Inflation is one of the most troubling words for an economy, especially for the world’s no.1 USA. The inflation rate in the US has been estimated at almost 8.5% in 2022. The growth in inflation is a prominent highlight, especially considering the fact that inflation rate was around 7.0% in 2021. Growing inflation has also imposed pressure on stagnancy of wages while facilitating rise in prices. Therefore, the inflationary vs deflationary cryptocurrencies debate has been gaining momentum in recent times. But why?

Many people have perceived cryptocurrencies as a viable option for hedging against higher inflation. However, you must also know that cryptocurrencies also qualify as inflationary and deflationary assets. Will they help you combat inflation? The following post might help you find the answer with a detailed overview of inflationary and deflationary cryptocurrencies and the differences between them.

Want to become a Cryptocurrency expert? Enroll Now in Cryptocurrency Fundamentals Course

What is Inflation vs Deflation?

One of the first aspects of a discussion about inflationary vs deflationary crypto would focus on the difference between inflation and deflation. Both the terms might seem to have jumped out of an accountant’s handbook for any cryptocurrency beginner. Inflation points to a growth in prices of products and services when excess currency is in circulation, thereby causing the currency to lose value.

On the other hand, deflation points to growth in the value of a currency along with the relevant drop in pricing of products and services. It is important to note that deflation is the consequence of limited currency in circulation. Inflation is good to an extent as it empowers the economy by driving people to spend more. On the other hand, inflation can turn into a serious issue when the prices grow faster in comparison to salaries.

Did you notice the common element in the difference between inflation and deflation? The answer is the supply of the currency. Fiat currencies are generally inflationary as it is possible to increase their supply according to your will. Since the overall economic activity remains constant in any situation, the value of a single unit of the currency drops. Deflation implies the reduction of demand and increase in supply, which can lead to higher purchasing power of the fiat currency. How does the concept of inflation and deflation fit in the domain of cryptocurrencies?

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Enroll now in the Crypto Fundamentals, Trading And Investing Course.

Inflationary Cryptocurrencies

As the world turns towards cryptocurrencies as a hedge against inflation, it is important to learn more about inflationary and deflationary cryptocurrency alternatives. The concepts of inflation and deflation are also applicable for cryptocurrencies as they are governed by the laws of supply and demand.

An inflationary cryptocurrency is one with an increasing number of tokens in circulation. Some of the common approaches for introducing new tokens through mining, staking, and other methods can help in increasing the circulating supply of tokens. The increasing supply of the token would cause a drop in its value. As a result, users have to spend more tokens for purchasing a specific product, asset, or item.

Dogecoin is the best example of inflationary cryptocurrencies in an inflationary vs deflationary cryptocurrencies debate. One of the creators of Dogecoin removed the hard supply cap of 100 billion DOGE in the year 2014. The move was particularly directed towards ensuring an unlimited supply of the asset. Subsequently, the supply of the token could easily outpace demand, thereby decreasing the value of all Dogecoin tokens.

On the other hand, you can also identify other inflationary assets, such as Bitcoin, which feature inflation only to a specific limit. How can a cryptocurrency be a limited inflationary asset? The total circulating supply of Bitcoin is 21 million, thereby implying that there could be 21 million Bitcoins ever in circulation. Once the supply limit runs out, Bitcoin mining would disappear, thereby turning Bitcoin into a deflationary cryptocurrency.

Interestingly, Bitcoin has employed an innovative mechanism for slowing down inflation by halving it. Period every four years, Bitcoin network reduces the number of Bitcoins that can be mined and entered into circulation. Some of you might be wondering about the fact that 19 million Bitcoins are already in circulation, thereby leaving little time for mining the rest.

On the contrary, the gradually dropping rewards for mining would suggest that the 21 million mark might be years away. Bitcoin treads the thin line between inflationary and deflationary cryptocurrency with a considerable reduction in mining rewards. For example, the mining reward in 2016 amounted to almost 12.50 Bitcoins. In 2020, the rewards dropped to almost 6.25 Bitcoin and would round up to 3.125 BTC in 2024. Halving is an effective mechanism for reducing the number of cryptocurrency tokens in circulation.

Start learning about Cryptocurrencies with World’s first Cryptocurrency Skill Path with quality resources tailored by industry experts Now!

