forms of delivering retail CBDCs to users.

-

Account-based CBDC

The account-based CBDC model offers a basic foundation for implementing retail CBDC. In the account-based model, the originator and beneficiary of a transaction approve a transaction on the basis of user identities. All the transactions in account-based CBDC architecture have direct attributes to the identity-based accounts. Central banks need to have accounted for all users alongside a digital identity system for deploying an account-based CBDC model.

-

Token-based CBDC

Another notable approach for the implementation of retail CBDC refers to the token-based model. The originator and beneficiary use digital signatures and public-private key pairs for approval of transactions in the token-based CBDC model. Interestingly, the token-based CBDC model does not imply the need for accessing a user’s identity, thereby ensuring improved privacy.

At the same time, the token-based model in design and architecture of central bank’s digital currency also creates setbacks for traceability of fraudulent transactions and money laundering activities. In the most basic perspective, token-based CBDCs are considered as the exact digital alternatives for cash.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Motivation Underlying the Retail CBDC Approach

The foremost factor in understanding the architecture of CBDC in the retail form focuses on consumer requirements addressed with CBDC. Therefore, the architecture of retail CBDCs primarily stems from the evaluation of different factors ranging from consumer needs to design choices.

-

The Drive for a Cashless Society

The primary requirement of consumers focuses on the fact that CBDCs represent a cash-like claim with the central bank. In the present times, consumers are more likely to convert their digital currency into cash in response to conditions of financial turmoil. The shift to cash has been evident in many instances of crisis, even in the recent past. Therefore, it is reasonable to have concerns about the condition in a future where cash is no longer acceptable. In such scenarios, day-to-day business transactions, as well as retail transactions, could encounter formidable setbacks.

-

Convenience

Another important factor that could drive the adoption of retail CBDC refers to the convenience of payments. Consumers will not adopt a CBDC if it lacks the convenience available in existing electronic payment systems. The convenience of making payments is undoubtedly one of the significant elements in central bank digital currency architecture. Banks and payment service providers leverage highly sophisticated infrastructures for coping with peak demand. Intermediaries help banks and payment service providers in simplifying the flow of payments by improving risk tolerance.

The two basic tenets of cash-like safety and ease of use serve as the foundations of the design and architecture of central banks digital currency. These factors establish the choice of operational architecture alongside approaches for balancing consumers’ demand for cash-like liability on central banks alongside the convenience of intermediaries in the payment system. Therefore, the design of retail CBDCs also needs to take many other factors into consideration.

Want to learn about the practical implementation of blockchain in the financial sector? Enroll Now in Blockchain in Finance Masterclass

Additional Factors in Design of Retail CBDCs

The necessity of cash-like safety in CBDC architecture points out the need for security from insolvency or technical discrepancies of intermediaries. At the same time, the need for cash-like liability with CBDCs also implies the need for safeguards against outages at the central bank.

You would also need to focus on two other consumer requirements when discussing the potential architecture of CBDC. The two requirements refer to privacy by default and universal access. If you go with privacy and ease of access, then you have to trade-off the ease of regulatory enforcement.

Therefore, it is important to think about whether the CBDC access should involve an identity system or cryptographic schemes without the need for identification. You can clearly notice the foundation of differences between account-based and token-based models for retail CBDC implementation here.

Among all the factors that you need to consider in the design and architecture of central banks digital currency, the ease of cross-border payments would also grab anyone’s attention. Without the functionality of cross-border payments, CBDCs would be just like any other new form of digital currency.

Want to become a Cryptocurrency expert? Enroll Now in Cryptocurrency Fundamentals Course

Different Types of Retail CBDC Architecture

The definition of essential design considerations shows what a retail CBDC is supposed to achieve. On the other hand, the central bank digital currency architecture plays a crucial role in tailoring the CBDC design according to the desired functionalities. So, what does the architecture of a retail CBDC entail?

While many sources of information could land you up with confusion regarding this question, you can find considerably simple answers. The legal structure of the claims alongside the operational roles of the central bank alongside private institutions in payments is the crucial defining element in the architecture of CBDCs.

Based on this assumption, you can find three distinct architectures for retail CBDCs such as direct, indirect, and hybrid architectures. Each type of architecture considers the central bank as the party responsible for issuing and redeeming CBDC. In addition, it is also important to note that the three different types of CBDC architecture for retail CBDC could be in the account-based or token-based models. Furthermore, the architectures could also run on different infrastructures without adequate efforts.

Another critical aspect for understanding the different types of architecture of CBDC refers to the differences between them. The three distinct architecture variations for retail CBDC differ in terms of the record kept by the central bank and the structure of legal claims. The consumer can have a direct claim on an intermediary in the indirect CBDC model, where the central bank keeps track of wholesale accounts only.

