Learn how blockchain truly works, master key definitions, and uncover what makes smart contracts so "smart." Dive into the fundamentals, gain valuable insights, and start your blockchain journey today!

- Reviews

Gwyneth Iredale

- on March 02, 2021

Blockchain and the Rise of Embedded Finance

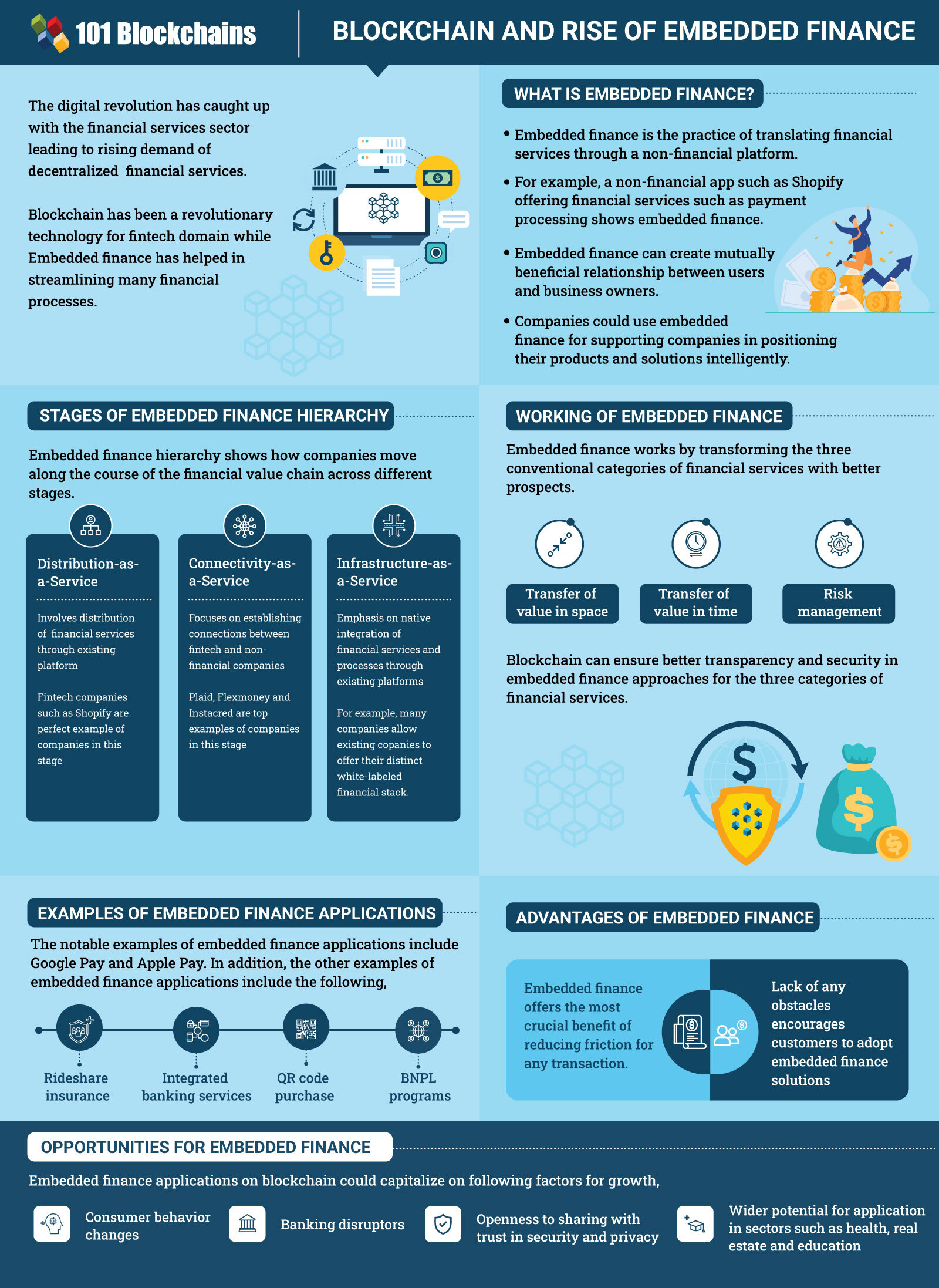

In recent times, the urgency revolving around tokenization of digital assets has led to an improved focus on new trends in decentralized finance services. One of the prominent trends that have been gaining attention in the fintech domain in recent times is the application of embedded finance in the blockchain. In recent years, many financial services have come together with applications and software offered by non-banking providers. The trend basically implies embedded finance and is gradually creating massive disruptive trends in payments, technology, and banking in present times.