Deflationary Cryptocurrencies

Deflationary cryptocurrencies are the ones where the supply of coins would decrease over the course of time. Therefore, the value of every coin would increase even in scenarios with consistent demand. On the other hand, different projects use unique deflationary initiatives for specific objectives. A detailed understanding of deflationary cryptocurrencies is an important requirement to learn the difference between inflationary and deflationary cryptocurrency alternatives in the market.

One of the examples of showcasing deflationary cryptocurrencies refers to the crypto exchange Binance. The crypto exchange destroys a few of its native Binance Coins or BNBs to reduce the supply every quarter. Similarly, the crypto exchange Polygon also burns its native MATIC tokens to reduce supply of the token.

In addition, you must also learn about the examples of cryptocurrencies that serve as central banks. Such cryptocurrencies use inflationary as well as deflationary methods for maintaining the value of the token. The best example of such a deflationary cryptocurrency refers to the TerraUSD or UST stablecoin. The TerraUSD network, or Terra Network, mints and destroys its tokens to maintain the price of the stablecoin constant at $1.

Your understanding of inflationary vs deflationary crypto would also focus on the understanding of Ethereum as a deflationary cryptocurrency. The native token of Ethereum, i.e., Ether, was a completely inflationary asset at one point in time. On the other hand, Ethereum introduced an update in August 2021 to make Ether deflationary during rising in network activity. The update introduced a clause for burning ETH to reduce supply. According to the reports of a tracking website, over 1.7 million Ether coins amounting to more than $4.5 billion have been destroyed.

The example of Ripple also shows a different approach for making its native token, XRP, a deflationary cryptocurrency. Ripple released 100 billion XRP tokens at once and locked away around 55 million tokens in 2017. The locked tokens would be released on a periodic basis to maintain liquidity. In addition, users have to pay a small transaction fee with every transaction featuring XRP. The Ripple network also burns the transaction fee for maintaining the deflationary nature of its XRP token.

Get familiar with the terms related to cryptocurrency with Cryptocurrency Flashcards

Factors behind Economics of Inflationary and Deflationary Crypto

The economic implications associated with inflation and deflation of fiat currencies can be quite confusing. However, the inflationary vs deflationary cryptocurrencies comparison presents a more straightforward interpretation of both concepts. Inflationary cryptocurrencies feature a system that enables a continuous growth in the number of tokens in supply.

On the other hand, deflationary cryptocurrencies feature a system with tokens in supply reducing gradually over time. The deflationary mechanisms can include periodic burnout of tokens or lowered minting rewards. How do you differentiate an inflationary cryptocurrency from a deflationary cryptocurrency? Here are the three important factors for the economics underlying inflationary and deflationary cryptocurrencies.

-

Maximum Supply

Some cryptocurrencies have set a hard cap on the number of tokens they can ever put in circulation. The best example of a cryptocurrency with a maximum supply limit is Bitcoin, with its 21 million BTC mark.

-

Circulating Supply

The most important factor of difference between inflationary and deflationary cryptocurrency refers to the token’s circulating supply. Circulating supply refers to the total number of cryptocurrencies associated with a specific blockchain moving around on the chain.

-

Total Supply

The total supply refers to the total supply of tokens defined for a specific cryptocurrency token. It may also point to the number of tokens mined till now on the blockchain network, thereby creating similarities with the description of circulating supply.

Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects.

Basis for Inflationary and Deflationary Cryptocurrencies Comparison

The most critical highlight in a comparison between inflationary and deflationary cryptocurrency draws attention to demand and supply pertaining to a specific cryptocurrency. A better understanding of tokenomics pertaining to inflationary and deflationary cryptocurrencies can set the ideal foundation for comparing them. The important factors in the tokenomics of a specific cryptocurrency include overall production, distribution, and quality of a cryptocurrency token.

The tokenomics of a cryptocurrency are generally outlined in the whitepaper of the concerning blockchain. You can use the whitepaper of a blockchain to identify whether the native token offers an unlimited and gradually increasing supply or a restricted and gradually dropping supply. The cryptocurrencies with a fixed supply, such as Bitcoin, Binance Coin, Ripple, and Cardano, can showcase a reduction in supply alongside driving higher demand. As a result, these cryptocurrencies can gain value improvements over the course of time.

Can the whitepaper help you identify the difference between inflationary and deflationary cryptocurrency? First of all, you need to discard the common beliefs regarding inflationary cryptocurrencies. Some of the inflationary cryptocurrencies with unlimited supply, such as Ethereum and Dogecoin, are not as bad as people imagine.