Direct CBDCs offers a direct claim on the central bank, which also maintains records of all the balances and ensures updates for all transactions. Hybrid CBDCs bring the intermediate solution between direct and indirect CBDCs with the facility of direct claims on central banks. The striking factor about hybrid CBDCs is the power of intermediaries for managing payments.

The differences between the distinct variations of central bank digital currency architecture provide a reliable impression of their design. However, a deep dive into each type of architecture adopted for retail CBDC offerings is essential for understanding them comprehensively.

-

Indirect CBDC

The first addition among the types of central bank digital currency refers to the indirect CBDC model. The indirect CBDC model is also considered as the ‘two-tier CBDC’ due to its similarities with the existing two-tier financial system. From the perspective of consumers, the indirect CBDC does not offer a direct claim on the central bank.

On the contrary, it involves an intermediary, which takes on the responsibility of backing the indirect CBDCs. Intermediaries are capable of providing cash-like liability to retail consumers through their existing pool of CBDCs in a central bank. The indirect CBDC architecture imposes many crucial responsibilities on the intermediaries.

In the indirect CBDC model, intermediaries have to take care of all types of communication with retail clients. Furthermore, intermediaries must also take on the responsibility of sending payment messages to other intermediaries alongside the wholesale payment instructions to central banks.

Apart from the benefits of convenience, you can find in existing intermediary-based systems; indirect CBDC also relieves central bank burden. With the indirect central bank digital currency architecture, central banks don’t have to worry about dispute resolution or KYC procedures.

On the other hand, central banks do not have any record of individual claims or direct proof of claim like with cash in the indirect CBDC model. Therefore, central banks could not fulfill consumer claims without the relevant information from intermediaries. So, the indirect CBDC model in the architecture for retail CBDCs features the same supervisory and regulatory issues evident in existing financial systems.

-

Direct CBDC

The next prominent addition among the variants of retail CBDC on the basis of CBDC architecture refers to the direct CBDC model. One of the prolific versions of direct CBDC implementation would involve the central bank taking care of account management. The direct CBDC model empowers players in the private sector or central banks, or other public sector institutions to take care of KYC processes and customer due diligence. However, the central bank only would have authority over the management of the payment services.

As you can notice clearly, the direct CBDC model takes away the need for depending on intermediaries. However, the exclusion of intermediaries subsequently leads to discrepancies in reliability, efficiency, and speed of the payment systems. Generally, the development and operation of technical capacity on retail CBDC scale are generally perceived as a better fit for the private sector.

On the other hand, retail CBDC could lose attractiveness for consumers in comparison to existing retail payment systems. In addition, the exclusion of intermediaries also increases the burden of risks generally taken by intermediaries. Furthermore, intermediaries also take care of customer due diligence and KYC procedures. If central banks have to take over these processes, then they must go through a massive operational makeover.

-

Hybrid CBDC

The two pure options for defining the design and architecture of central banks digital currency have some unique value propositions. At the same time, you can also discover some new setbacks with them, which call for completely new solutions. The best possible recommendation in this case for defining CBDC architecture would point towards blending the elements of direct and indirect CBDC. It involves a combination of direct claims on the central bank and a private sector messaging layer.

The most crucial element in the hybrid CBDC model refers to the legal framework responsible for underpinning claims. The legal framework also plays a crucial role in maintaining the segregation of claims from the balance sheets of payment service providers. As a result, the hybrid CBDC model could ensure improved portability.

In event of failure of a payment service provider, the CBDC holdings are no longer a part of the payment service provider’s holdings which are accessible to creditors. The legal framework in the hybrid CBDC model enables better flexibility of switching retail customer connections to functional payment service providers. In addition, the hybrid CBDC model also implies the need for central banks to have technical capability for restoring retail balances.

The hybrid architecture of CBDC could present advantages as well as setbacks with respect to the indirect and direct CBDC architectures. For example, you can avail improved resilience in comparison to indirect CBDC and better ease of operation in comparison to direct CBDCs.

Want to learn what is the scope and purpose of DeFi? Enroll Now: Introduction to DeFi Course

Final Words

The three distinct types of CBDC architecture models for retail CBDC showcase distinct ways of taking CBDC to the public. With the basic design considerations in mind and common ways for offering CBDC tokens, understanding the architecture of CBDCs definitely becomes easier. The architecture models for CBDCs rely profoundly on classifying the authority responsible for liability claims for CBDCs.

In the case of direct CBDC models, users can have a direct claim on the central banks. On the other hand, indirect CBDC models place the liability on an intermediary. Hybrid CBDC models bring the best of direct and indirect CBDC models, albeit with certain setbacks. Dive into the world of CBDCs and learn more about the architecture models of retail CBDC right now!

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!