Embedded finance has been successful in reshaping the distribution model for financial services. At the same time, it has also transformed the role of technology companies in the financial lives of enterprises and consumers. Therefore, the interest in embedded finance is growing gradually with each passing day, especially with respect to its applications in the blockchain ecosystem. The following discussion helps you obtain a detailed impression of embedded finance and how blockchain has been crucial in promoting the rise of embedded finance.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

What is Embedded Finance?

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2019/07/Blockchain-technology-explained.jpg' alt='Centralized Vs Decentralized Systems' border='0' /> </a>

The first question that comes forward in any discussion regarding embedded finance deals with its definition. The answer to ‘what is embedded finance?’ can help in establishing a fundamental impression of the new trend. Embedded finance basically refers to financial services accessible according to the customer’s terms. It can enable customers for accessing financial services from any location, at any time, according to their requirements.

Embedded finance has taken away the need for customers to visit their bank for accessing their money. In the case of advanced applications such as embedded banking, embedded finance could also eliminate traditional intermediaries such as banks completely. As a result, many enterprises are slowly considering the adoption of embedded finance in blockchain without any traditional command over financial services.

Importance of Embedded Finance

If you dive deeper into answers for ‘what is embedded finance?’ you can find additional insights about its capabilities. Embedded finance entails a seamless combination of conventional financial services such as payment processing, through another service. In the simplest terms, embedded finance involves integrating a financial service into a non-financial website or app. Customers paying for a ride-share at the end of the ride in the company’s app depend on embedded finance.

As a result, the customer doesn’t have to worry about having cash in hand or handing over their payment card to the driver. The customer can just use their phone for paying the rider conveniently. You can find similar examples of embedded finance in the case of Shopify merchant accounts, Amazon loans, and Apple Cards.

The rise of embedded finance in blockchain-primarily revolves around its capability for creating a mutually beneficial relationship. Users could save a considerable amount of time while businesses could also save expenses of resources and time. At the same time, embedded finance also empowers users with the opportunity for making payments according to their convenience. The time factor is a formidable aspect in embedded finance as business owners should recognize the benefits of maximizing time.

Furthermore, modern Banking-as-a-Service (BaaS) providers are working towards improvements for ensuring a developer-friendly experience. The features with BaaS providers include modern RESTful APIs, comprehensive documentation and support, and modular services. In addition, the BaaS providers also present pay-as-you-go pricing models that are tailored for customers. Therefore, the rise of BaaS providers is also a massive factor for fostering embedded banking.

Wallets, payments, and banking-like services have turned into indispensable components of internet-based companies. Embedded finance can support such companies with intelligent positioning of products and solutions for accessing in-depth insights. As a result, businesses could leverage the insights for offering a highly customized and seamless experience for B2B and B2C customers. With notable companies such as Uber, Google, and Apple has already launched their money services, embedded finance definitely presents vital promises for long-term sustainability.

Get familiar with the terms related to blockchain with Blockchain Basics Flashcards.

Stages of Embedded Finance Hierarchy

The implications of embedded finance in blockchain have achieved mainstream attention in recent times, especially after the COVID-19 pandemic. Financial companies have already leveraged blockchain for digital transformation of conventional processes and tasks related to financial services. Many financial companies don’t focus on the choices between trading and maintenance of digital currencies or securities.

Embedded finance is a clear example of the drive of financial organizations for introducing changes in traditional financial systems. You can get a deeper understanding of how embedded finance offers credible advantages and its relationship with blockchain by reflecting on its important components. Generally, companies adopting embedded finance leverage the various stages included in the financial value chain. The hierarchy of embedded finance can clearly showcase how they align with financial ecosystems in specific regions.

-

Distribution-as-a-Service

The first aspect or stage in the hierarchy of embedded finance focuses on distributing financial services through an existing platform. The applications of embedded finance in blockchain rely prominently on the ecosystem builders in this stage. The first stage in embedded finance focuses on distribution-as-a-service and is a commonly prevalent practice in Asia.

The facility of embedded finance in the form of distribution-as-a-service is suitable for regions that face issues in distribution and education. Fintech companies such as Shopify and Grab emphasize on development of an ecosystem of services, tailored for intense integration across the value chain in the concerned verticals in this stage.