They might be serving lower demand and higher supply now. However, one should understand how the crypto ecosystems don’t fall prey to economic downturns like the fiat currencies. Irrespective of an unlimited supply, an inflationary asset would never affect the long-term picture of demand and supply.

Take the example of Ethereum, which does not have any hard cap. Irrespective of the hard cap, Ethereum blockchain allows only a specific amount of ETH to be mined every year. Assume that the existing ETH supply has a market capitalization of almost 100 million, then users can mine only 18 million ETH every year. In this case, the inflation rate would be 18%. With continuous growth in market cap of ETH over the course of time, the inflation rate would reduce gradually.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in Ethereum Technology Course

Inflationary vs Deflationary Cryptocurrency Comparison

The general action of investors might turn towards deflationary cryptocurrencies over the inflationary crypto assets. However, you can notice how inflationary cryptocurrencies can also bring plausible benefits alongside working on new mechanisms for reducing inflation. For now, the inflationary vs deflationary crypto debate ultimately rounds up on one plausible observation.

The observation suggests that inflationary and deflationary cryptocurrencies have their unique advantages and drawbacks. For example, inflationary cryptocurrencies can cause scenarios where demand overpowers supply. At the same time, they are also essential for continuing the mining process without any interruptions. On the other hand, deflationary cryptocurrencies can help you capitalize on the benefits of a price surge, an important value benefit for investors.

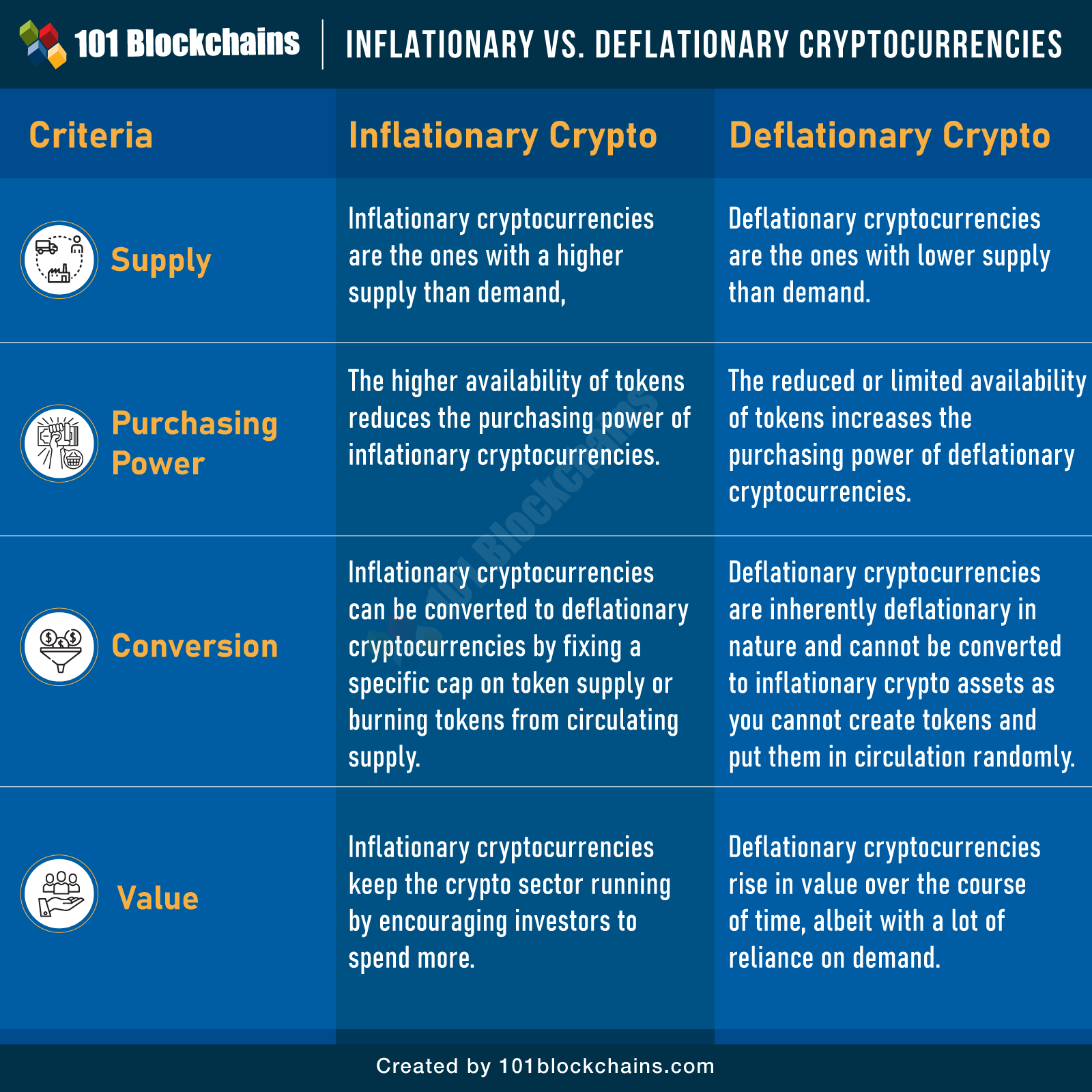

Here is an overview of the comparison between inflationary and deflationary cryptocurrencies on the basis of different factors.

Please include attribution to 101blockchains.com with this graphic. <a href='https://101blockchains.com/blockchain-infographics/'> <img src='https://101blockchains.com/wp-content/uploads/2022/07/Inflationary-vs.-Deflationary-Cryptocurrencies-Key-Differences-1.png' alt='Inflationary vs. Deflationary Cryptocurrencies='0' /> </a>

-

Supply

The obvious aspect in the overview of inflationary vs deflationary cryptocurrencies points at supply. As a matter of fact, the difference between inflationary and deflationary cryptocurrencies is all about the change in supply of the native token. In the case of an inflationary cryptocurrency, you have an increased supply of the token in circulation. On the other hand, a deflationary cryptocurrency is one that offers a reduced supply of cryptocurrencies.

-

Purchasing Power

The purchasing power of inflationary and deflationary cryptocurrency also serves as one of the basic pointers in their comparison. One of the evident observations about an inflationary cryptocurrency would refer to the lower purchasing power. When the number of tokens of a specific cryptocurrency has increased in circulation, it loses its value. On the other hand, the deflationary cryptocurrency would gain value due to the limited supply. The reduced supply alongside the consistent demand can support growth in pricing of the deflationary cryptocurrency.

-

Conversion

The flexibility for conversion of inflationary to deflationary assets is also another important aspect in the comparison between the two types of cryptocurrencies. Inflationary cryptocurrencies are inherently inflationary, which means that they come with an unlimited supply. On the other hand, the inflationary vs deflationary crypto debate must focus on how inflationary cryptocurrencies can turn into deflationary cryptocurrencies temporarily.

Inflationary cryptocurrencies can impose deflationary mechanisms for fighting inflation in certain cases. For example, Ethereum, which has an inflationary cryptocurrency ETH, burns a specific share of the tokens at times of high activity. However, deflationary cryptocurrencies are deflationary by nature and could not be created according to will. The specific examples of deflationary cryptocurrencies show how they use distinct mechanisms or restrictions to restrict the supply of tokens in circulation.

-

Value

One of the significant highlights in a comparison between inflationary and deflationary cryptocurrencies would also refer to their value. How are inflationary and deflationary cryptocurrencies different in terms of their value for crypto in general? The difference between inflationary and deflationary cryptocurrency would show you that deflationary cryptocurrencies would increase in value over the course of time owing to scarcity.

On the other hand, it is important to note that demand also plays a critical role in driving the value of deflationary cryptocurrencies. Without any demand, the value of an asset would decrease considerably, contrary to general expectations. When you consider the value of inflationary cryptocurrencies, you might not fetch much with them right now. However, the value of intrinsic cryptocurrencies rests in diverse use cases, such as the popular example of Ether for DeFi applications.

Curious to know the impact and in-depth understanding of crypto compliance in businesses? Enroll now in the Crypto Compliance Fundamentals Course.

Final Words

The inflationary vs deflationary cryptocurrencies debate offers interesting insights into the world of cryptocurrencies. Even the crypto landscape is not immune to the clauses of inflation and deflation, owing to the factors of demand and supply. The differences between inflationary and deflationary cryptocurrencies basically reflect the fact that supply of a cryptocurrency determines its value and purchasing power.

However, you must notice mechanisms for converting inflationary cryptocurrencies into deflationary cryptocurrencies through burning tokens or fixing caps on circulating supply. The differences between inflationary and deflationary cryptocurrencies are essential for every investor interested in cryptocurrencies. At the same time, it is also important to learn every risk factor associated with cryptocurrencies in detail.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!