-

Connectivity-as-a-Service

The second phase associated with embedded finance establishes the functionality of the connectivity-as-a-service model. The connectivity-as-a-service model primarily focuses on pipe builders attempting to establish connections between Fintech and non-financial companies. Companies generally recognize the difficulty of managing financial services due to the lack of substantial capital and institutional knowledge. The applications of embedded finance in blockchain could have better levels of privacy in connectivity.

Fintech companies could leverage the connectivity for streamlining the development of new, innovative financial services. Furthermore, connectivity can also help fintech companies in adding social aspects for industries that have been under corporate dominance. Some of the examples of companies in this stage are Plaid, Instacred, and Flexmoney. In most cases, regulators focus on maintaining products and services under the scope of banks. On the other hand, banks are trying hard for participating in the front lines of fintech. Both of these factors have played a crucial role as catalysts for developing the second stage of embedded finance.

Start your blockchain journey Now with the Enterprise Blockchains Fundamentals

-

Infrastructure-as-a-Service

The third phase in the embedded finance hierarchy emphasizes on native integration of financial services and processes through an existing platform. The third stage clearly reflects on the infrastructure-as-a-model of embedded finance. Platform ecosystems could grow substantially with the increasing number of transactions. Subsequently, it can enhance the dependency on external financial processes. The development and maintenance of massive in-house platforms are not economically feasible. Therefore, startups have started enabling B2B companies for adopting white-labeled financial processes in digital ecosystems.

The applications of embedded finance in blockchain are primarily based on the efficiency of the IaaS model in this stage. Many enterprises such as DriveWealth, Finix, and Matchmove allow existing companies such as Shopify for offering their unique white-labeled financial stack. Most important of all, the infrastructure-as-a-service model could ensure better proprietary financial ecosystems. In addition, support for cloud-based integrations could offer better convenience and ease of use with solutions for customers. Therefore, users can save a considerable amount of time.

Working of Embedded Finance in Blockchain

The most significant factor in understanding the application of embedded finance in blockchain refers to the working of embedded finance. By now, you must have understood that embedded finance involves the integration of financial services into non-financial programs. Now, you can find out the link between embedded finance and “how is Blockchain used in finance?” by reflecting on the working of embedded finance. In the conventional approach, financial services generally focused on three prominent categories. The first category of financial services related to the transfer of value in space.

The transfer of value in space focused on traditional bank products such as savings accounts and payment processing. The second category of financial services refers to the transfer of value in time. The notable additions in this category include loans, investments, and other forms of financing. The third category of financial services focused on risk management with the prominent example of insurance. The financial services for managing risk also include products capable of offering safeguards against risks.

Embedded finance gives the opportunity for integrating all three categories of financial services into non-financial programs. In addition, it is also possible to deliver financial services across a network. The most distinctive aspect in the working of embedded finance directly refers to the vertical integration functionality for cross-industry integration. For instance, a vertically integrated company generally owns its personal supply chain. On the other hand, it could manufacture its own products and sell them at retail outlets of top brands.

The working of embedded finance in the blockchain is different from other digital financial services by offering better transparency and security. Digital wallets are one of the prominent examples of embedded banking. A person should store their payment card information in the app and a traditional bank issues the credit or debit cards. Now, the user could use the app for purchasing products at brick-and-mortar stores or purchase online. In addition, users could also transfer money to other users of the app without typing their credit card or bank account information every time.

Blockchain technology has been gaining mainstream recognition, read our previous discussion to take a look at how blockchain is the future of technology.

Examples of Embedded Finance Applications

The examples of Apple Pay and Google Pay clearly showcase the intervention of embedded finance in the transfer of value in the space category. In addition, the applications of embedded finance in blockchain are also clearly evident in the other two categories. Some examples of embedded finance in the transfer of value in time and risk management categories of financial services are,

-

Integrated Banking Services

Many financial service providers could opt for moving out to additional traditional banking services. For instance, Credit Karma offered free access to credit scores of people for pitching products and services to customers. Now the website has successfully embraced embedded finance and launched its own savings account. The savings account feature of Credit Karma is integrated effectively with other components of Credit Karma. As a result, the savings account feature can help a person in monitoring their credit health. In addition, users could also save for their future by using similar login.

-

Rideshare Insurance

Individuals driving for rideshare companies require additional insurance apart from personal auto coverage. This is particularly important during the times when they are driving for the company actively. The application of embedded finance in blockchain could help in resolving the gap. For example, Uber provides insurance coverage for different levels of protection when a person drives for them. The insurance coverage depends on whether the driver has a passenger currently or is on the way to pick up.

-

BNPL Programs

Buy now, pay later or BNPL programs are some of the prominent highlights in the online shopping space recently. Many online stores offer the option of buying today and paying later. These programs are clear examples of applying embedded finance in blockchain with the transfer of value in time financial services. By selecting a BNPL option rather than using a credit or debit card, a shopper basically takes out a loan to pay for their purchase. Many BNPL programs don’t require credit checks and consumers could select instant use of the program when checking out. All programs have unique features including division of purchase price into four payments or allowing shoppers for determining the period of the loan.

-

QR Code Purchases

Another prominent example that showcases the potential of embedded finance in blockchain refers to QR code purchases. China’s most popular text messaging app, WeChat, allows users to communicate easily with each other. On the other hand, it has also introduced many convenient payment features. The most notable payment feature on WeChat is the facility for users to scan a QR code for making payments. A mobile payment service in the US, Venmo, also has a similar feature that allows users to scan QR codes for finding other users and making faster payments.

Advantages of Embedded Finance in Blockchain

It is practically impossible to discuss embedded finance in blockchain without focusing on the advantages of embedded finance. Embedded finance provides various benefits for traditional financial services companies, consumers using the products, and fintech. One of the notable benefits associated with embedded finance is the seamless experience it can guarantee.

The lack of friction in a transaction enables customers to complete it easily. For instance, shoppers generally abandon their carts on online shopping websites due to trust issues. However, the availability of payment information through a blockchain-based app could provide security and flexibility with embedded finance. So, customers are more likely to complete a business transaction when using embedded finance.

Curious to learn about blockchain implementation and strategy for managing your blockchain projects? Enroll Now in Blockchain Technology – Implementation And Strategy Course!

Opportunities with Embedded Finance in Blockchain

Blockchain can provide a suitable support mechanism for the growth of embedded finance. Various opportunities in embedded finance can influence the notions for adopting blockchain in embedded finance. Blockchain could serve as an immutable record for all transactions in the new financial services delivery model. The applications of embedded finance in blockchain are increasing slowly while gaining the attention of top enterprises.

- The other important factor that could give embedded finance in blockchain a fair chance at growth is consumer behavior. People are shopping online and have different preferences while purchasing products online and on non-traditional platforms such as social media. Embedded payment programs could help in ensuring a faster and effective transition from brick-and-mortar shopping to digital shopping.

- The risk of data breaches and security concerns is undoubtedly one of the prominent threats for embedded finance. However, the use of embedded finance in blockchain can capitalize on the increased trust of people for sharing their personal information with third parties.

- The notice of banking disruptors is one of the prominent highlights in understanding embedded finance in the blockchain. Almost a few years ago, opening an account with an e-commerce company might have sounded absurd. However, the times have changed and people use an app for almost all financial transactions. Banking disruptors have started to gain popularity among consumers and embedded finance is undoubtedly one of them.

The long-term prospects for the growth of embedded finance are also evident in the industries that can receive benefits. Some of the notable examples include real estate, health, and education. The real estate sector could employ many use cases of embedded finance and blockchain in combination.

For example, embedded finance can enable the creation of a seamless experience for property owners. In the health sector, embedded systems can help in balancing the dynamics of student loans. By taking the income potential of students after finishing a degree program, embedded finance mechanisms can avoid excessive debts.

Start learning Blockchain with World’s first Blockchain Career Paths with quality resources tailored by industry experts Now!

Bottom Line

As you can notice, the implementation of blockchain with embedded finance can create a revolutionary financial instrument. The introduction of blockchain-based payment systems shows the prospects for the growth of embedded finance with blockchain. There are many factors relating the functionalities of blockchain with the fundamentals of embedded finance.

With the requirement of Blockchain solutions, enterprises would need Blockchain experts to address their business objectives. Therefore, individuals interested in Blockchain technology should start learning through the Introduction to Enterprise Blockchain Free Course and get ahead to master the technology and become a certified expert in Blockchain.

You can explore the various aspects of digital asset convergence in our webinar titled “Blockchain and the Rise of Embedded Finance”. The webinar focuses on different topics such as transitions from internet-enabled to finance-enabled businesses by converging digital assets, payments, and trade. You can also find out more details about the implications of leveraging blockchain for embedded finance applications. Access the webinar right now!

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!